Pep Boys 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

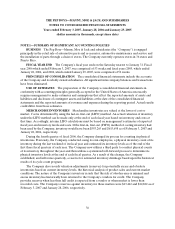

In March 2006, the FASB issued SFAS No. 156, “Accounting for Servicing of Financial Assets—an

amendment of FASB Statement No. 140.” SFAS No. 156 amends SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments of Liabilities,” with respect to the

accounting for separately recognized servicing assets and servicing liabilities. SFAS No. 156 is effective for

fiscal years beginning after September 15, 2006. We are currently evaluating the impact of SFAS No. 156

and will adopt the standard February 4, 2007.

In June of 2006, the FASB ratified the consensus reached by the Emerging Issues Task Force on

Issue 06-3, How Taxes Collected from Customers and Remitted to Governmental Authorities Should be

Presented in the Income Statement (That Is, Gross versus Net Presentation). The scope of this consensus

includes any tax assessed by a governmental authority that is directly imposed on a revenue-producing

transaction between a seller and a customer and may include, but is not limited to sales, use, value added

and some excise taxes. Additionally, this consensus seeks to address how a company should address the

disclosure of such items in interim and annual financial statements, either gross or net pursuant to

APB Opinion No. 22, Disclosure of Accounting Policies. The Company is required to adopt this statement

in fiscal 2007. The Company presents sales net of sales taxes in its consolidated statement of operations

and does not anticipate changing its policy as a result of EITF 06-3.

In July of 2006, the FASB released FASB Interpretation No. 48, Accounting for Uncertainty in

Income Taxes—an Interpretation of FASB Statement 109 (FIN 48). FIN 48 prescribes a model for the

recognition and measurement of a tax position taken or expected to be taken in a tax return, and provides

guidance on derecognition, classification, interest and penalties, disclosure and transition. FIN 48 is

effective for financial statements issued for fiscal years beginning after December 15, 2006. The Company

does not expect the adoption of this statement to have a material impact on its consolidated financial

statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (SFAS No. 157).

SFAS 157 defines the term fair value, establishes a framework for measuring it within generally accepted

accounting principles and expands disclosures about its measurements. SFAS No. 157 is effective for

financial statements issued for fiscal years beginning after November 15, 2007. We are currently evaluating

the impact of SFAS No. 157.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans—an Amendment of FASB Statements No. 87, 88, 106 and

132(R)” (SFAS 158). SFAS No. 158 requires entities to:

•Recognize on its balance sheet the funded status (measured as the difference between the fair value

of plan assets and the benefit obligation) of pension and other postretirement benefit plans;

•Recognize, through comprehensive income, certain changes in the funded status of a defined

benefit and post retirement plan in the year in which the changes occur;

•Measure plan assets and benefit obligations as of the end of the employer’s fiscal year; and

•Disclose additional information.