Pep Boys 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

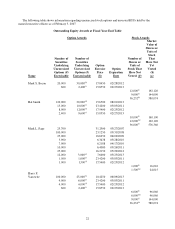

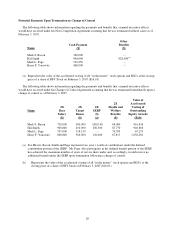

(a) Based upon the closing stock price of a share of PBY Stock on February 2, 2007 ($16.01).

(b) One-third of such options became/become exercisable on each of February 28, 2007, 2008 and 2009.

(c) One-quarter of such options became/become exercisable on each of February 27, 2007, 2008, 2009 and

2010.

(d) All of such options become exercisable on August 1, 2007.

(e) One-half of such options became/become exercisable on each of March 3, 2007 and 2008.

(f) One-third of such options became/become exercisable on each of February 25, 2007, 2008 and 2009.

(g) All of such options became exercisable on March 25, 2007.

(h) All of such options become exercisable on June 9, 2007.

(i) One-third of such RSUs vested/vest on each of February 28, 2007, 2008 and 2009.

(j) One-quarter of such RSUs vested/vest on each of February 27, 2007, 2008, 2009 and 2010.

(k) All of such RSUs vest on the earlier of July 17, 2007 or Mr. Bacon’s termination without cause.

(l) One-half of such RSUs vested/vest on each of March 3, 2007 and 2008.

(m) One-third of such RSUs vested/vest on each of February 25, 2007, 2008 and 2009.

(n) All of such RSUs vest on the earlier of September 1, 2007 or Mr. Yanowitz’ termination without cause.

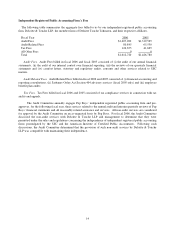

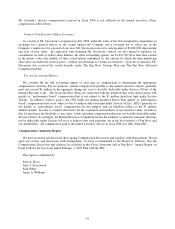

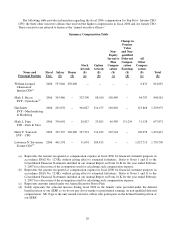

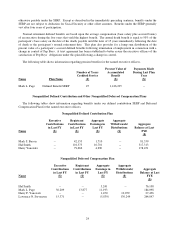

The following table shows information regarding stock options exercised by the named executive officers and

RSUs held by the named executive officers that vested, during fiscal 2006.

Option Exercises and Stock Vested Table

Option Awards Stock Awards

Name

Number of Shares

Acquired on

Exercise (#)

Value Realized on

Exercise ($)

Number of Shares

Acquired on

Vesting (#)(a)

Value Realized on

Vesting ($)(b)

Mark S. Bacon -- -- 4,000 62,800

Hal Smith -- -- 9,000 138,700

Mark L. Page -- -- 1,000 15,435

Harry F. Yanowitz -- -- 5,000 76,960

Lawrence N. Stevenson 840,632

(c)

$1,691,307 18,333 283,328

(a) Messrs. Page and Yanowitz defer the issuance of vested shares underlying RSUs.

(b) Based upon the closing price of a share of PBY Stock on the vesting date(s) not the SFAS No. 123(R)

recognized compensation expense reflected elsewhere in this proxy statement.

(c) In connection with Mr. Stevenson’s resignation we purchased for cancellation, in order to reduce share

dilution, all of his outstanding options, for their then current in the money value (the number of then vested

options multiplied, by the amount by which the then underlying share price exceeded the exercise price –

without any premium or vesting acceleration).

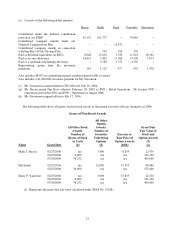

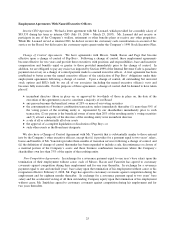

Pension Plans

Qualified Defined Benefit Pension Plan. We have a qualified defined benefit pension plan for all employees

hired prior to February 2, 1992. Future benefit accruals on behalf of all participants were frozen under this plan as

of December 31, 1996. Benefits payable under this plan are calculated based on the participant’s compensation

(base salary plus accrued bonus) over the last five years of the participant’s employment by Pep Boys and the

number of years of participation in the plan. Benefits payable under this plan are not subject to deduction for

Social Security or other offset amounts. The maximum annual benefit for any employee under this plan is $20,000.

Mr. Page is the only named executive officer who participates in the qualified defined benefit pension plan. His

accrued annualized benefit there under, at normal retirement age, is $19,162.

Executive Supplemental Retirement Plan. As discussed above, our SERP includes a defined benefit portion for

certain participants. Mr. Page is the only named executive officer participating in the defined benefit portion of the

SERP. Benefits paid to a participant under the qualified defined pension plan will be deducted from the benefits