Pep Boys 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

accordance with the requirements of the SEC. In the fourth quarter of fiscal 2006, we had repurchased

$7,311,000 at an average of $14.77 per share. This program expires on September 30, 2007.

Our capital expenditure program in 2007 is expected to be similar to the fiscal 2006 program, with

inventory levels in 2007 comparable to 2006.

We anticipate that cash provided by operating activities, our existing line of credit, cash on hand and

future access to the capital markets will exceed our expected cash requirement in fiscal 2007.

The Company’s working capital was $163,960,000 at February 3, 2007, $247,526,000 at January 28,

2006, and $180,651,000 at January 29, 2005. The Company’s long-term debt, as a percentage of its total

capitalization, was 49% at February 3, 2007, 50% at January 28, 2006 and 42% at January 29, 2005

respectively. As of February 3, 2007, the Company had a $357,500,000 line of credit, with an availability of

approximately $190,000,000. Our current portion of long term debt is $3,490,000 at February 3, 2007.

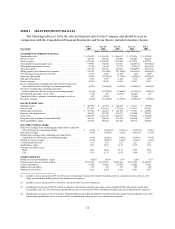

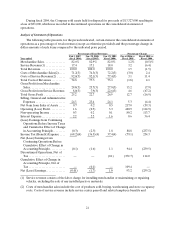

Contractual Obligations

The following chart represents the Company’s total contractual obligations and commercial

commitments as of February 3, 2007:

Due in less Due in Due in Due after

Obligation Total than 1 year 1 - 3 years 3 - 5 years 5 years

(dollar amounts in thousands)

Long-term debt(1) . . . . . . . . . . . . . . . . . . . . . $ 537,836 $ 3,201 $ 24,028 $ 6,456 $504,151

Operating leases. . . . . . . . . . . . . . . . . . . . . . . 482,849 57,670 100,902 84,727 239,550

Expected scheduled interest payments on

all long-term debt. . . . . . . . . . . . . . . . . . . . 289,487 39,932 118,285 116,270 15,000

Capitalleases ......................... 685 289 239 157 —

Total cash obligations . . . . . . . . . . . . . . . . . . $1,310,857 $101,092 $243,454 $207,610 $758,701

(1) Long-term debt includes current maturities.

The table excludes our pension obligation. We made voluntary contributions of $504,000, $1,867,000

and $1,819,000, to our pension plans in fiscal 2006, 2005 and 2004, respectively. Future plan contributions

are dependent upon actual plan asset returns and interest rates. We expect contributions to approximate

$1,258,000 in fiscal 2007. See Note 9 of Notes to Consolidated Financial Statements in “Item 8 Financial

Statements and Supplementary Data” for further discussion of our pension plans.

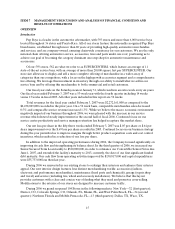

Due in less Due in Due in Due after

Commercial Commitments Total than 1 year 1 - 3 years 3 - 5 years 5 years

(dollar amounts in thousands)

Importlettersofcredit ..................... $ 487 $ 487 $ — $— $—

Standbylettersofcredit .................... 55,708 42,708 13,000 — —

Suretybonds.............................. 11,224 11,016 208 — —

Purchase obligations(1) 14,448 14,448 — — —

Total commercial commitments . . . . . . . . . . . . . $81,867 $68,659 $13,208 $— $—

(1) Our open purchase orders are based on current inventory or operational needs and are fulfilled by our

vendors within short periods of time. We currently do not have minimum purchase commitments

under our vendor supply agreements and generally our open purchase orders (orders that have not

been shipped) are not binding agreements. Those purchase obligations that are in transit from our

vendors at February 3, 2007 are considered to be a contractual obligation.