Pep Boys 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

See notes to the consolidated financial statements

35

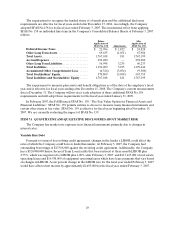

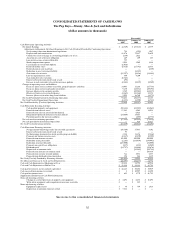

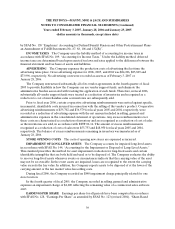

CONSOLIDATED STATEMENTS OF CASH FLOWS

The Pep Boys—Manny, Moe & Jack and Subsidiaries

(dollar amounts in thousands)

Year ended

February 3,

2007

January 28,

2006

January 29,

2005

Cash Flows from Operating Activities:

Net(Loss)Earnings ................................................................. $ (2,549) $ (37,528) $ 23,579

Adjustments to Reconcile Net (Loss) Earnings to Net Cash (Used in) Provided by Continuing Operations:

Net(earnings)lossfromdiscontinuedoperations ......................................... 738 (292) 2,087

Depreciationandamortization...................................................... 88,476 79,887 76,620

Cumulativeeffectofchangeinaccountingprinciple,netoftax................................ (189) 2,021 —

Accretionofassetretirementobligation................................................ 269 109 135

Lossondefeasanceofconvertibledebt................................................. 755 — —

Stockcompensationexpense........................................................ 3,051 2,049 1,184

Cancellationofvestedstockoptions................................................... (1,056) — —

Deferred income taxes . ........................................................... (8,316) (27,792) 26,853

Deferred gain on sale leaseback. . . ................................................... — — (130)

Reductioninassetretirementliability ................................................. — (1,815) —

Gain from sales of assets........................................................... (15,297) (4,826) (11,848)

Lossonimpairmentofassets........................................................ 840 4,200 —

Gain from derivative valuation . . . ................................................... (5,568) — —

Excesstaxbenefitsfromstockbasedawards............................................. (95) — —

Increaseincashsurrendervalueoflifeinsurancepolicies.................................... (2,143) (3,389) (3,540)

Changes in operating assets and liabilities:

Decrease(increase)inaccountsreceivable,prepaidexpensesandother.......................... 24,045 15,166 (17,753)

Decrease(increase)inmerchandiseinventories........................................... 9,250 (13,532) (49,198)

Increase(decrease)inaccountspayable................................................ 3,549 (49,041) (24,387)

(Decrease)increaseinaccruedexpenses................................................ (4,165) (18,864) 25,853

Increase(decrease)inotherlong-termliabilities.......................................... 2,093 16,760 (1,272)

NetCashProvided(Usedin)byContinuingOperations........................................ 93,688 (36,887) 48,183

NetCashUsedinDiscontinuedOperations................................................. (1,258) (1,500) (2,732)

NetCashProvidedby(Usedin)OperatingActivities............................................ 92,430 (38,387) 45,451

Cash Flows from Investing Activities:

Cashpaidforpropertyandequipment................................................. (50,212) (85,945) (88,068)

Proceeds from sales of assets. . . . . . . . ................................................ 17,542 4,043 18,021

Proceeds from sales of assets held for disposal ........................................... — 6,913 —

(Repayment)proceedsfromlifeinsurancepolicies........................................ (24,669) 24,655 —

Premiumspaidonlifeinsurancepolicies ............................................... — (605) (1,778)

Net cash used in continuing operations . ................................................... (57,339) (50,939) (71,825)

Netcashprovidedbydiscontinuedoperations............................................... — 916 13,327

NetCashUsedinInvestingActivities....................................................... (57,339) (50,023) (58,498)

Cash Flows from Financing Activities:

Net(payments)borrowingsunderlineofcreditagreements.................................. (48,569) 57,985 8,102

Excesstaxbenefitsfromstockbasedawards............................................. 95 — —

Net borrowings (payments) on trade payable program liability ................................ 2,834 11,156 (7,216)

Payments for finance issuance costs . . . . ............................................... (2,217) (5,150) (5,500)

Proceedsfromissuanceofnotes ..................................................... 121,000 200,000 200,000

Reductionoflong-termdebt........................................................ (2,263) (183,459) (189,991)

Reductionofconvertibledebt....................................................... (119,000) — (31,000)

Paymentsoncapitalleaseobligations.................................................. (227) (383) (1,040)

Dividendspaid ................................................................. (14,757) (14,686) (15,676)

Repurchaseofcommonstock....................................................... — (15,562) (39,718)

Proceedsfromissuanceofcommonstock............................................... — — 108,854

Proceedsfromexerciseofstockoptions................................................ 722 3,071 6,887

Proceedsfromdividendreinvestmentplan.............................................. 894 961 1,119

NetCash(Usedin)ProvidedbyFinancingActivities ............................................ (61,488) 53,933 34,821

Net (Decrease) Increase in Cash and Cash Equivalents. . . . ....................................... (26,397) (34,477) 21,774

Cash and Cash Equivalents at Beginning of Year ............................................... 48,281 82,758 60,984

CashandCashEquivalentsatEndofYear................................................... $ 21,884 $ 48,281 $ 82,758

Cash paid for interest, net of amounts capitalized. . . . ........................................... $ 46,245 $ 50,602 $ 30,019

Cashreceivedfromincometaxrefunds...................................................... $ 1 $ 10,097 $ 23,290

Cashpaidforincometaxes .............................................................. $ 632 $ 1,770 $ 48,732

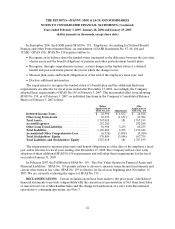

Supplemental Disclosure of Cash Flow Information:

Non-cash investing activities:

Changesinaccruedpurchasesofpropertyandequipment ................................... $ 3,691 $ 6,138 $ 15,698

Writeoffofequipmentandrecognitionofinsurancereceivable ............................... $ — $ 345 $ —

Non-cash financing activities:

Equipmentcapitalleases .......................................................... $ 84 $ 789 $ 1,413

Repurchaseofcommonstocknotsettled............................................... $ 7,311 $ — $ —