Pep Boys 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

Abilene, TX and Tyler, TX—25 (fourth quarter). We expect to grand reopen approximately 125

remodeled stores in each of 2007 and 2008 with the remaining approximately 50 stores to be completed in

2009.

Business Strategy

Keeping Our Merchandising Fresh and Exciting. We continually merchandise our stores with a new

and flexible product mix designed to increase customer purchases. We take advantage of our

industry-leading average retail square footage to increase the appeal of our merchandise displays. We

utilize product-specific advertising to highlight promotional items and pricing, primarily through weekly

print advertising.

•Enhancing Our Stores. We are investing in our existing stores to redesign our interiors and

enhance their exterior appeal. We believe that this layout will provide customers with a clear and

concise way of finding what they need and will promote cross-selling.

•Improving Service Center Performance. We are working to improve the financial performance of

our service center operations by improving tire sales and related attachment sales, and improving

labor productivity. To improve tire sales, we have reduced our advertised opening price points,

while offering attractive opportunities for customers to upgrade to tires with better warranties,

features, or brands. In addition, we have emphasized training our staff to offer beneficial services

related to each tire sale such as wheel balancing, alignments and warranties, as well as to provide a

thorough safety check that highlights any further car maintenance or repair needs. We continually

tailor our labor costs to labor sales volumes providing an opportunity to improve labor productivity

going forward.

•Improve Store Productivity. We continually focus on improving the returns of our investment in

store assets through managing our store portfolio, and taking advantage of opportunities for store

relocations, disposals or new store additions. Any net store growth will focus primarily upon

increasing penetration in our existing markets to further leverage our investments.

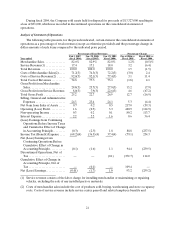

The following discussion explains the material changes in our results of operations for the fifty-three

weeks ended February 3, 2007, and fifty-two weeks ended January 28, 2006, and January 28, 2005.

CAPITAL & LIQUIDITY

Capital Resources and Needs

Our cash requirements arise principally from the purchase of inventory, capital expenditures related

to existing stores, offices and distribution centers and our stock repurchase program.

In fiscal 2006, improved operating results and working capital management, real estate sales and

reduced capital expenditures allowed us to reduce our total debt by $48,975,000 and to repay in full

$24,669,000 of borrowings against our company-owned life insurance policy assets.

While the primary capital expenditures for the fiscal year 2006 continue to be attributed to store

redesigning, the rate of our store refurbishment program was decreased significantly both as a result of our

decision in the second quarter to extend it through fiscal 2009 as well as its increased cost effectiveness. We

remodeled 120 stores in 2006 and grand reopened 104 stores. In 2007, we expect to remodel 137 stores

with the remaining being completed in late 2008 or early 2009.

On September 7, 2006 our Board of Directors renewed our stock repurchase program, resetting the

authorized amount of shares that we can repurchase under the program to $100,000,000. We will purchase

our common stock on the open market or in privately negotiated transactions from time to time in