Pep Boys 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

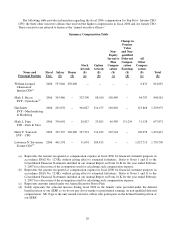

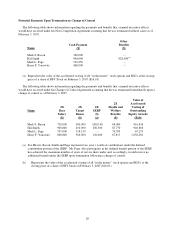

If the Participant is…

Annual contribution as a

percentage of cash

compensation (salary +

short-term cash

incentive)

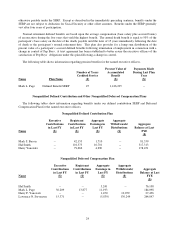

At least 55 years of age 19%

At least 45 years of age but not more than 54 years of age 16%

At least 40 years of age but not more than 44 years of age 13%

Not more than 39 years of age 10%

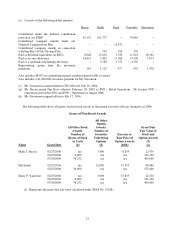

Of the named executive officers, Messrs. Smith, Bacon and Yanowitz participate in the defined contribution

portion of the SERP, while Mr. Page participates in the defined benefit portion of the SERP. Mr. Page also has a

frozen benefit under our qualified defined benefit plan, as described in “Pension Plans” on page 23 below.

Health and Welfare Benefits.In order to keep our executive compensation program competitive, we also

provide our named executive officers with health and welfare benefits, including medical and dental coverage, life

insurance valued at one times salary, long term disability coverage, an auto allowance and a tax/financial planning

allowance.

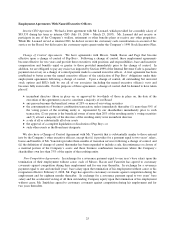

Employment Agreements. We entered into a letter agreement with Mr. Leonard, which described the terms of

his employment with us as Interim CEO, and Non-Competition and Change of Control Agreements with Messrs.

Bacon, Smith, Page and Yanowitz, as described in “Employment Agreements with Named Executive Officers”on

page 25 below. The purpose of our Non-Competition Agreements is to prevent our named executive officers from

soliciting our employees or competing with us if they leave Pep Boys of their own volition. As consideration for

such restrictive covenants, the Non-Competition Agreements provide for a severance payment to be made to a

named executive officer if he is terminated by the Company without “cause.” The purpose of the Change of Control

Agreements is to provide an incentive for our officers to remain in employment and continue to focus on the best

interests of the company without regard to any possible change of control.

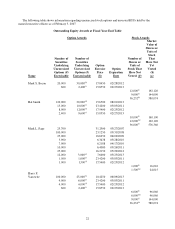

Retention Awards.

In February 2006, we engaged Goldman Sachs to conduct a review of our strategic alternatives. The Board of

Directors asked Mr. Yanowitz to lead management’s efforts in connection with this process. In order to compensate

Mr. Yanowitz for these additional responsibilities and to retain Mr. Yanowitz through the completion of the process,

we paid him a one-time cash bonus of $340,000.

In July 2006, Mr. Stevenson, our then CEO, resigned. Faced with the impact of this vacancy, disappointing

operating performance and a threatened proxy fight for control of our Board of Directors, we granted $400,000 of

RSUs to each of Messrs. Bacon and Yanowitz, in order to ensure stability amongst our senior management team.

The RSUs were valued at the current market price of Pep Boys Stock on the date of grant.

Interim Chief Executive Officer.

In order to secure the services of our Chairman of the Board, from July 2006 through March 2007, we paid Mr.

Leonard a monthly salary of $83,333 and reimbursed him for his commuting expense, with a tax gross-up, from his

home in California to our Philadelphia store support center. Otherwise, Mr. Leonard did not receive or participate

in any of our welfare, retirement or other benefit plans or receive any perquisites. While Mr. Leonard served as

interim CEO, he did not receive his customary cash consideration on account of his service on the Board of

Directors, but he did receive his customary equity grants under our Stock Incentive Plan as a member of the Board.