Pep Boys 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

(ITEM 3) SHAREHOLDER PROPOSAL REGARDING OUR SHAREHOLDER RIGHTS PLAN

John Chevedden, 2215 Nelson Avenue, No. 205, Redondo Beach, California 90278 has notified us that he

intends to introduce the following resolution at the meeting:

“Subject Poison Pills to a Shareholder Vote

RESOLVED, Shareholders request that our Board adopt a bylaw or charter amendment that any poison pill,

active currently or active within a year preceding any future annual meeting, be subject to a shareholder vote as a

separate ballot item, to be held as soon as possible. A poison pill is such a drastic step that a required shareholder

vote on a poison pill is important enough to be a permanent part of our bylaws or charter - rather than a fleeting

short-lived policy.

It is essential that a sunset provision not be used as an escape from a shareholder vote. Since a vote would be as

soon as possible, it could take place within 4-months of the adoption of a new poison pill. Since a poison pill is such

a drastic measure that deserves shareholder input, a shareholder vote would be required even if a pill had been

terminated.

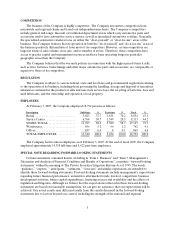

We as shareholders repeatedly voted in support of this topic:

Year Rate of Support

2003 68%

2004 74%

2005 75%

2006 79%

Our serial-ignorer-of-shareholder-proposal directors may lead to a shareholder reaction similar to the Sempra

Energy (SRE) scenario recounted in The Wall Street Journal on October 9, 2006: For four years beginning in 2001,

a Sempra shareholder submitted shareholder proposals calling for Sempra to elect its directors annually rather than

every three years in staggered terms. The votes passed with increasing majorities every year, garnering 67% of the

votes in 2005.

Sempra ignored the proposals. But in the 2005 voting, shareholders also withheld nearly 30% of their votes from the

directors up for re-election - a big proportion by corporate election standards. And that seemed to wake Sempra up.

In May 2006, Sempra management introduced its own resolution for annual elections, which passed with 95

shareholder approval. Source: Wall Street Journal, October 9,2006.

Already our following six Pep Boys directors each received more than 25% against votes at our belated 2006 annual

meeting:

Mr. Leonard

Mr. Bassi

Ms. Scaccetti

Mr. Sweetwood

Ms. Atkins

Mr. Hotz

The Corporate Library, http://www.thecorporatelibrarv.com/, an independent investment research firm said the use

of a so-called "fiduciary out" (not allowed by this proposal) especially in light of recent Delaware case law

suggesting such a proviso is unnecessary - as well as a 12-month duration for non-shareholder-approved plans

undermines the effectiveness of certain 12-month policies (used at some companies) in giving shareholders a