Pep Boys 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

Table of contents

-

Page 1

-

Page 2

-

Page 3

... service center operations. The service and parts business is a great business - a highly profitable business. It is the backbone of Pep Boys' business model and should be a differentiating competitive advantage for our company. Of course, tires also remain a key entry point for our service business...

-

Page 4

... Boys' new CEO will be to focus on our core business through improved tactical execution, over the longer term I look forward to collaborating with the senior leadership team and Board of Directors on a long term strategic plan to grow the business. I want you to know that I did not come to Pep Boys...

-

Page 5

... record at the close of business on Friday, April 13, 2007 are entitled to vote at the meeting and any postponements or adjournments. Whether or not you plan to attend the meeting, please make sure that your shares are represented by signing and returning the enclosed proxy card.

Brian D. Zuckerman...

-

Page 6

THE PEP BOYS âˆ' MANNY, MOE & JACK 3111 West Allegheny Avenue Philadelphia, Pennsylvania 19132 _____ PROXY STATEMENT _____ TABLE OF CONTENTS

GENERAL INFORMATION ...1 SHARE OWNERSHIP ...3 (ITEM 1) ELECTION OF DIRECTORS ...6 What is the makeup of the Board of Directors? ...6 Nominees for Election ...6...

-

Page 7

... Boys Stock that you owned as of the close of business on the record date, April 13, 2007. As of the record date, 54,349,472 shares were outstanding. As of the record date, 2,195,270 of the outstanding shares were held by The Pep Boys âˆ' Manny, Moe & Jack Flexitrust. This flexible employee benefits...

-

Page 8

... nominated slate of directors, subject to the proxies' discretion to cumulate votes • FOR the ratification of the appointment of our independent registered public accounting firm • AGAINST the shareholder proposal regarding our Shareholder Rights Plan We have not received proper notice of, and...

-

Page 9

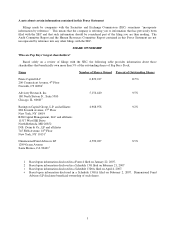

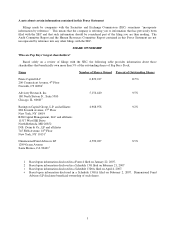

... of Pep Boys Stock. Name Pirate Capital LLC 200 Connecticut Avenue, 4th Floor Norwalk, CT 068541 Advisory Research, Inc. 180 North Stetson St., Suite 5500 Chicago, IL 606012 Barington Capital Group, L.P. and affiliates 888 Seventh Avenue, 17th Floor New York, NY 10019 RJG Capital Management, LLC...

-

Page 10

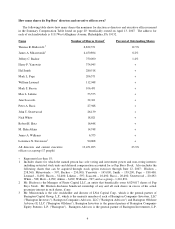

... many shares the nominees for election as directors and executive officers named in the Summary Compensation Table found on page 20` beneficially owned on April 13, 2007. The address for each of such individuals is 3111 West Allegheny Avenue, Philadelphia, PA 19132. Name Thomas R. Hudson Jr.2 James...

-

Page 11

... Fund beneficially own 1,419,338, 844,023 and 2,183,958 shares of Pep Boys Stock, respectively. Mr. Mitarotonda disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest therein. Mr. Stevenson resigned as of July 17, 2006. His beneficial ownership is reported...

-

Page 12

...Drucker & Scaccetti PC, a private accounting firm, since 1990. Ms. Scaccetti serves as a director of Nutrition Management Services Company. John T. Sweetwood Director since 2002

Mr. Sweetwood, 59, is a principal and the President of Woods Investment, LLC, a private real estate investment firm. From...

-

Page 13

..., an oilfield services company, in a number of capacities, including Chairman of the Board, President and Chief Executive Officer. Mr. Lukens serves as a director of NCI Building Systems Inc. and Westlake Chemical Corporation. James A. Mitarotonda Director since August 2006

Mr. Mitarotonda...

-

Page 14

... as a Director and to Move a Business Proposal at the 2006 Annual Meeting. Mr. Hudson was nominated for election at the 2007 Annual Meeting in exchange for Pirate Capital LLC's support of the Board's slate of directors for election at the 2007 Annual Meeting. See "Certain Relationships and Related...

-

Page 15

...embodied in our corporate Code of Ethics (applicable to all Pep Boys associates including our executive officers and members of the Board), the Board of Directors Code of Conduct and the various Board committee charters, all of which are available for review on our website, www.pepboys.com, or which...

