Reebok 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

128

2011

Cash flow remains strong

In 2011, net cash inflow from operating activities was € 792 million

(2010: € 894 million). The decrease in cash generated from operating

activities compared to the prior year was primarily due to higher income

taxes paid, as well as higher operating working capital requirements,

partly offset by the improved Group profitability. Net cash outflow

from investing activities was € 566 million (2010: € 330 million). This

was mainly related to spending for property, plant and equipment

such as investments in the furnishing and fitting of stores in our

Retail segment, in new office buildings and in IT systems, as well as

to the purchase of short-term financial assets and the acquisition of

Five Ten

SEE NOTE 03, P. 188

. Net cash outflow from financing activities

totalled € 491 million (2010: € 238 million). Cash outflows from

financing activities were mainly related to the repayment of short-

term borrowings totalling € 273 million, dividends paid in an amount

of € 167 million as well as the repayment of long-term borrowings

in an amount of € 48 million. Exchange rate effects in an amount of

€ 15 million positively impacted the Group’s cash position in 2011

(2010: € 55 million). As a result of all these developments, cash and

cash equivalents decreased € 250 million to € 906 million at the end

of December 2011 compared to € 1.156 billion at the end of December

2010

DIAGRAM 40

.

Other current provisions up 8%

Other current provisions were up 8% to € 507 million at the end of

2011 versus € 470 million at the end of 2010. This primarily relates to

increases in provisions for returns, allowances and warranties

SEE

NOTE 19, P. 194

.

Current accrued liabilities grow 18%

Current accrued liabilities increased 18% to € 990 million at the end of

2011 from € 842 million in 2010, mainly due to an increase in accruals

for invoices not yet received

SEE NOTE 20, P. 195

.

Other current liabilities up 24%

Other current liabilities were up 24% to € 301 million at the end of

2011 from € 241 million in 2010, mainly due to increases in customer

prepayments

SEE NOTE 21, P. 196

.

Shareholders’ equity grows 15%

Shareholders’ equity increased 15% to € 5.327 billion at the end of

December 2011 versus € 4.616 billion in 2010

DIAGRAM 39

. The net

income generated during the last twelve months and the increase

in the fair value of financial instruments were the main contributors

to this develop ment, partially offset by the dividend in an amount of

€ 167 million paid in 2011

SEE NOTE 25, P. 198

. The Group’s equity ratio

at the end of December 2011 was 46.8% compared to 43.5% in the

prior year.

Expenses related to off-balance sheet items

Our most significant off-balance sheet commitments are operating

leases, which are related to own-retail stores, offices, warehouses

and equipment. The Group has entered into various operating leases

as opposed to property acquisitions in order to reduce exposure

to property value fluctuations. Rent expenses increased 12% to

€ 608 million in 2011 from € 544 million in the prior year, mainly due

to the continued expansion of the adidas Group’s own-retail activities

SEE NOTE 27, P. 201

.

