Pep Boys 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

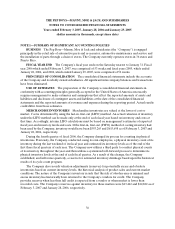

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

40

Payment.” Basic earnings per share is computed by dividing earnings by the weighted average number of

common shares outstanding during the year. Diluted earnings per share is computed by dividing earnings

plus the interest on the convertible senior notes by the weighted average number of common shares

outstanding during the year plus the assumed conversion of dilutive convertible debt and incremental

shares that would have been outstanding upon the assumed exercise of dilutive stock options.

ACCOUNTING FOR STOCK-BASED COMPENSATION At February 3, 2007, the Company has

three stock-based employee compensation plans, which are described in full in Note 12, “Equity

Compensation Plans.”

Effective January 29, 2006, the Company adopted the provisions of Statement of Financial

Accounting Standards No. 123 (revised 2004), “Share-Based Payment” (SFAS No.123R) requiring that

compensation cost relating to share-based payment transactions be recognized in the financial statements.

The cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as

an expense over the employee’s requisite service period (generally the vesting period of the equity award).

Prior to January 29, 2006, the Company accounted for share-based compensation to employees in

accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to

Employees” (APB No. 25), and related interpretations. The Company also followed the disclosure

requirements of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based

Compensation”. The Company adopted SFAS No. 123R using the modified prospective method and,

accordingly, financial statement amounts for periods prior to January 29, 2006 have not been restated to

reflect the fair value method of recognizing compensation cost relating to share-based compensation.

The Company recognized approximately $1,340 of compensation expense related to stock options,

and approximately $1,711 of compensation expense related to restricted stock units (RSUs), in its

operating results (included in selling, general and administrative expenses) for fiscal year 2006. The related

tax benefit recognized was approximately $894. Compensation expense for RSUs was $2,049 and $1,183,

for fiscal year 2005 and 2004 respectively, and was included in selling, general and administrative expenses.

The cumulative effect from adopting the provisions of SFAS No. 123R in fiscal year 2006 was $189 benefit,

net of tax.

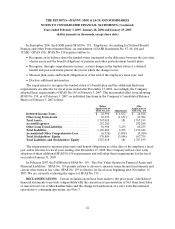

The application of SFAS 123(R) had the following effect on reported amounts in fiscal year 2006,

relative to amounts that would have been reported using the intrinsic value method under previous

accounting (dollars in thousands, except per share amounts):

SFAS 123(R)

Adjustments

Operating profit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,340)

Loss from Continuing Operations Before Income Taxes and

CumulativeEffectofChangeinAccountingPrinciple............... $(1,340)

IncomeTaxBenefit............................................... $ 393

Net Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (947)

BasicLossperShare.............................................. $ (0.02)

DilutedLossperShare............................................ $ (0.02)

Cashflowfromoperatingactivities ................................. $ (95)

Cashflowfromfinancingactivities.................................. $ 95