Pep Boys 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

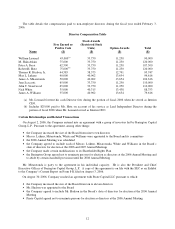

16

named executive officer’s individual performance during the applicable fiscal year on a five-point scale, based upon

a “360° Assessment” driven by supervisor, lateral and subordinate feedback designed to improve team performance.

These performance values are then applied against the relative position of the named executive officer’s current

salary within the market range for his position and the budgeted percentage increase for all officers as a group. This

budgeted percentage increase was 3.0% for fiscal 2006. In fiscal 2006, each of the named executive officers, except

for Mr. Stevenson, received merit-based increases to their base salaries in accordance with the foregoing process.

In addition to their merit-based increases, (i) Mr. Smith received an additional increase to his base salary as an

acknowledgement of his forgoing another employment opportunity, and (ii) Mr. Yanowitz received an additional

increase to his base salary in connection with the renegotiation of his employment relationship with the Company,

which was otherwise set to expire on June 9, 2006.

Short-Term Incentives. The named executive officers participate in our Annual Incentive Bonus Plan, which is

a short-term incentive plan designed to reward the achievement of pre-established corporate and, except for the

CEO, individual goals. For fiscal 2006, the named executive officers’ bonus levels were as follows:

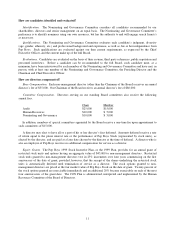

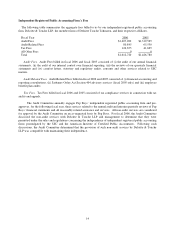

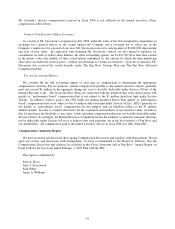

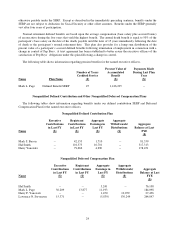

%of Salary Weig

h

ting

Title Threshold Target MAX CAP Corporate (%) Individual (%)

CEO 50 100 150 200 100 0

EVP 25 50 75 100 60 40

SVP 22.5 45 67.5 90 60 40

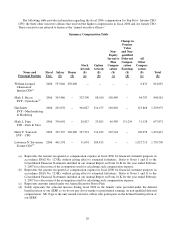

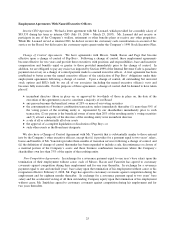

For fiscal 2006, the corporate bonus objectives, which are those financial measures deemed most important to

Pep Boys’ overall success, and their weightings were: operating profit (40%); Service Business variable profit

(20%); management turnover (15%); working capital (15%); and Service Center customer service index (10%). For

fiscal 2006, the Human Resources Committee established target levels that it believed were achievable. However, it

also believed, at the time the target levels were established, that the achievement of the targets was substantially

uncertain.

Individual performance goals were also established for each named executive officer, other than the CEO,

based upon departmental objectives.

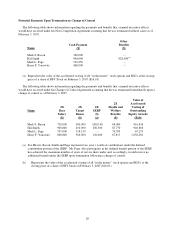

For fiscal 2006, the Company achieved its bonus targets in the areas of management turnover, working capital

and Service Center customer service index resulting in a corporate bonus payout of 62% of target. In addition, each

of Messrs. Bacon, Smith, Page and Yanowitz earned individual bonus payouts of 116%, 59%, 33% and 100% of

target, respectively, based upon the achievement of certain departmental objectives. However, because the

Company did not achieve threshold performance against its operating profit bonus target, each of the named

executive’s individual bonus payouts was reduced by 50% to 58%, 29%, 16% and 50% of target, respectively.

Accordingly, for fiscal 2006, Messrs. Bacon, Smith, Page and Yanowitz received bonus payouts of 30%, 24%, 20%

and 26%, respectively, of their 2006 annual salaries.

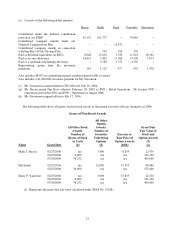

Long-Term Incentives. We believe that compensation through equity grants directly aligns the interests of

management with that of its shareholders -- long-term growth in the price of Pep Boys sock. The Stock Incentive

Plans provide for the grant of stock options at exercise prices equal to the fair market value (the mean between and

the high and low quoted selling prices) of Pep Boys stock on the date of grant and the grant of RSUs. All of the

stock options granted in fiscal 2006 expire seven years from the date of grant and become exercisable in 20%

installments over four years beginning on the date of grant. All of the RSUs granted in fiscal 2006 vest in 25%

increments over four years beginning on the first anniversary of the date of grant. Dividend equivalents are paid on

RSUs.

The Human Resources Committee has established annual target grants for the named executive officers (other

than the CEO), which are designed to be competitive at market median of other comparably sized retail companies.

The annual grants are typically made at the Board meeting immediately prior to our year-end earnings release. The

annual target grants are also designed to assist the named executive officers in achieving our established ownership