Pep Boys 2006 Annual Report Download - page 82

Download and view the complete annual report

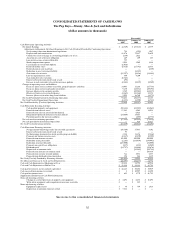

Please find page 82 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

43

Statement No. 125,” by eliminating the restriction on passive derivative instruments that a qualifying

special-purpose entity may hold. SFAS No. 155 is effective for financial instruments acquired or issued

after the beginning of our fiscal year 2007. We are currently evaluating the impact of SFAS No 155 and will

adopt the standard February 4, 2007.

In March 2006, the FASB issued SFAS No. 156, “Accounting for Servicing of Financial Assets—an

amendment of FASB Statement No. 140.” SFAS No. 156 amends SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments of Liabilities,” with respect to the

accounting for separately recognized servicing assets and servicing liabilities. SFAS No. 156 is effective for

fiscal years beginning after September 15, 2006. We are currently evaluating the impact of SFAS No. 156

and will adopt the standard February 4, 2007.

In June 2006, the FASB ratified the consensus reached by the Emerging Issues Task Force on

Issue 06-3, “How Taxes Collected from Customers and Remitted to Governmental Authorities Should be

Presented in the Income Statement (That Is, Gross versus Net Presentation).” The scope of this consensus

includes any tax assessed by a governmental authority that is directly imposed on a revenue-producing

transaction between a seller and a customer and may include, but is not limited to sales, use, value added

and some excise taxes. Additionally, this consensus seeks to address how a company should address the

disclosure of such items in interim and annual financial statements, either gross or net pursuant to APB

Opinion No. 22, Disclosure of Accounting Policies. The Company is required to adopt this statement in

fiscal 2007. The Company presents sales net of sales taxes in its consolidated statement of operations and

does not anticipate changing its policy as a result of EITF 06-3.

In July 2006, the FASB released FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes—an Interpretation of FASB Statement 109” (FIN 48). FIN 48 prescribes a model for the

recognition and measurement of a tax position taken or expected to be taken in a tax return, and provides

guidance on derecognition, classification, interest and penalties, disclosure and transition. The Company

does not expect the adoption of this statement, beginning in fiscal 2007, will have a material impact on its

consolidated financial statements.

In September 2006, the SEC, staff issued Staff Accounting Bulletin No. 108, “Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” or

SAB 108. SAB 108 was issued in order to eliminate the diversity in practice surrounding how public

companies quantify financial statement misstatements. SAB 108 requires that registrants quantify errors

using both a balance sheet and income statement approach and evaluate whether either approach results

in a misstated amount that, when all relevant quantitative and qualitative factors are considered, is

material. SAB 108 is effective for financial statements covering the first fiscal year ending after

November 15, 2006. We adopted SAB 108 for the year ended February 3, 2007 with no impact on our

consolidated financial condition, results of operations or cash flows.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (SFAS 157).

SFAS 157 defines the term fair value, establishes a framework for measuring it within generally accepted

accounting principles and expands disclosures about its measurements. SFAS 157 is effective for financial

statements issued for fiscal years beginning after November 15, 2007. We are currently evaluating the

impact SFAS No. 157 will have on our financial statements beginning in fiscal 2008.