Reebok 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

138

2011

03.3 Business Performance by Segment Wholesale Business Performance

03.3

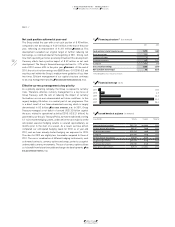

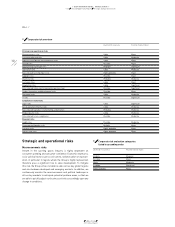

01 Wholesale at a glance (€ in millions)

2011 2010 Change

Net sales 8,971 8,181 10%

Gross profit 3,585 3,379 6%

Gross margin 40.0% 41.3% (1.3pp)

Segmental operating profit 2,725 2,572 6%

Segmental operating margin 30.4% 31.4% (1.1pp)

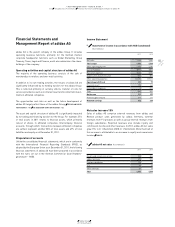

02 Wholesale net sales by region (€ in millions)

2011 2010 Change Change

(currency-neutral)

Western Europe 3,187 2,882 11% 10%

European Emerging Markets 496 503 (1%) 5%

North America 1,771 1,609 10% 15%

Greater China 1,038 840 23% 24%

Other Asian Markets 1,354 1,270 7% 5%

Latin America 1,125 1,077 5% 8%

Total 1) 8,971 8,181 10% 11%

1) Rounding differences may arise in totals.

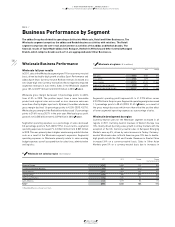

Business Performance by Segment

The adidas Group has divided its operating activities into Wholesale, Retail and Other Businesses. The

Wholesale segment comprises the adidas and Reebok business activities with retailers. The Retail

segment comprises the own-retail and eCommerce activities of the adidas and Reebok brands. The

financial results of TaylorMade-adidas Golf, Rockport, Reebok-CCM Hockey and Other Centrally Managed

Brands, which comprise brands such as Y-3, are aggregated under Other Businesses.

Segmental operating profit improved 6% to € 2.725 billion versus

€ 2.572 billion in the prior year. Segmental operating margin decreased

1.1 percentage points to 30.4% (2010: 31.4%)

TABLE 01

, as a result of

the gross margin decrease which more than offset the positive effect

of lower segmental operating expenses as a percentage of sales.

Wholesale development by region

Currency-neutral sales for the Wholesale segment increased in all

regions in 2011. Currency-neutral revenues in Western Europe rose

10%, mainly driven by strong sales growth in all key markets with the

exception of the UK. Currency-neutral sales in European Emerging

Markets were up 5%, driven by sales increases in Turkey. Currency-

neutral Wholesale sales in North America grew 15% due to double-

digit growth in both the USA and Canada. Revenues in Greater China

increased 24% on a currency-neutral basis. Sales in Other Asian

Markets grew 5% on a currency-neutral basis due to increases in

Wholesale Business Performance

Wholesale full year results

In 2011, sales in the Wholesale segment grew 11% on a currency-neutral

basis, driven by double-digit growth at adidas Sport Performance and

adidas Sport Style. Currency-neutral Reebok revenues increased at a

low-single-digit rate. Currency translation effects negatively impacted

segmental revenues in euro terms. Sales in the Wholesale segment

grew 10% to € 8.971 billion from € 8.181 billion in 2010

TABLE 01

.

Wholesale gross margin decreased 1.3 percentage points to 40.0%

from 41.3% in 2010. The positive impact from a more favourable

product and regional sales mix as well as less clearance sales was

more than offset by higher input costs. By brand, the adidas wholesale

gross margin declined 1.6 percentage points to 42.0% (2010: 43.7%).

Wholesale gross margin of the Reebok brand decreased 1.1 percentage

points to 29.6% versus 30.7% in the prior year. Wholesale gross profit

grew 6% to € 3.585 billion from € 3.379 billion in 2010

TABLE 01

.

Segmental operating expenses as a percentage of sales decreased

0.3 percentage points to 9.6% (2010: 9.9%). In euro terms, segmental

operating expenses increased 7% to € 861 million from € 807 million

in 2010. This was primarily due to higher warehousing and distribution

costs as a result of the Wholesale segment’s expansion. Segmental

operating expenses in Wholesale primarily relate to sales working

budget expenses as well as expenditure for sales force, administration

and logistics.