Reebok 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

127

2011

03.2 Group Business Performance Statement of Financial Position and Statement of Cash Flows

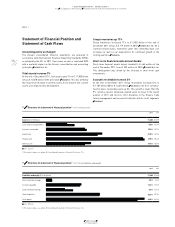

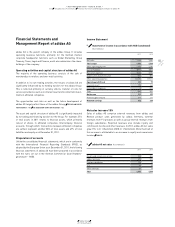

35 Total assets (€ in millions)

2011 11,380

2010 10,618

2009 8,875

2008 9,533

2007 8,325

37 Accounts receivable (€ in millions)

2011 1,707

2010 1,667

2009 1,429

2008 1,624

2007 1,459

36 Inventories (€ in millions)

2011 2,482

2010 2,119

2009 1,471

2008 1,995

2007 1,629

38 Accounts payable (€ in millions)

2011 1,886

2010 1,694

2009 1,166

2008 1,218

2007 849

Other current financial assets up 55%

Other current financial assets grew 55% to € 304 million at the end

of December 2011 from € 197 million in 2010

SEE NOTE 07, P. 189

. This

develop ment was mainly due to the increase in the fair value of

financial instruments.

Other current assets up 21%

Other current assets increased 21% to € 469 million at the end of

December 2011 from € 390 million in 2010, mainly as a result of an

increase in tax receivables other than income taxes as well as prepaid

expenses

SEE NOTE 09, P. 190

.

Fixed assets increase 6%

Fixed assets increased 6% to € 4.303 billion at the end of December

2011 versus € 4.076 billion in 2010. Fixed assets include property,

plant and equipment, goodwill, trademarks and other intangible

assets as well as long-term financial assets. Additions in an amount of

€ 415 million were primarily related to the continued expansion of our

own-retail activities, investments into the Group’s IT infrastructure,

the acquisition of Five Ten as well as the further development of the

Group’s headquarters in Herzogenaurach. Moreover, currency trans-

lation effects in an amount of € 81 million on fixed assets denom-

inated in currencies other than the euro positively impacted this

develop ment. Additions were partly offset by depreciation and amorti-

sation amounting to € 252 million, as well as disposals of € 17 million.

Assets held for sale decrease 47%

At the end of December 2011, assets held for sale declined 47% to

€ 25 million compared to € 47 million in 2010. This decrease was

mainly due to the sale of a warehouse in the Netherlands. Assets held

for sale primarily relate to the planned sale of land and buildings in

Herzogenaurach, Germany

SEE NOTE 10, P. 190

.

Other non-current financial assets down 22%

Other non-current financial assets decreased 22% to € 42 million at

the end of December 2011 from € 54 million in 2010, mainly driven by

a decline in the fair value of financial instruments

SEE NOTE 15, P. 192

.

Accounts payable increase 11%

Accounts payable were up 11% to € 1.886 billion at the end of

December 2011 versus € 1.694 billion at the end of 2010

DIAGRAM 38

.

On a currency-neutral basis, accounts payable increased 12%,

reflecting the growth in inventories compared to the prior year.

Other current financial liabilities decrease 54%

At the end of December 2011, other current financial liabilities

decreased 54% to € 56 million from € 123 million in 2010, primarily as

a result of the decrease in the negative fair value of financial instru-

ments

SEE NOTE 18, P. 193

.