Pep Boys 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

42

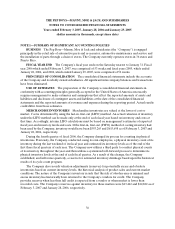

COMPREHENSIVE LOSS Comprehensive loss is reported in accordance with SFAS No. 130,

“Reporting Comprehensive Income.” Other comprehensive loss includes minimum pension liability and

fair market value of cash flow hedges.

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The Company may enter into

interest rate swap agreements to hedge the exposure to increasing rates with respect to its variable rate

debt, when the Company deems it prudent to do so. The Company reports derivatives and hedging

activities in accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” as amended by SFAS No. 137, SFAS No. 138 and SFAS No. 149. This statement establishes

accounting and reporting standards for derivative instruments, including certain derivative instruments

embedded in other contracts (collectively referred to as derivatives), and for hedging activities. It requires

that an entity recognize all derivatives as either assets or liabilities in the statement of financial position

and measure those instruments at fair value.

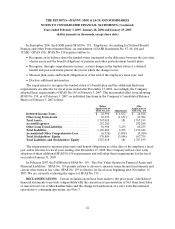

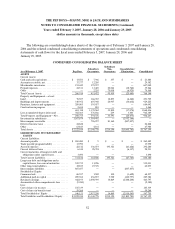

SEGMENT INFORMATION The Company reports segment information in accordance with SFAS

No. 131, “Disclosure about Segments of an Enterprise and Related Information.” The Company operates

in one industry, the automotive aftermarket. In accordance with SFAS No. 131, the Company aggregates

all of its stores and reports one operating and reporting segment. Sales by major product categories are as

follows:

Year ended

Feb. 3,

2007

Jan. 28,

2006

Jan. 29,

2005

Parts and Accessories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,555,406 $1,550,309 $1,539,513

Tires . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 320,884 304,099 323,502

Total Merchandise Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . 1,876,290 1,854,408 1,863,015

Service Labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 395,871 383,621 409,881

Total Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,272,161 $2,238,029 $2,272,896

SIGNIFICANT SUPPLIERS During fiscal 2006, the Company’s ten largest suppliers accounted for

approximately 40% of the merchandise purchased by the Company. No single supplier accounted for more

than 17% of the Company’s purchases. The Company has no long-term contracts under which the

Company is required to purchase merchandise. Management believes that the relationships the Company

has established with its suppliers are generally good.

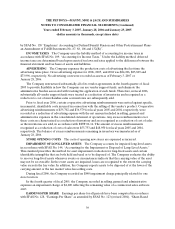

RECENT ACCOUNTING STANDARDS

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial

Instruments—an amendment of FASB Statements No. 133 and 140.” This statement simplifies accounting

for certain hybrid instruments currently governed by SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” or SFAS No. 133, by allowing fair value remeasurement of hybrid

instruments that contain an embedded derivative that otherwise would require bifurcation. SFAS No. 155

also eliminates the guidance in SFAS No. 133 Implementation Issue No. D1, “Application of

Statement 133 to Beneficial Interests in Securitized Financial Assets,” which provides such beneficial

interests are not subject to SFAS No. 133. SFAS No. 155 amends SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments of Liabilities—a Replacement of FASB