Pep Boys 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

meaningful voice in a takeover context.

Additionally:

ƔOur directors also served on boards rated D by The Corporate Library

http://www.thecorporatelibrarv.com/, an independent investment research firm:

1) Mr. White Playtex (PYX) D-rated

2) Mr. Hotz Universal Health (UHS) D-rated

ƔThree directors held less than 628 shares each:

Mr. White

Ms. Atkins

Mr. Williams

The above status shows there is room for improvement and reinforces the reason to take one step forward now and

vote yes:

Subject Poison Pills to a Shareholder Vote

Yes on 3.”

PEP BOYS’ STATEMENT IN OPPOSITION TO THE FOREGOING SHAREHOLDER PROPOSAL

The Board of Directors originally adopted our Shareholder Rights Plan in December 1987, renewed and updated

it in December 1997 and amended it further in August 2006 to protect and maximize the value of every

shareholder’s investment in Pep Boys.

The Board of Directors maintains a special committee of independent Directors which annually evaluates our

Shareholder Rights Plan. To assist in its evaluation, the Committee consults with outside counsel and our primary

investment bankers and makes recommendations to the full Board concerning the maintenance, amendment or

redemption of the Shareholder Rights Plan.

Following this year’s evaluation and recognizing that the shareholders have previously voted in favor of the

recommendation that Pep Boys should not maintain our current Shareholder Rights Plan, the Board of Directors has

determined to allow the Shareholder Rights Plan to expire, in accordance with its terms, on December 31, 2007.

By allowing the Shareholder Rights Plan to expire in due course, rather than immediately redeeming the plan

(which would serve to extinguish the plan only a few months earlier than its scheduled expiration), the Company

will avoid the redemption expense of approximately $500,000.

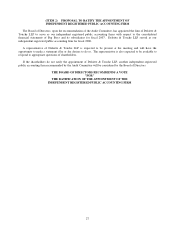

ACCORDINGLY, THE BOARD OF DIRECTORS RECOMMENDS A VOTE

“AGAINST”

THE FOREGOING SHAREHOLDER PROPOSAL

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and 10% Holders

to file initial reports of ownership and reports of changes in ownership of Pep Boys Stock. Based solely upon a

review of copies of such reports, we believe that during fiscal 2006, our directors, executive officers and 10%

Holders complied with all applicable Section 16(a) filing requirements.