Reebok 2011 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

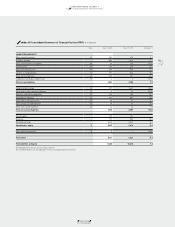

CONSOLIDATED FINANCIAL STATEMENTS

04.8 Notes

185

2011

185

2011

Intangible assets (except goodwill)

Intangible assets are valued at amortised cost less accumulated amor-

tisation (except for assets with indefinite useful lives) and impairment

losses. Amortisation is calculated on a straight-line basis taking into

account any potential residual value.

Estimated useful lives are as follows:

Estimated useful lives of intangible assets

Years

Trademarks indefinite

Software 3 – 5

Patents, trademarks and concessions 5 – 15

The adidas Group determined that there was no impairment neces-

sary for any of its trademarks with indefinite useful lives in the years

ending December 31, 2011 and 2010.

The recoverable amount is determined on the basis of fair value

less costs to sell (costs to sell are calculated with 1% of the fair value).

The fair value is determined in discounting notional royalty savings

after tax and adding a tax amortisation benefit, resulting from the

amortisation of the acquired asset (“relief-from-royalty method”).

These calculations use projections of net sales related royalty savings,

based on financial planning which covers a period of five years in total.

The level of the applied royalty rate for the determination of the royalty

savings is based on contractual agreements between the adidas Group

and external licensees as well as publicly available royalty rate agree-

ments for similar assets. Notional royalty savings beyond this period

are extrapolated using steady growth rates of 1.7% (2010: 1.7%). The

growth rates do not exceed the long-term average growth rate of the

business to which the trademarks are allocated.

The discount rate is based on a weighted average cost of capital

calculation derived using a five-year average market-weighted debt/

equity structure and financing costs referencing the Group’s major

competitors. The discount rate used is an after-tax rate and reflects

the specific equity and country risk. The applied discount rate depends

on the respective intangible asset being valued and ranges between

6.5% and 8.1% (2010: between 6.4% and 8.3%).

Expenditures during the development phase of internally

generated intangible assets are capitalised when they occur if they

qualify for recognition under IAS 38 “Intangible Assets”.

Goodwill

Goodwill is an asset representing the future economic benefits arising

from assets acquired in a business combination that are not indi-

vidually identified and separately recognised. This results when the

purchase cost exceeds the fair value of acquired identifiable assets,

liabilities and contingent liabilities. Goodwill arising from the acquisi-

tion of a foreign entity and any fair value adjustments to the carrying

amounts of assets, liabilities and contingent liabilities of that foreign

entity are treated as assets, liabilities and contingent liabilities of

the respective reporting entity, and are translated at exchange rates

prevailing at the date of the initial consolidation. Goodwill is carried in

the functional currency of the acquired foreign entity.

Acquired goodwill is valued at cost and is tested for impairment

on an annual basis and additionally when there are indications of

potential impairment.

On August 4, 2011, the Group published the error findings of the

German Financial Reporting Enforcement Panel (FREP) regarding

the inconsistency between the designation of segments and of cash-

generating units on which the impairment test for goodwill is based.

As a consequence, the cash-generating units were redefined. The

geographic regions responsible for the joint distribution of adidas

and Reebok were split into Wholesale and Retail for purposes of

impairment testing. As a result of the redefinition of cash-generating

units, the number of cash-generating units increased to 30 from 19,

including the other operating segments TaylorMade-adidas Golf,

Rockport and Reebok-CCM Hockey.

The cash-generating units (or groups of units) represent the

lowest level within the Group at which goodwill is monitored for

internal management purposes.

The impairment test for goodwill has been performed based on

cash-generating units (or groups of units).

Overall, no impairment of goodwill resulted.

The recoverable amount of a cash-generating unit is determined

on the basis of value in use. This calculation uses cash flow projec-

tions based on the financial planning covering a five-year period in

total. The planning is based on the adidas Group’s strategic business

plan “Route 2015”

SEE SUBSEQUENT EVENTS AND OUTLOOK, P. 163

and reflects an

expected mid- to high-single-digit sales increase for the majority of

the cash-generating units (or groups of units). For a few emerging

markets, we expect, on average, a low-double-digit sales growth rate.

Furthermore, we expect the operating margin to improve, primarily

driven by a slight improvement in the gross margin as well as lower

operating expenses as a percentage of sales. The planning for capital

expenditure and working capital is primarily based on past experience.

The planning for future tax payments is based on current statutory

corporate tax rates of the single cash-generating units (or groups of

units). Cash flows beyond this period are extrapolated using steady

growth rates of 1.7% (2010: 1.7%). According to our expectations,

these growth rates do not exceed the long-term average growth rate

of the business in which each cash-generating unit operates.