Pep Boys 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

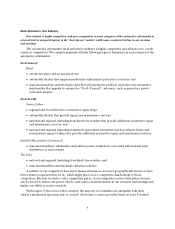

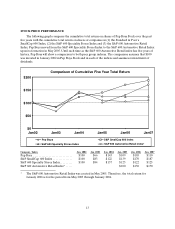

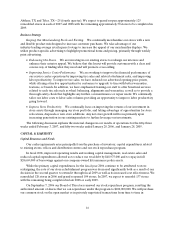

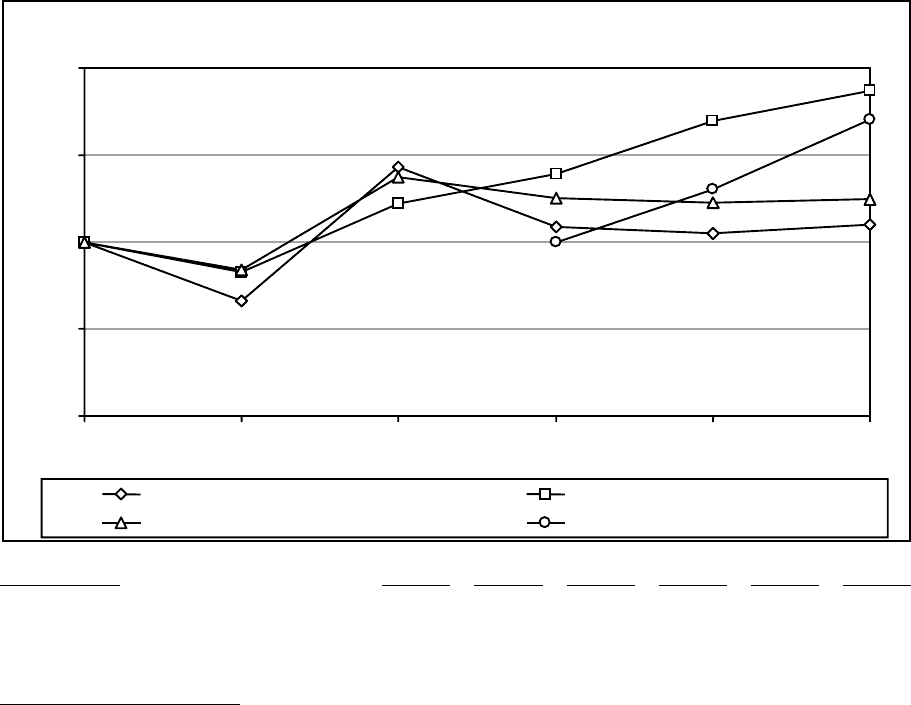

STOCK PRICE PERFORMANCE

The following graph compares the cumulative total return on shares of Pep Boys Stock over the past

five years with the cumulative total return on shares of companies in (1) the Standard & Poor’s

SmallCap 600 Index, (2) the S&P 600 Speciality Stores Index and (3) the S&P 600 Automotive Retail

Index. Pep Boys moved from the S&P 600 Speciality Stores Index to the S&P 600 Automotive Retail Index

upon its formation in May 2005. Until such time as the S&P 600 Automotive Retail index has five years of

history, Pep Boys will show a comparison to both peer group indexes. The comparison assumes that $100

was invested in January 2002 in Pep Boys Stock and in each of the indices and assumes reinvestment of

dividends.

Comparison of Cumulative Five Year Total Return

$200

$150

$100

$50

$0

Jan02 Jan03 Jan04 Jan05 Jan06 Jan07

Pep Boys

S&P 600 Specialty Stores Index

S&P SmallCap 600 Index

S&P 600 Automotive Retail Index*

Company / Index Jan. 2002 Jan. 2003 Jan. 2004 Jan. 2005 Jan. 2006 Jan. 2007

PepBoys ............................ $100 $66 $143 $109 $105 $110

S&P SmallCap 600 Index . . . . . . . . . . . . . . $100 $83 $122 $139 $170 $187

S&P 600 Specialty Stores Index. . . . . . . . . $100 $84 $137 $125 $122 $125

S&P 600 Automotive Retail Index* . . . . . $100 $130 $170

* The S&P 600 Automotive Retail Index was created in May 2005. Therefore, the total return for

January 2006 is for the period from May 2005 through January 2006.