Pep Boys 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

73

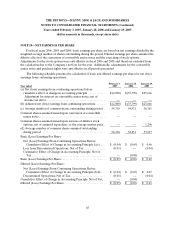

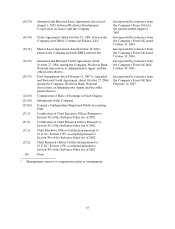

NOTE 17—QUARTERLY FINANCIAL DATA (UNAUDITED)

Total Gross

Operating

(Loss)

Net

(Loss)

Earnings

From

Continuing

Operations

Before

Cumulative

Effect of

Change in

Accounting

Net

(Loss)

Net

(Loss)

Earnings Per

Share

From

Continuing

Operations

Before

Cumulative

Effect of

Change in

Accounting

Principle

Net

(Loss)

Earnings

Per Share

Cash

Dividends

Market

Price Per

Share

Revenues Profit Profit Principle Earnings Basic Diluted Basic Diluted Per Share High Low

Year Ended

February 3, 2007

4th Quarter. . . . . . . $586,146 $150,083 $ 18,140 $ 8,110 $ 7,716 $ 0.15 $ 0.15 $ 0.14 $ 0.14 $0.0675 $16.05 $12.48

3rd Quarter . . . . . . 550,849 137,693 (1,349) (10,713) (10,914) (0.20) (0.20) (0.20) (0.20) 0.0675 14.58 9.33

2nd Quarter . . . . . . 578,565 145,102 11,989 1,470 1,352 0.03 0.03 0.03 0.03 0.0675 14.96 10.66

1st Quarter . . . . . . . 556,601 138,878 7,242 (867) (703) (0.02) (0.02) (0.01) (0.01) 0.0675 16.55 14.05

Year Ended

January 28, 2006

4th Quarter(1) . . . . $550,481 $110,412 $(15,690) $(22,869) $(24,601) $(0.42) $(0.42) $(0.46) $(0.46) $0.0675 $15.99 $12.54

3rd Quarter . . . . . . 545,904 119,113 (8,553) (11,376) (11,196) (0.21) (0.21) (0.20) (0.20) 0.0675 14.84 11.75

2nd Quarter . . . . . . 577,418 138,228 9,659 2,264 1,043 0.01 0.01 0.02 0.02 0.0675 15.24 12.54

1st Quarter . . . . . . . 564,226 139,514 3,359 (3,818) (2,774) (0.04) (0.04) (0.05) (0.05) 0.0675 18.80 14.06

(1) Includes a pretax charge of $4,200 related to an asset impairment charge reflecting the remaining value of a commercial sales software asset,

which was included in selling, general and administrative expenses.

Under the Company’s present accounting system, actual gross profit from merchandise sales can be

determined only at the time of physical inventory, which is taken at the end of the fiscal year. In fiscal year

2006, these physical inventories were taken at different times during the course of the fourth quarter

resulting in the Company recording an estimate for inventory shrinkage from the time of the physical

inventory to the end of the fiscal year. Gross profit from merchandise sales for the first, second and third

quarters is estimated by the Company based upon recent historical gross profit experience and other

appropriate factors. Any variation between estimated and actual gross profit from merchandise sales for

the first three quarters is reflected in the fourth quarter’s results.

Certain reclassifications have been made to the prior years’ consolidated financial statements to

provide comparability with the current year’s presentation of Net Gain from Sales of Assets from Cost of

Merchandise Sales and the change in classification of a store from discontinued operations to continuing

operations.