Pep Boys 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

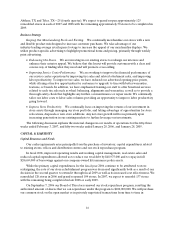

The degree to which we are leveraged could have important consequences to your investment in our

securities, including the following risks:

•our ability to obtain additional financing for working capital, capital expenditures, acquisitions or

general corporate purposes may be impaired in the future;

•a substantial portion of our cash flow from operations must be dedicated to the payment of

principal and interest on our debt, thereby reducing the funds available for other purposes;

•our failure to comply with financial and operating restrictions placed on us and our subsidiaries by

our credit facilities could result in an event of default that, if not cured or waived, could have a

material adverse effect on our business or our prospects; and

•if we are substantially more leveraged than some of our competitors, we might be at a competitive

disadvantage to those competitors that have lower debt service obligations and significantly greater

operating and financial flexibility than we do.

We depend on our relationships with our vendors and a disruption of these relationships or of our vendors’

operations could have a material adverse effect on our business and results of operations.

Our business depends on developing and maintaining productive relationships with our vendors.

Many factors outside our control may harm these relationships. For example, financial difficulties that

some of our vendors may face may increase the cost of the products we purchase from them. In addition,

our failure to promptly pay, or order sufficient quantities of inventory from our vendors may increase the

cost of products we purchase or may lead to vendors refusing to sell products to us at all. A disruption of

our vendor relationships or a disruption in our vendors’ operations could have a material adverse effect on

our business and results of operations.

We depend on our senior management team and our other personnel, and we face substantial competition for

qualified personnel.

Our success depends in part on the efforts of our senior management team. Our continued success

will also depend upon our ability to retain existing, and attract additional, qualified field personnel to meet

our needs. We face substantial competition, both from within and outside of the automotive aftermarket to

retain and attract qualified personnel. In addition, we believe that the number of qualified automotive

service technicians in the industry is generally insufficient to meet demand.

We are subject to environmental laws and may be subject to environmental liabilities that could have a

material adverse effect on us in the future.

We are subject to various federal, state and local laws and governmental regulations relating to the

operation of our business, including those governing the handling, storage and disposal of hazardous

substances contained in the products we sell and use in our service bays, the recycling of batteries, tires and

used lubricants, and the ownership and operation of real property. As a result of investigations undertaken

in connection with a number of our store acquisitions and financings, we are aware that soil or

groundwater may be contaminated at some of our properties. Any failure by us to comply with

environmental laws and regulations could have a material adverse effect on us.