Pep Boys 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

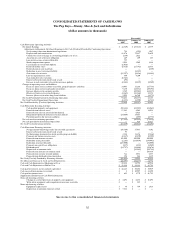

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

44

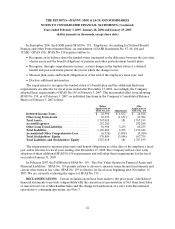

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans- an Amendment of FASB Statements No. 87, 88, 106 and

132(R)” (SFAS 158). SFAS No. 158 requires entities to:

•Recognize on its balance sheet the funded status (measured as the difference between the fair value

of plan assets and the benefit obligation) of pension and other postretirement benefit plans;

•Recognize, through comprehensive income, certain changes in the funded status of a defined

benefit and post retirement plan in the year in which the changes occur;

•Measure plan assets and benefit obligations as of the end of the employer’s fiscal year; and

•Disclose additional information.

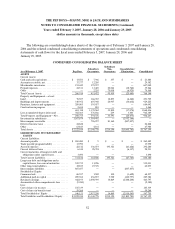

The requirement to recognize the funded status of a benefit plan and the additional disclosure

requirements are effective for fiscal years ended after December 15, 2006. Accordingly, the Company

adopted these requirements of SFAS No.158 at February 3, 2007. The incremental effect from adopting

SFAS No. 158, as of February 3, 2007, on individual line items in the Company’s Consolidated Balance

Sheets at February 3, 2007 follows:

Before After

Application of Application of

SFAS No. 158 Adjustments SFAS No. 158

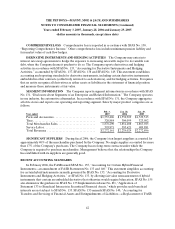

Deferred Income Taxes........................ $ 22,996 $ 1,832 $ 24,828

Other Long Term Assets ....................... 69,635 (1,651) 67,984

Total Assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,767,018 181 1,767,199

Accrued Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . 292,280 — 292,280

Other Long Term Liabilities ................... 56,998 3,235 60,233

Total Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,196,209 3,235 1,199,444

Accumulated Other Comprehensive Loss . . . . . . . . (6,326) (3,054) (9,380)

Total Stockholders’ Equity. . . . . . . . . . . . . . . . . . . . . 570,809 (3,054) 567,755

Total Liabilities and Stockholders’ Equity . . . . . . . 1,767,018 181 1,767,199

The requirement to measure plan assets and benefit obligations as of the date of the employer’s fiscal

year-end is effective for fiscal years ending after December 15, 2008. The Company will not elect early

adoption of these additional SFAS No.158 requirements and will adopt these requirements for the fiscal

year ended January 31, 2009.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities.” SFAS No. 159 permits entities to choose to measure many financial instruments and

certain other items at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15,

2007. We are currently evaluating the impact of SFAS No. 159.

RECLASSIFICATIONS Certain reclassifications have been made to the prior years’ consolidated

financial statements to provide comparability with the current year’s presentation of Net Gain from Sales

of Assets from Cost of Merchandise Sales and the change in classification of a store from discontinued

operations to continuing operations, see Note 7.