03.2 Group Business Performance Statement of Financial Position and Statement of Cash Flows

03.2

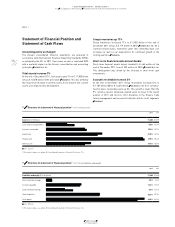

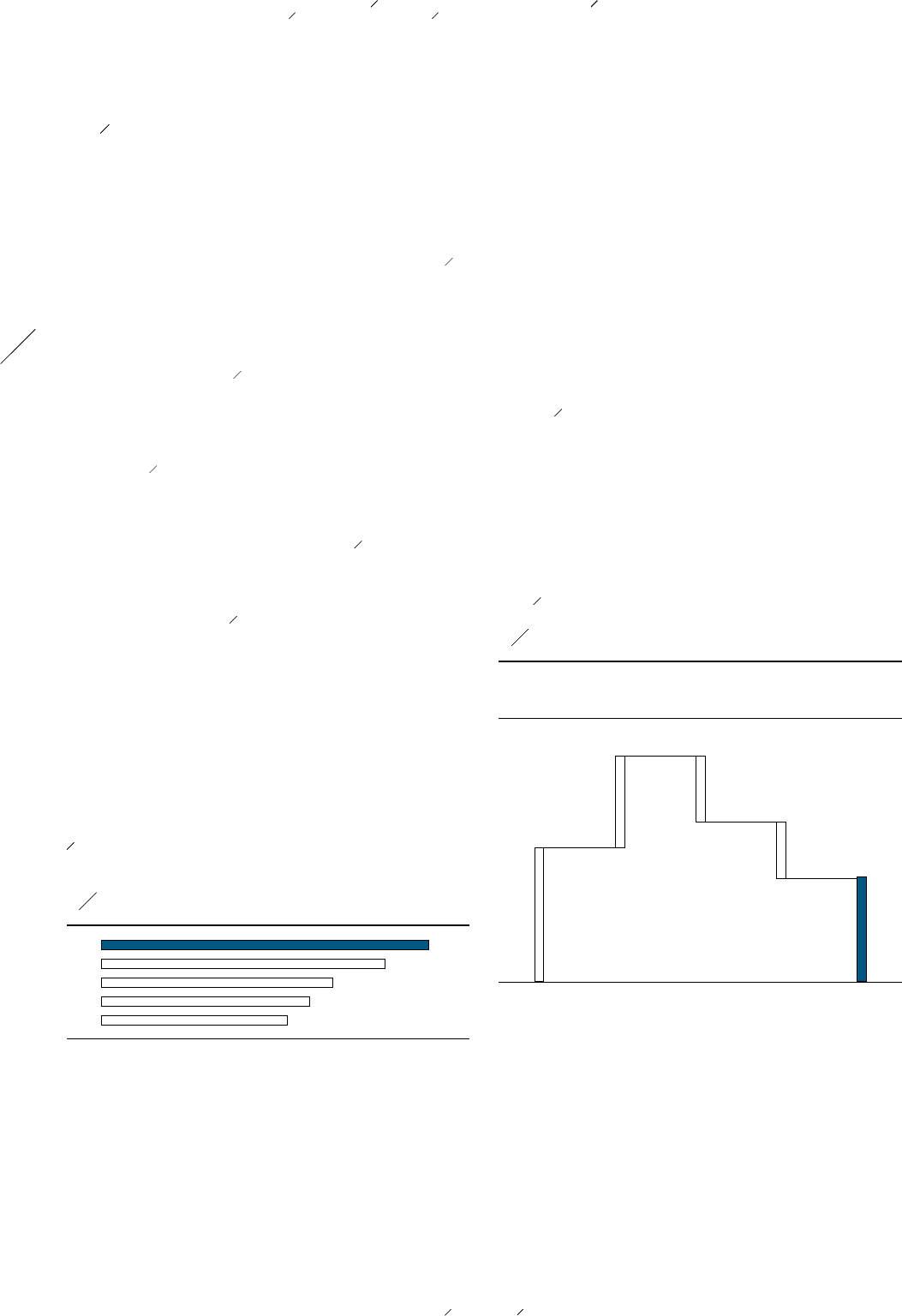

40 Change in cash and cash equivalents (€ in millions)

Cash and cash

equivalents at the

end of 2010 1)

Net cash generated

from operating

activities

Net cash used

in investing

activities

Net cash used

in financing

activities

Cash and cash

equivalents at the

end of 2011 2)

1) Includes a positive exchange rate effect of € 55 million.

2) Includes a positive exchange rate effect of € 15 million.

1,156

792 (566)

(491)

906

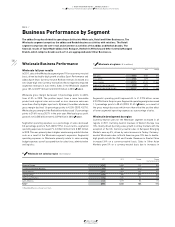

39 Shareholders’ equity (€ in millions)

2011 5,327

2010 4,616

2009 3,771

2008 3,386

2007 3,023