Pep Boys 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

47

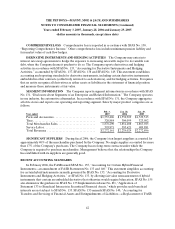

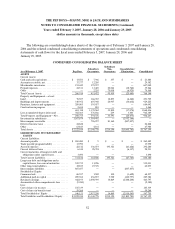

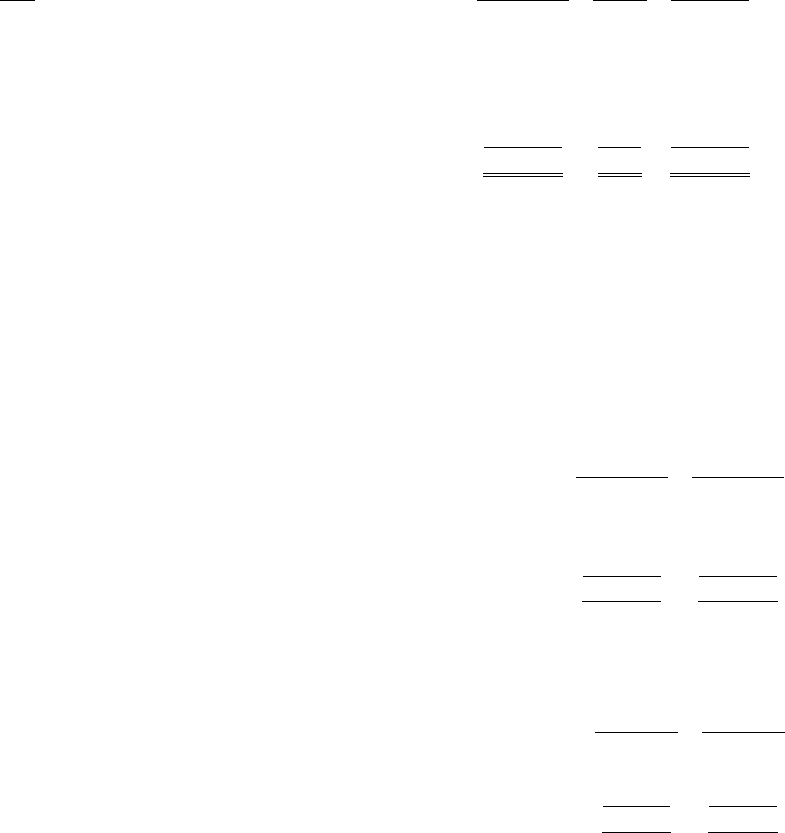

The annual maturities of all long-term debt and capital lease commitments for the next five fiscal

years are:

Long-Term Capital

Year Debt Leases Total

2007.......................................... $ 3,201 $289 $ 3,490

2008.......................................... 3,241 239 3,480

2009.......................................... 20,787 157 20,944

2010.......................................... 3,229 — 3,229

2011.......................................... 3,227 — 3,227

Thereafter..................................... 504,151 — 504,151

Total.......................................... $537,836 $685 $538,521

The Company has letter of credit arrangements in connection with its risk management, import

merchandising and vendor financing programs. The Company was contingently liable for $487 and $1,015

in outstanding import letters of credit and $55,708 and $41,218 in outstanding standby letters of credit as of

February 3, 2007 and January 28, 2006 respectively. The Company was also contingently liable for surety

bonds in the amount of approximately $11,224 and $13,021 at February 3, 2007 and January 28, 2006,

respectively.

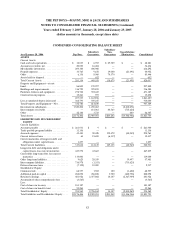

NOTE 3—ACCRUED EXPENSES

The Company’s accrued expenses as of February 3, 2007 and January 28, 2006, were as follows:

February 3,

2007

January 28,

2006

Casualty and medical risk insurance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $173,826 $178,498

Accruedcompensationandrelatedtaxes ........................ 44,317 44,565

Salestaxpayable ............................................. 11,286 11,597

Other....................................................... 62,851 56,101

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $292,280 $290,761

NOTE 4—OTHER CURRENT ASSETS

The Company’s other current assets as of February 3, 2007 and January 28, 2006, were as follows:

February 3,

2007

January 28,

2006

Reinsurancepremiumsandreceivable ............................ $69,239 $82,629

Income taxes receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2,694

Other......................................................... 1,129 123

Total.......................................................... $70,368 $85,446

NOTE 5—LEASE AND OTHER COMMITMENTS

On October 18, 2004, the Company entered into a Master Lease agreement providing for the lease of

up to $35,000 of new point-of-sale hardware for the Company’s stores at an interest rate of LIBOR plus