Pep Boys 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

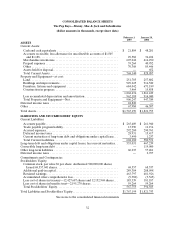

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

38

The Company accounts for vendor support funds in accordance with Financial Accounting Standards

Board (FASB) Emerging Issues Task Force (EITF) Issue No. 02-16, “Accounting by a Customer

(Including a Reseller) for Cash Consideration Received from a Vendor” (EITF 02-16). Rebates and other

miscellaneous incentives are earned based on purchases or product sales. These incentives are treated as a

reduction of inventories and are recognized as a reduction to cost of sales as the inventories are sold.

Certain vendor allowances are used exclusively for promotions and to partially or fully offset certain other

direct expenses. Such allowances would be offset against the appropriate expenses they offset, once the

Company determines the allowances are for specific, identifiable incremental expenses.

WARRANTY RESERVE The Company provides warranties for both its merchandise sales and

service labor. Warranties for merchandise are generally covered by its vendors, with the Company covering

any costs above the vendor’s stipulated allowance. Service labor warranties are covered in full by the

Company on a limited lifetime basis. The Company establishes its warranty reserves based on historical

data of warranty transactions. These costs are included in either our Costs of Merchandise Sales or Costs

of Service Revenue.

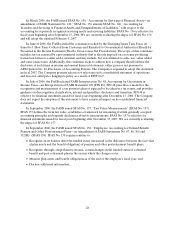

Components of the reserve for warranty costs for fiscal years ended February 3, 2007 and January 28,

2006, are as follows:

Balance at January 29, 2005 ........................................ $1,324

Additionsrelatedtofiscal2005sales............................... 13,429

Warrantycostsincurredinfiscal2005.............................. (13,276)

Balance at January 28, 2006 ........................................ 1,477

Additionsrelatedtofiscal2006sales............................... 11,577

Warrantycostsincurredinfiscal2006.............................. (12,409)

Balance at February 3, 2007 ........................................ $645

LEASES The Company’s policy is to amortize leasehold improvements over the lesser of the lease

term or the economic life of those assets. Generally, for the stores the lease term is the base lease term and

for distribution centers the lease term includes the base lease term plus certain renewal option periods for

which renewal is reasonably assured and for which failure to exercise the renewal option would result in an

economic penalty. The calculation for straight-line rent expense is based on the same lease term with

consideration for step rent provisions, escalation clauses, rent holidays and other lease concessions. The

Company expenses rent during the construction or build-out phase of the lease.

SERVICE REVENUE Service revenue consists of the labor charge for installing merchandise or

maintaining or repairing vehicles, excluding the sale of any installed parts or materials.

COSTS OF REVENUES Costs of merchandise sales include the cost of products sold, buying,

warehousing and store occupancy costs. Costs of service revenue include service center payroll and related

employee benefits, service center occupancy costs and cost of providing free or discounted towing services

to our customers. Occupancy costs include utilities, rents, real estate and property taxes, repairs and

maintenance and depreciation and amortization expenses.

PENSION EXPENSE The Company reports all information on its pension and savings plan benefits

in accordance with FASB Statement of Financial Accounting Standards (SFAS) No. 132, “Employers’

Disclosure about Pensions and Other Postretirement Benefits (revised 2003)” (SFAS 132R), as amended