Pep Boys 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 3, 2007, January 28, 2006 and January 29, 2005

(dollar amounts in thousands, except share data)

45

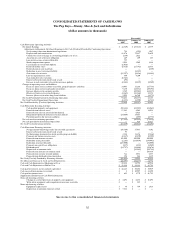

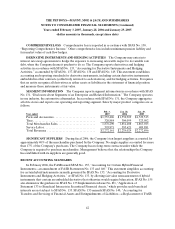

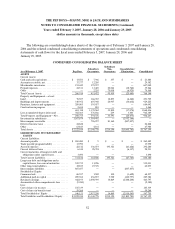

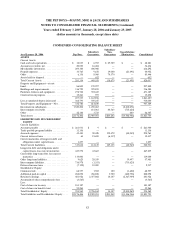

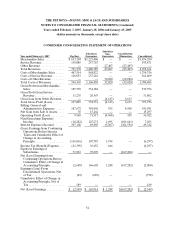

NOTE 2—DEBT AND FINANCING ARRANGEMENTS

LONG-TERM DEBT

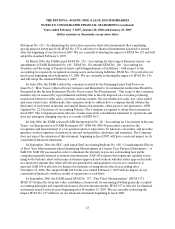

February 3,

2007

January 28,

2006

7.50% Senior Subordinated Notes, due December 2014 . . . . . . . . . . . . . . . . . . . $200,000 $200,000

Senior Secured Term Loan, due October 2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . 320,000 200,000

Medium-Term Notes, 6.4% to 6.52%, due July 2007 through

September2007.................................................... — 215

Othernotespayable,8.0%............................................. 268 1,315

Capitalleaseobligations,payablethroughOctober2009................... 685 829

Lineofcreditagreement,throughDecember2009........................ 17,568 66,137

538,521 468,496

Lesscurrentmaturities................................................ 3,490 1,257

Total Long-Term Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $535,031 $467,239

On January 27, 2006 the Company entered into a $200,000 Senior Secured Term Loan facility due

January 27, 2011. This facility is secured by the real property and improvements associated with 154 of the

Company’s stores. Interest at the rate of London Interbank Offered Rate (LIBOR) plus 3.0% on this

facility was payable by the Company starting in February 2006. Proceeds from this facility were used to

satisfy and discharge the Company’s then outstanding $43,000 6.88% Medium Term Notes due March 6,

2006 and $100,000 6.92% Term Enhanced Remarketable Securities (TERMS) due July 7, 2016 and to

reduce borrowings under the Company’s line of credit by approximately $39,000.

On October 30, 2006, the Company amended and restated the Senior Secured Term Loan facility to

(i) increase the size from $200,000 to $320,000, (ii) extend the maturity from January 27, 2011 to

October 27, 2013, (iii) reduce the interest rate from LIBOR plus 3.00% to LIBOR plus 2.75%. An

additional 87 stores (bringing the total to 241 stores) were added to the collateral pool securing the facility.

Proceeds were used to satisfy and discharge $119,000 in outstanding 4.25% convertible Senior Notes due

June 1, 2007.

On February 15, 2007, the Company further amended the Senior Secured Term Loan facility to

reduce the interest rate from LIBOR plus 2.75% to LIBOR plus 2.00%.

The TERMS were retired on January 27, 2006 with proceeds from the Company’s Senior Secured

Term Loan facility. In retiring the TERMS, the Company was obligated to purchase a call option, which, if

exercised, would have allowed the securities to be remarketed through a maturity date of July 7, 2016. The

$8,100 redemption price of the call option was based upon the then present value of the remaining

payments on the TERMS through July 17, 2016, at 5.45%, discounted at the 10-year Treasury rate.

On December 14, 2004, the Company issued $200,000 aggregate principal amount of 7.5% Senior

Subordinated Notes due December 15, 2014.

On December 2, 2004, the Company further amended its amended and restated line of credit

agreement. The amendment increased the amount available for borrowings to $357,500, with an ability,

upon satisfaction of certain conditions, to increase such amount to $400,000. The amendment also reduced