Pep Boys 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

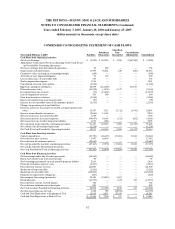

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

63

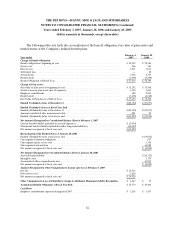

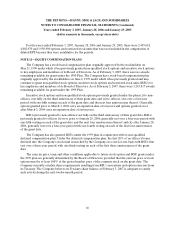

The following table sets forth additional fiscal year-end information for the defined benefit portion of

the Company’s SERP for which the accumulated benefit obligation is in excess of plan assets:

Year ended

February 3,

2007

January 28,

2006

Projectedbenefitobligation...................................... $17,499 $16,859

Accumulatedbenefitobligation .................................. 14,264 12,914

The following actuarial assumptions were used by the Company to determine pension expense and to

present disclosure benefit obligations:

Year ended

February 3,

2007

January 28,

2006

January 29,

2005

Weighted-Average Assumptions as of December 31:

Discountrate .................................. 5.90% 5.70%

Rate of compensation increase . . . . . . . . . . . . . . . . . . . 4.0%(1) 4.0%(1)

Weighted-Average Assumptions for Net Periodic

Benefit Cost Development:

Discountrate .................................. 5.70% 5.75% 6.25%

Expectedreturnonplanassets................... 6.30% 6.75% 6.75%

Rate of compensation expense . . . . . . . . . . . . . . . . . . . 4.0%(1) 4.0%(1) 4.0%(1)

(1) In addition, bonuses are assumed to be 25% of base pay for the SERP.

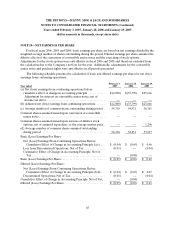

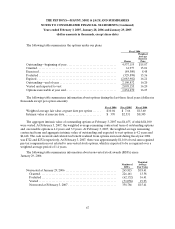

To develop the expected long-term rate of return on assets assumption, the Company considered the

historical returns and the future expectations for returns for each asset class, as well as the target asset

allocation of the pension portfolio. This resulted in the selection of the 6.30% long-term rate of return on

assets assumption.

The Company selected the discount rate at December 31, 2006 to reflect a rate commensurate with a

model bond portfolio with durations that match the expected payment patterns of the plans.

Pension plan assets are stated at fair market value and are composed primarily of money market

funds, stock index funds, fixed income investments with maturities of less than five years, and the

Company’s common stock.

Our target asset allocation is 50% equity securities and 50% fixed income. The weighted average asset

allocations by asset category are as follows:

Plan Assets

As of

December 31,

2006

As of

December 31,

2005

Equitysecurities............................................ 54% 50%

Fixedincome .............................................. 46% 50%

Total...................................................... 100% 100%