Pep Boys 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

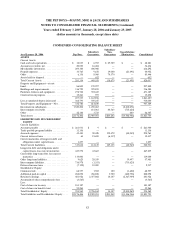

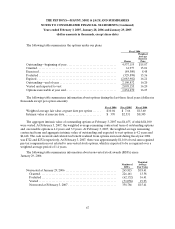

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

57

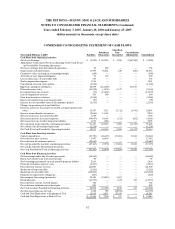

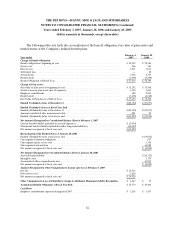

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Year ended February 3, 2007 Pep Boys

Subsidiary

Guarantors

Subsidiary

Non-

Guarantors

Consolidation

Elimination Consolidated

Cash Flows from Operating Activities:

Net(Loss)Earnings................................... $ (2,549) $ 165,914 $ 1,288 $(167,202) $ (2,549)

Adjustments to Reconcile Net (Loss) Earnings to Net Cash (Used

in) Provided By Continuing Operations:

Netloss(earnings)fromdiscontinuedoperations............. 49 689 — — 738

Depreciationandamortization........................... 31,795 56,681 240 (240) 88,476

Cumulativeeffectofchangeinaccountingprinciple........... (189) — — — (189)

Accretionofassetdisposalobligation...................... 95 174 — — 269

Lossondefeasanceofconvertibledebt..................... 755 — — — 755

Stock compensation expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,051 — — — 3,051

Cancellationofvestedstockoptions....................... (1,056) — — — (1,056)

Equityinearningsofsubsidiaries......................... 28,039 (163,669) — 135,630 —

Deferredincometaxes................................. (11,598) (3,055) 6,337 — (8,316)

Loss (gain) from sale of assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . (35) (15,262) — — (15,297)

Loss on impairment of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . 550 290 — — 840

Gain from derivative valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,568) — — — (5,568)

Excess tax benefits from stock based awards . . . . . . . . . . . . . . . . . (95) — — — (95)

Increase in cash surrender value of life insurance policies . . . . . . . (2,143) — — — (2,143)

Changes in operating assets and liabilities:

Decrease (increase) in accounts receivable, prepaid expenses and

other............................................. 24,587 7,113 (5,712) (1,943) 24,045

Increase in merchandise inventories . . . . . . . . . . . . . . . . . . . . . . . (2,061) 11,311 — — 9,250

(Decrease) increase in accounts payable . . . . . . . . . . . . . . . . . . . . 3,549 — — — 3,549

(Decrease) increase in accrued expenses. . . . . . . . . . . . . . . . . . . . (49,057) 45,645 (151) (602) (4,165)

(Decrease) increase in other long-term liabilities. . . . . . . . . . . . . . 3,074 (981) — — 2,093

Net cash (used in) provided by continuing operations . . . . . . . . . . 21,193 104,850 2,002 (34,357) 93,688

Netcashusedindiscontinuedoperations................... (1,258) — — — (1,258)

Net Cash (Used in) Provided by Operating Activities . . . . . . . . . . 19,935 104,850 2,002 (34,357) 92,430

Cash Flows from Investing Activities:

Capitalexpenditures................................... (23,793) (26,419) (33,830) 33,830 (50,212)

Proceedsfromsalesofassets............................. 1,097 16,445 — — 17,542

Proceedsfromlifeinsurancepolicies....................... (24,669) — — — (24,669)

Net cash provided by (used in) continuing operations . . . . . . . . . . (47,365) (9,974) (33,830) 33,830 (57,339)

Netcashprovidedbydiscontinuedoperations................ — — — — —

Net Cash Provided by (Used in) Investing Activities . . . . . . . . . . . (47,365) (9,974) (33,830) 33,830 (57,339)

Cash Flows from Financing Activities:

Net borrowings under line of credit agreements . . . . . . . . . . . . . . (48,569) — — — (48,569)

Excess tax benefits from stock based awards . . . . . . . . . . . . . . . . . 95 — — — 95

Net borrowings (payments) on trade payable program liability . . . 2,834 — — — 2,834

Paymentsforfinanceissuancecosts ....................... (2,217) — — — (2,217)

Proceedsfromissuanceofnotes.......................... 121,000 — — — 121,000

Reductionoflong-termdebt............................. (2,263) — — — (2,263)

Reduction of convertible debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . (119,000) — — — (119,000)

Paymentsoncapitalleaseobligations...................... (227) — — — (227)

Intercompanyborrowings(payments)...................... 90,480 (93,883) 3,403 — —

Dividendspaid....................................... (14,757) — (527) 527 (14,757)

Proceedsfromexerciseofstockoptions .................... 722 — — — 722

Proceedsfromdividendreinvestmentplan.................. 894 — — — 894

Net Cash (used in) Provided by Financing Activities . . . . . . . . . . . 28,992 (93,883) 2,876 527 (61,488)

Net (Decrease) Increase in Cash. . . . . . . . . . . . . . . . . . . . . . . . . . 1,562 993 (28,952) — (26,397)

Cash and Cash Equivalents at Beginning of Year . . . . . . . . . . . . . 12,019 6,953 29,309 — 48,281

CashandCashEquivalentsatEndofYear.................. $ 13,581 $ 7,946 $ 357 $ — $ 21,884