Pep Boys 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

71

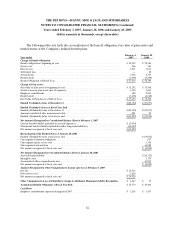

As of February 3, 2007 and January 28, 2006, the Company had available tax net operating losses that

can be carried forward to future years. The $328,826 net operating loss carryforward in 2007 consists of

$118,802 of federal losses and $210,024 of state losses. The federal net operating loss begins to expire in

2023 while the state net operating losses will expire in various years beginning in 2008.

The tax credit carryforward in 2007 consists of $4,772 of alternative minimum tax credits, $3,021 of

work opportunity credits, $5,829 of state tax credits and $322 of charitable contribution carryforward.

The tax credit carryforward in 2006 consists of $4,412 of alternative minimum tax credits, $2,612 of

work opportunity credits, $ 5,506 of state tax credits and $246 of charitable contribution carryforward.

Due to the uncertainty of the Company’s ability to realize certain state tax attributes, valuation

allowances of $4,077 and $3,545 were recorded at February 3, 2007 and January 28, 2006, respectively.

NOTE 14—CONTINGENCIES

The Company is party to various actions and claims, including purported class actions, arising in the

normal course of business. The Company believes that amounts accrued for awards or assessments in

connection with such matters are adequate and that the ultimate resolution of these matters will not have a

material adverse effect on the Company’s financial position, results of operations or cash flows.

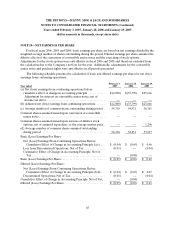

NOTE 15—INTEREST RATE SWAP AGREEMENT

On June 3, 2003, the Company entered into an interest rate swap for a notional amount of $130,000.

The Company had designated the swap as a cash flow hedge of the Company’s real estate operating lease

payments. The interest rate swap converts the variable LIBOR portion of the lease payment to a fixed rate

of 2.90% and terminates on July 1, 2008. If the critical terms of the interest rate swap or hedge item do not

change, the interest rate swap is considered to be highly effective with all changes in fair value included in

other comprehensive income. As of February 3, 2007 and January 28, 2006, the fair value was $4,150 and

$5,790, respectively. In the fourth quarter of fiscal 2006, the Company determined it was not in compliance

with SFAS No. 133 for hedge accounting and, accordingly, recorded a reduction of rent expense, which is

included in Costs of Merchandise and Costs of Service Revenues, for the cumulative fair value change of

$4,150. This change in fair value had previously been recorded in Accumulated Other Comprehensive

Income (Loss) on the consolidated balance sheets. The Company evaluated the impact of this error, along

with three other errors, on an annual and quarterly basis and concluded there was no material impact on

any historical periods, on an individual or aggregate basis. The Company corrected these errors in the

fourth quarter of fiscal 2006, resulting in no material impact to the consolidated financial statements. The

Company has removed its designation as a cash flow hedge on this transaction and will record the change

in fair value through its operating statement until the date of termination.

On November 2, 2006, the Company entered into an interest rate swap for a notional amount of

$200,000. The Company has designated the swap a cash flow hedge on the first $200,000 of the Company’s

$320,000 senior secured notes. The interest rate swap converts the variable LIBOR portion of the interest

payments to a fixed rate of 5.036% and terminates in October 2013. The Company did not meet the

documentation requirements of SFAS No. 133, at inception or as of February 3, 2007 and, accordingly,

recorded the increase in the fair value of the interest rate swap of $1,490 as a reduction to Interest