Reebok 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

150

2011

03.4 Risk and Opportunity Report Strategic and operational risks

03.4

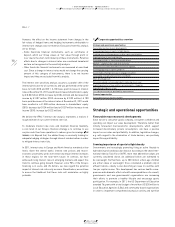

Reputation/brand image risks

The adidas Group faces considerable risk if we are unable to uphold

high levels of consumer awareness, affiliation and purchase intent

for our brands. Negative media coverage on our products or business

practices, unfavourable stakeholder activism and speed and influence

of social media discussion may significantly hurt the Group’s reputation

and brand image and eventually lead to a sales slowdown. In addition,

if the Group’s brands are not allocating sufficient marketing resources

to activate our sports assets and brand campaigns in a sustainable

manner, we face the risk of fading consumer awareness and brand

attractiveness. To mitigate these risks, we pursue pro-active, open

communication with key stakeholders (e.g. consumers, media,

non-governmental organisations, financial community, etc.) on a

continuous basis. We have also defined clear mission statements,

values and goals for all our brands

SEE GLOBAL BRANDS STRATEGY, P. 68

SEE

OTHER BUSINESSES STRATEGY, P. 82

. These form the foundation of our product

and brand communication strategies. Furthermore, we continue to

invest significant marketing resources to build brand momentum and

foster consumer awareness.

We continue to believe that a considerable deterioration in the Group’s

reputation and the image of our brands could have a significant

financial impact on our Group. As a result of ever-increasing media

and other stakeholder activities worldwide, coupled with the fast-

moving and hardly controllable nature of social media, we consider

reputation and brand image risks more likely to materialise and have

therefore increased the likelihood of occurrence to probable.

Own-retail risks

New adidas, Reebok and Rockport own-retail stores require consid-

erable up-front investment in furniture and fixtures as well as ongoing

maintenance. In addition, own-retail activities often require longer-

term lease or rent commitments. Retail also employs significantly

more personnel in relation to sales than our wholesale business. The

higher portion of fixed costs compared to our wholesale business

implies a larger profitability impact in cases of significant sales

declines. Delayed openings or poorly executed store operations

could lead to sales shortfalls and also negatively affect brand image.

Further, inability to secure appropriate store locations may result in

worse than expected sales development.

The Group reduces this risk by only entering into lease contracts

with durations of less than ten years. Store openings are managed

according to a standardised Group-wide business plan model. Store

performance is measured by a retail scorecard consisting of nine

quantitative key performance indicators. Underperforming stores are

reorganised, remodelled or closed as appropriate.

Our increased focus on improving our sophistication as a retailer

by investing in management expertise as well as in IT systems

remains a key priority for 2012

SEE GLOBAL SALES STRATEGY, P. 62

. Never-

theless, we continue to view the risk of underperformance of some

of our own-retail stores as likely. The potential financial impact from

own-retail underperformance, which may also involve impairment

charges and store closures, is moderate.

Risks related to rising input costs

Raw material and labour costs account for approximately 70% of the

Group’s cost of sales. Prices of materials such as rubber, cotton,

polyester and those which closely correlate with the oil price are

especially subject to the risk of price changes. As our ordering process

and price negotiations usually take place around six months in advance

of production, our sourcing function has visibility and reaction time to

reflect sharp increases in input costs in its planning.

To reduce the financial impact on our product margins from higher

sourcing costs, we are implementing further lean manufacturing

techniques at our partner factories, reducing time and cost in the

procurement process, re-engineering our products and selec-

tively increasing prices where possible. In addition, the Profitability

Management department within the Global Operations function is

mandated with driving strategic initiatives to ensure competitiveness

of our supply chain in light of increasing input costs

SEE GLOBAL

OPERATIONS, P. 90

. In the medium term, we also have the ability to adapt

our sourcing structure to take advantage of more competitive pricing

in other locations.

As a result of the high degree of volatility on global commodity

markets in 2011 as well as currently increasing labour costs, we do

not forecast any positive impact on our sourcing costs in 2012. As we

begin planning for 2013, increases in sourcing costs cannot be ruled

out. Therefore, we continue to assess the risks related to rising input

costs as having a highly probable likelihood of occurrence and a major

potential financial impact.

Supplier risks

Almost the entire adidas Group product offering is sourced through

independent suppliers, mainly located in Asia

SEE GLOBAL OPERATIONS, P. 90

.

To reduce the risk of business interruptions following the potential

underperformance of a supplier, the relocation of a supplier’s

production sites or a potential supplier default, we work with vendors

who demonstrate reliability, quality, innovation and continuous

improvement.