Pep Boys 2006 Annual Report Download - page 75

Download and view the complete annual report

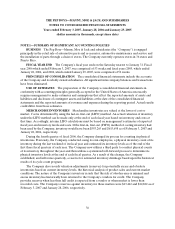

Please find page 75 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

36

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BUSINESS The Pep Boys—Manny, Moe & Jack and subsidiaries (the “Company”) is engaged

principally in the retail sale of automotive parts and accessories, automotive maintenance and service and

the installation of parts through a chain of stores. The Company currently operates stores in 36 states and

Puerto Rico.

FISCAL YEAR END The Company’s fiscal year ends on the Saturday nearest to January 31. Fiscal

year 2006 which ended February 3, 2007, was comprised of 53 weeks and fiscal years 2005, which ended

January 28, 2006, and 2004, which ended January 29, 2005, were comprised of 52 weeks.

PRINCIPLES OF CONSOLIDATION The consolidated financial statements include the accounts

of the Company and its wholly owned subsidiaries. All significant intercompany balances and transactions

have been eliminated.

USE OF ESTIMATES The preparation of the Company’s consolidated financial statements in

conformity with accounting principles generally accepted in the United States of America necessarily

requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could differ from those estimates.

MERCHANDISE INVENTORIES Merchandise inventories are valued at the lower of cost or

market. Cost is determined by using the last-in, first-out (LIFO) method. An actual valuation of inventory

under the LIFO method can be made only at the end of each fiscal year based on inventory and costs at

that time. Accordingly, interim LIFO calculations must be based on management’s estimates of expected

fiscal year-end inventory levels and costs. If the first-in, first-out (FIFO) method of costing inventory had

been used by the Company, inventory would have been $593,265 and $615,698 as of February 3, 2007 and

January 28, 2006, respectively.

During the fourth quarter of fiscal 2006, the Company changed its process for counting its physical

inventories. Previously, the Company conducted, using its own employees, a physical inventory count of its

inventory during the last weekend of its fiscal year and estimated its inventory levels as of the end of the

first three fiscal quarters of each year. The Company now utilizes a third party to conduct physical counts

of its inventory throughout the year and then utilizes a systemized roll-forward process to determine its

physical inventory levels at the end of each fiscal quarter. As a result of this change, the Company

established, and will revise quarterly, a reserve for estimated inventory shrinkage based upon the historical

results of its cycle count program.

The Company also records valuation adjustments (reserves) for potentially excess and obsolete

inventories based on current inventory levels, the historical analysis of product sales and current market

conditions. The nature of the Company’s inventory is such that the risk of obsolescence is minimal and

excess inventory has historically been returned to the Company’s vendors for credit. The Company

provides reserves when less than full credit is expected from a vendor or when market is lower than

recorded costs. The Company’s reserves against inventory for these matters were $13,462 and $12,822 as of

February 3, 2007 and January 28, 2006, respectively.