Pep Boys 2006 Annual Report Download - page 78

Download and view the complete annual report

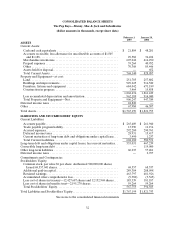

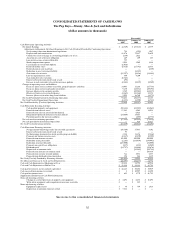

Please find page 78 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

39

by SFAS No. 158 “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans-

an Amendment of FASB Statements No. 87, 88, 106 and 132(R)”.

INCOME TAXES The Company uses the liability method of accounting for income taxes in

accordance with SFAS No. 109, “Accounting for Income Taxes.” Under the liability method, deferred

income taxes are determined based upon enacted tax laws and rates applied to the differences between the

financial statement and tax bases of assets and liabilities.

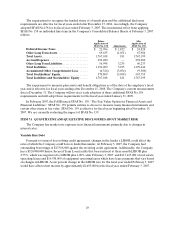

ADVERTISING The Company expenses the production costs of advertising the first time the

advertising takes place. Gross advertising expense for 2006, 2005, and 2004 was $84,206, $85,809 and

$73,996, respectively. No advertising costs were recorded as assets as of February 3, 2007 or

January 28, 2006.

The Company restructured substantially all of its vendor agreements in the fourth quarter of fiscal

2005 to provide flexibility in how the Company can use vendor support funds, and eliminate the

administrative burden associated with tracking the application of such funds. Therefore, in fiscal 2006,

substantially all vendor support funds were treated as a reduction of inventories and recognized as a

reduction to cost of merchandise sales as inventories are subsequently sold.

Prior to fiscal year 2006, certain cooperative advertising reimbursements were netted against specific,

incremental, identifiable costs incurred in connection with the selling of the vendor’s product. Cooperative

advertising reimbursements of $35,702 and $36,579 for fiscal years 2005 and 2004, respectively, were

recorded as a reduction of advertising expense with the net amount included in selling, general and

administrative expenses in the consolidated statement of operations. Any excess reimbursements over

these costs are characterized as a reduction of inventory and are recognized as a reduction of cost of sales

as the inventories are sold, in accordance with EITF 02-16. The amount of excess reimbursements

recognized as a reduction of costs of sales were $53,753 and $48,950 for fiscal years 2005 and 2004,

respectively. The balance of excess reimbursements remaining in inventory was immaterial as of

January 28, 2006.

STORE OPENING COSTS The costs of opening new stores are expensed as incurred.

IMPAIRMENT OF LONG-LIVED ASSETS The Company accounts for impaired long-lived assets

in accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.”

This standard prescribes the method for asset impairment evaluation for long-lived assets and certain

identifiable intangibles that are both held and used or to be disposed of. The Company evaluates the ability

to recover long-lived assets whenever events or circumstances indicate that the carrying value of the asset

may not be recoverable. In the event assets are impaired, losses are recognized to the extent the carrying

value exceeds the fair value. In addition, the Company reports assets to be disposed of at the lower of the

carrying amount or the fair market value less selling costs.

During fiscal 2006, the Company recorded an $840 impairment charge principally related for one

store location.

In the fourth quarter of fiscal 2005, the Company recorded in selling, general and administrative

expenses an impairment charge of $4,200 reflecting the remaining value of a commercial sales software

asset.

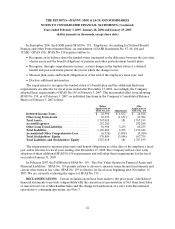

EARNINGS PER SHARE Earnings per share for all periods have been computed in accordance

with SFAS No. 128, “Earnings Per Share” as amended by SFAS No. 123 (revised 2004), “Share-Based