Pep Boys 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

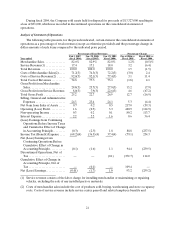

Pension Plans

The Company has a defined benefit pension plan covering its full-time employees hired on or before

February 1, 1992 and an unfunded Supplemental Executive Retirement Plan (SERP) that includes a

defined benefit portion. The pension expense under these plans for fiscal 2006, 2005, and 2004 was

$3,999,000, $4,331,000 and $4,076,000, respectively. The fiscal year 2006 expense is calculated based upon a

number of actuarial assumptions, including an expected return on plan assets of 6.30% and a discount rate

of 5.70%. In developing the expected return on asset assumptions, the Company evaluated input from its

actuaries, including their review of asset class return expectations. The discount rate utilized for the

pension plans is based on a model bond portfolio with durations that match the expected payment patterns

of the plans. The Company will continue to evaluate its actuarial assumptions and adjust as necessary. In

fiscal 2006, the Company contributed an aggregate of $504,000 to our pension plans. Based upon the

current funded status of the defined benefit pension plan and the unfunded defined benefit portion of the

SERP, aggregate cash contributions are expected to be $1,258,000 in fiscal 2007.

On January 31, 2004, the Company amended and restated its SERP. This amendment converted the

defined benefit plan to a defined contribution plan for certain unvested participants and all future

participants. All vested participants under the defined benefit portion will continue to accrue benefits

according to the defined benefit formula. In connection with these amendments, the Company settled

several obligations related to the benefits under the defined benefit SERP. These obligations totaled

$568,000, and resulted in an expense under SFAS No. 88, “Employers’ Accounting for Settlements and

Curtailments of Defined Benefit Pension Plans and for Termination Benefits,” of approximately $774,000

in fiscal 2004.

RESULTS OF OPERATIONS

Management Overview-Fiscal 2006

Fiscal 2006 was a year of continuous improvement to operating performance for the Company. Our

operating profit for fiscal 2006 was $36,022,000 or a $47,247,000 improvement over the operating loss in

fiscal 2005 of $11,225,000. On a 52 week basis, our comparable sales were basically flat, but included a

1.3% improvement in service revenues. With revenue flat, improvements in margins and lower operating

costs helped drive this operating profit improvement. Net loss for fiscal 2006 decreased to $2,549,000 or

$0.05 per share (basic & diluted) from a net loss in 2005 of $37,528,000 or $0.69 per share (basic &

diluted).

Discontinued Operations

In accordance with SFAS No. 144, our discontinued operations continues to reflect the costs

associated with the stores remaining from the 33 stores closed on July 31, 2003 as part of our corporate

restructuring (see Item 8 Financial Statements and Supplementary Data- note 7).

During the second quarter of fiscal 2006, we sold a store that we have leased back and will continue to

operate for a one year period. Due to our significant continuing involvement with this store following the

sale, we reclassified back into continuing operations, for all periods presented, this store’s revenues and

costs that had been previously reclassified into discontinued operations during the third quarter of fiscal

2005, in accordance with SFAS No. 144 and EITF 03-13.

During fiscal 2005, the Company sold a closed store for proceeds of $931,000 resulting in a pre-tax

gain of $341,000, which was recorded in discontinued operations on the consolidated statement of

operations.