Pep Boys 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

65

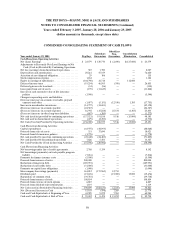

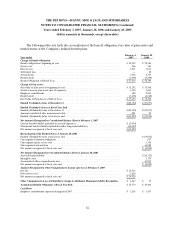

NOTE 10—NET EARNINGS PER SHARE

For fiscal years 2006, 2005 and 2004, basic earnings per share are based on net earnings divided by the

weighted average number of shares outstanding during the period. Diluted earnings per share assumes the

dilutive effects of the conversion of convertible senior notes and the exercising of stock options.

Adjustments for the stock options were anti-dilutive in fiscal 2006 and 2005 and therefore excluded from

the calculation due to the Company’s net loss for the year. Additionally, adjustments for the convertible

senior notes and purchase rights were anti-dilutive in all periods presented.

The following schedule presents the calculation of basic and diluted earnings per share for net (loss)

earnings from continuing operations:

Year ended

February 3,

2007

January 28,

2006

January 29,

2005

(a) Net (loss) earnings from continuing operations before

cumulative effect of change in accounting principle . . . . . . . . . . . . $ (2,000) $(35,799) $25,666

Adjustment for interest on convertible senior notes, net of

incometaxeffect.......................................... — — —

(b) Adjusted net (loss) earnings from continuing operations. . . . . . . $ (2,000) $(35,799) $25,666

(c) Average number of common shares outstanding during period . 54,318 54,831 56,361

Common shares assumed issued upon conversion of convertible

seniornotes............................................... — — —

Common shares assumed issued upon exercise of dilutive stock

options, net of assumed repurchase, at the average market price . — — 1,296

(d) Average number of common shares assumed outstanding

duringperiod ............................................. 54,318 54,831 57,657

Basic (Loss) Earnings Per Share:

Net (Loss) Earnings From Continuing Operations Before

Cumulative Effect of Change in Accounting Principle (a/c) . . . $ (0.04) $ (0.65) $ 0.46

LossfromDiscontinuedOperations,NetofTax............... (0.01) — (0.04)

Cumulative Effect of Change in Accounting Principle, Net of

Tax.................................................... — (0.04) —

Basic (Loss) Earnings Per Share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (0.05) $ (0.69) $ 0.42

Diluted (Loss) Earnings Per Share:

Net (Loss) Earnings From Continuing Operations Before

Cumulative Effect of Change in Accounting Principle (b/d) . . . $ (0.04) $ (0.65) $ 0.45

DiscontinuedOperations,NetofTax......................... (0.01) — (0.04)

Cumulative Effect of Change in Accounting Principle, Net of Tax. . — (0.04) —

Diluted (Loss) Earnings Per Share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (0.05) $ (0.69) $ 0.41