Pep Boys 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

70

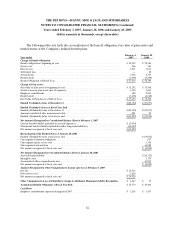

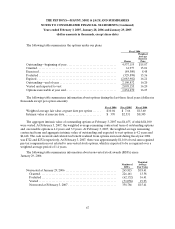

A reconciliation of the statutory federal income tax rate to the effective rate of the provision for

income taxes follows:

Year ended

February 3,

2007

January 28,

2006

January 29,

2005

Statutorytaxrate................................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefits . . . . . . . . . . (3.6) 0.9 2.8

Jobcredits......................................... 5.8 0.8 (1.0)

State Deferred Adjustment(a). . . . . . . . . . . . . . . . . . . . . . . . 38.9 — —

ForeignTaxes,netoffederalbenefits................. (3.8) — —

Other,net......................................... (4.1) (0.2) 0.6

68.2% 36.5% 37.4%

(a) The tax rate for the year ended February 2007 includes an adjustment to the state deferred liabilities

primarily due to change in the Company’s filing position in certain states. Based on the new filing

position, the Company has recorded certain tax attributes that were not recognized previously.

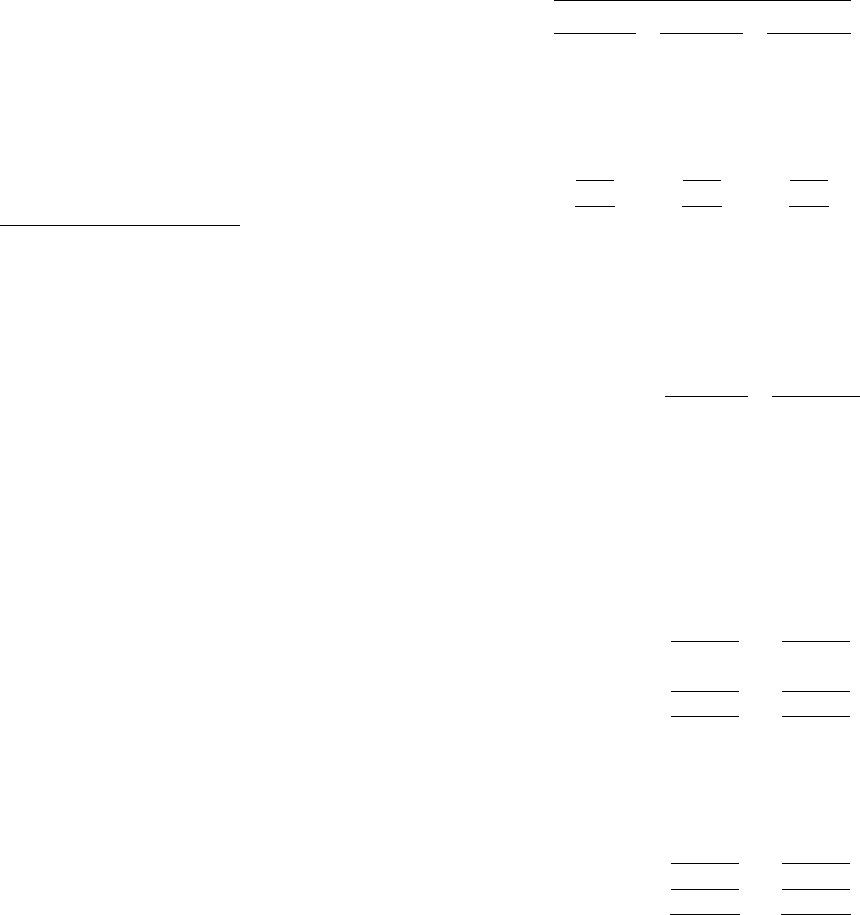

Items that gave rise to significant portions of the deferred tax accounts are as follows:

February 3,

2007

January 28,

2006

Deferred tax assets:

Employee compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,227 $ 6,693

Store closing reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 741 1,087

Legal ...................................................... 2,193 500

BenefitAccruals............................................. 1,998 538

Netoperatinglosscarryforwards .............................. 46,831 27,640

Taxcreditcarryforwards...................................... 13,944 12,775

Accruedleases.............................................. 12,937 13,522

Interestratederivatives ...................................... 1,305 —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,566 3,049

Grossdeferredtaxassets..................................... 91,742 65,804

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,077) (3,545)

$87,665 $62,259

Deferred tax liabilities:

Depreciation................................................ $51,017 $55,222

Inventories ................................................. 37,544 17,655

Real estate tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,414 2,405

Insurance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 793 3,180

Interest rate derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 2,151

$91,768 $80,613

Net deferred tax liability........................................ $4,103 $18,354