Reebok 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

158

2011

03.4 Risk and Opportunity Report Financial risks Strategic and operational opportunities

03.4

However, the effect on the income statement from changes in the

fair values of hedged items and hedging instruments attributable to

interest rate changes was not material. Exclusions from this analysis

are as follows:

− Some fixed-rate financial instruments, such as certificates of

deposit, which our Group values at “fair value through profit or

loss” due to the short-term maturity of these instruments. Potential

effects due to changes in interest rates are considered immaterial

and are not recognised in the sensitivity analysis.

− Other fixed-rate financial instruments are measured at amortised

cost. Since a change in interest rates would not change the carrying

amount of this category of instruments, there is no net income

impact and they are excluded from this analysis.

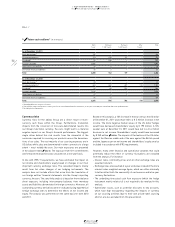

The interest rate sensitivity analysis assumes a parallel shift of the

interest yield curve for all currencies and was performed on the same

basis for both 2010 and 2011. A 100 basis point increase in interest

rates at December 31, 2011 would have increased shareholders’ equity

by € 0.00 million (2010: increase by € 0.04 million) and decreased net

income by € 0.07 million (2010: decrease by € 0.22 million). A 100

basis point decrease of the interest rates at December 31, 2011 would

have resulted in a € 0.00 million decrease in shareholders’ equity

(2010: decrease by € 0.04 million) and a € 0.07 million increase in net

income (2010: increase by € 0.22 million).

We believe the IFRS 7 interest rate analysis represents a realistic if

rough estimate of our current interest rate risk.

To moderate interest rate risks and maintain financial flexibility,

a core tenet of our Group’s financial strategy is to continue to use

surplus cash flow from operations to reduce gross borrowings

SEE

TREASURY, P. 129

. Beyond that, the adidas Group is constantly looking for

adequate hedging strategies through interest rate derivatives in order

to mitigate interest rate risks.

In 2011, interest rates in Europe and North America remained at low

levels. Given the central banks’ interest rate policies and macro-

economic uncertainty, we do not foresee any major interest increases

in these regions for the near-term future. In contrast, we have

witnessed rising interest rates in emerging markets and expect this

trend to continue going forward. However, since 90% of the Group’s

financing is in euros and US dollars, we now regard the potential

impact of interest rate risks only as minor. Nevertheless, we continue

to assess the likelihood that these risks will materialise as highly

probable.

Strategic and operational opportunities

Favourable macroeconomic developments

Since we are a consumer goods company, consumer confidence and

spending can impact our sales development. Therefore, better than

initially forecasted macroeconomic developments, which support

increased discretionary private consumption, can have a positive

impact on our sales and profitability. In addition, legislative changes,

e.g. with regard to the elimination of trade barriers, can positively

impact Group profitability.

Growing importance of sports to fight obesity

Governments are increasingly promoting living an active lifestyle to

fight obesity and cardiovascular disease. According to the latest Inter-

national Obesity Task Force (IOTF), more than 600 million adults are

currently considered obese. An additional billion are estimated to

be overweight. Furthermore, up to 200 million school-age children

are either obese or overweight. Once considered a problem only in

affluent nations, obesity is also becoming an issue in countries with

low per capita income. This development has serious health conse-

quences and a dramatic effect on health care expenditures. As a result,

governments and non-governmental organisations are increasing

their efforts to promote a healthy lifestyle and encourage sports

participation. For example, in 2011, the US Department of Education

awarded 76 grants with a total budget of more than US $ 35 million to

Local Education Agencies (LEAs) and community-based organisations

in order to implement comprehensive physical activity and nutrition

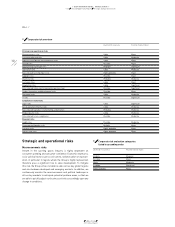

07 Corporate opportunities overview

Strategic and operational opportunities

Favourable macroeconomic developments

Growing importance of sports to fight obesity

Creating new social experiences to drive sports participation

Ongoing fusion of sport and lifestyle

Emerging markets as long-term growth drivers

Women’s segment offers long-term potential

Increasing consumer demand for functional apparel

Growing popularity of "green" products

Social media offering new ways to engage consumers

Leveraging strong market positions worldwide

Multi-brand approach

Personalised and customised products replacing mass wear

Exploiting potential of new and fast-growing sports categories

Expanding distribution scope

Cost optimisation drives profitability improvements

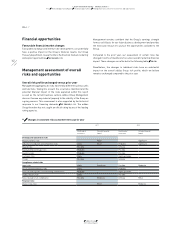

Financial opportunities

Favourable financial market changes