Pep Boys 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

49

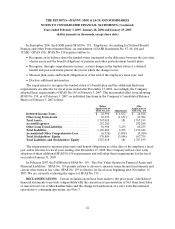

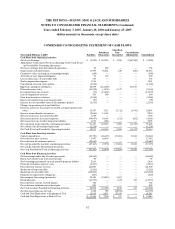

The aggregate minimum rental payments for such leases having initial terms of more than one year

are approximately:

Year

Operating

Leases

Capital

Leases

2007 ............................................................. $ 57,670 $290

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53,788 260

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47,114 183

2010 ............................................................. 43,548 —

2011 ............................................................. 41,179 —

Thereafter........................................................ 239,550 —

Aggregate minimum lease payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $482,849 $733

Less:interestoncapitalleases....................................... (48)

Present Value of Net Minimum Lease Payments. . . . . . . . . . . . . . . . . . . . . . . $685

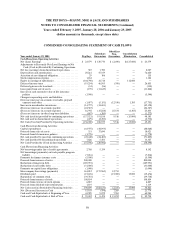

Rental expenses incurred for operating leases in fiscal years 2006, 2005, and 2004 were $59,953,

$67,601 and $60,941, respectively.

In October 2001, the Company entered into a contractual commitment to purchase media advertising

services with equal annual purchase requirements totaling $39,773 over four years. During the second

quarter of fiscal 2004, it was determined that the Company would be unable to meet its obligation for the

2004 contract year, which ended on November 30, 2004. As a result, the Company recorded a $1,579

charge to selling, general and administrative expenses in the quarter ended July 31, 2004 related to the

anticipated shortfall in this purchase commitment. This agreement expired in October 2005.

Our open purchase orders are based on current inventory or operational needs and are fulfilled by our

vendors within short periods of time. We currently do not have minimum purchase commitments under

our vendor supply agreements and generally our open purchase orders (orders that have not been shipped)

are not binding agreements. Those purchase obligations that are in transit from our vendors at February 3,

2007 are considered to be a contractual obligation.

NOTE 6—STOCKHOLDERS’ EQUITY

SHARE REPURCHASE—TREASURY STOCK On September 7, 2006, the Company renewed its

share repurchase program, which had approximately $45,000 of its original $100,000 authorization

remaining and was set to expire on September 30, 2006. Under the renewed program, the Board reset the

authority back to $100,000 for repurchases to be made from time to time in the open market or in privately

negotiated transactions through September 30, 2007. The Company repurchased approximately 494,800

shares during fiscal 2006 for approximately $7,311.

All of these repurchased shares were placed into the Company’s treasury. A portion of the treasury

shares will be used by the Company to provide benefits to employees under its compensation plans and in

conjunction with the Company’s dividend reinvestment program. As of February 3, 2007, the Company

reflected 12,427,687 shares of its common stock at a cost of $185,339 as “cost of shares in treasury” on the

Company’s consolidated balance sheet.