Pep Boys 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

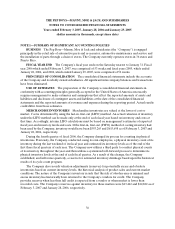

29

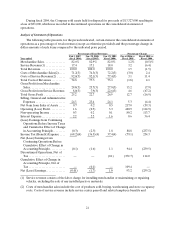

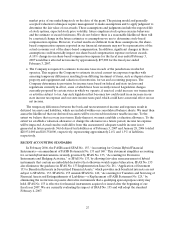

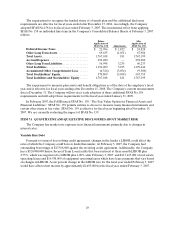

The requirement to recognize the funded status of a benefit plan and the additional disclosure

requirements are effective for fiscal years ended after December 15, 2006. Accordingly, the Company

adopted SFAS No.158 for its fiscal year ended February 3, 2007. The incremental effect from applying

SFAS No. 158 on individual line items in the Company’s Consolidated Balance Sheets at February 3, 2007

follows:

Before After

Application of Application of

SFAS No. 158 Adjustments SFAS No. 158

Deferred Income Taxes $ 22,996 $ 1,832 $ 24,828

Other Long Term Assets ..................... 69,635 (1,651) 67,984

Total Assets................................. 1,767,018 181 1,767,199

Accrued Expenses ........................... 292,280 — 292,280

Other Long Term Liabilities .................. 56,998 3,235 60,233

Total Liabilities ............................. 1,196,209 3,235 1,199,444

Accumulated Other Comprehensive Loss ....... (6,326) (3,054) (9,380)

Total Stockholders’ Equity.................... 570,809 (3,054) 567,755

Total Liabilities and Stockholders’ Equity ...... 1,767,018 181 1,767,199

The requirement to measure plan assets and benefit obligations as of the date of the employer’s fiscal

year-end is effective for fiscal years ending after December 15, 2008. The Company’s current measurement

date is December 31. The Company will not elect early adoption of these additional SFAS No.158

requirements and will adopt these requirements for the fiscal year ended January 31, 2009.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities.” SFAS No. 159 permits entities to choose to measure many financial instruments and

certain other items at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15,

2007. We are currently evaluating the impact of SFAS No. 159.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company has market rate exposure in its financial instruments primarily due to changes in

interest rates.

Variable Rate Debt

Pursuant to terms of its revolving credit agreement, changes in the lender’s LIBOR could affect the

rates of which the Company could borrow funds thereunder. At February 3, 2007, the Company had

outstanding borrowings of $17,568,000 against the revolving credit agreement. Additionally, the Company

has a $320,000,000 Senior Secured Term Loan facility that bears interest at three month LIBOR plus

2.75%, which was negotiated to LIBOR plus 2.00% after February 3, 2007, and $117,627,000 of real estate

operating leases and $14,938,000 of equipment operating leases which have lease payments that vary based

on changes in LIBOR. A one percent change in the LIBOR rate for the fiscal year ended February 3, 2007

would have affected net income by approximately $1,493,000 for the fiscal year ended February 3, 2007.