-

Page 16

... and realizing opportunities to reduce operational costs. The Committee currently consists of Messrs. Hudson (chair), Leonard, White and Williams. The Committee met once during fiscal 2006. Real Estate Committee. On December 15, 2007, the Board appointed a special committee to assist management with...

-

Page 17

...by the director at the time of deferral. A director who is also an employee of Pep Boys receives no additional compensation for service as a director. Equity Grants. The Pep Boys 1999 Stock Incentive Plan, or the 1999 Plan, provides for an annual grant of restricted stock units and options having an...

-

Page 18

...committees the 2006 Annual Meeting was scheduled the Company agreed to include each of Messrs. Lukens, Mitarotonda, White and Williams in the Board's slate of directors for election at the 2006 and 2007 Annual Meetings • the Company made certain modifications to its Shareholder Rights Plan • the...

-

Page 19

... as a focal point for communication among the Board of Directors, the independent registered public accounting firm, management and Pep Boys' internal audit function, as the respective duties of such groups, or their constituent members, relate to Pep Boys' financial accounting and reporting and to...

-

Page 20

... 2005 only) and (iii) employee benefit plan audits. Tax Fees. Tax Fees billed in fiscal 2006 and 2005 consisted of tax compliance services in connection with tax audits and appeals. The Audit Committee annually engages Pep Boys' independent registered public accounting firm and preapproves, for the...

-

Page 21

... CEO from July 18, 2006 through March 25, 2007, follows under "Interim Chief Executive Officer." Components of Compensation. Base Salary. The Human Resources Committee reviews base salaries annually to reflect the experience, performance and scope of responsibility of the named executive officers...

-

Page 22

... also established for each named executive officer, other than the CEO, based upon departmental objectives. For fiscal 2006, the Company achieved its bonus targets in the areas of management turnover, working capital and Service Center customer service index resulting in a corporate bonus payout of...

-

Page 23

... first five years of employment with Pep Boys, and then hold, at least two times their annual salary in Pep Boys stock. An officer may satisfy the stock ownership guidelines through direct share ownership or by holding RSUs. Retirement Plans. We maintain The Pep Boys Savings Plan, which is a broad...

-

Page 24

... amongst our senior management team. The RSUs were valued at the current market price of Pep Boys Stock on the date of grant. Interim Chief Executive Officer. In order to secure the services of our Chairman of the Board, from July 2006 through March 2007, we paid Mr. Leonard a monthly salary of $83...

-

Page 25

... Savings Plan and The Pep Boys Deferred Compensation Plan. Tax and Accounting Matters. We consider the tax and accounting impact of each type of compensation in determining the appropriate compensation structure. For tax purposes, annual compensation payable to the named executive officers generally...

-

Page 26

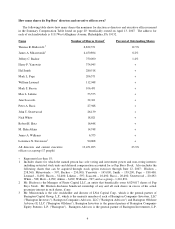

... the fiscal 2006 compensation for Pep Boys' Interim CEO, CFO, the three other executive officers that received the highest compensation in fiscal 2006 and our former CEO. These executives are referred to herein as the "named executive officers." Summary Compensation Table Change in Pension Value...

-

Page 27

...Contributed (company match) under our Deferred Compensation Plan Contributed (company match) in connection with Pep Boys 401(k) Savings Plan Paid as dividend equivalents on RSUs Paid as an auto allowance Paid as a tax/financial planning allowance Representing group term life insurance premiums Smith...

-

Page 28

... executive officers as of February 3, 2007 Outstanding Equity Awards at Fiscal Year-End Table Option Awards Stock Awards Market Value of Shares or Units of Stock Number of That Have Not Shares or Units of Yet Vested Stock That ($) Have Not (a) Vested (#)

Name Mark S. Bacon

Number of Securities...

-

Page 29

...employment by Pep Boys and the number of years of participation in the plan. Benefits payable under this plan are not subject to deduction for Social Security or other offset amounts. The maximum annual benefit for any employee under this plan is $20,000. Mr. Page is the only named executive officer...

-

Page 30

.... The following table shows information regarding pension benefits for the named executive officers. Present Value of Accumulated Benefit ($) 1,416,205 Payments Made During Last Plan Year ($) --

Name Mark L. Page

Plan Name Defined Benefit SERP

Number of Years Credited Service (#) 25

Nonqualified...

-

Page 31

...2006 - March 25, 2007). Mr. Leonard did not receive or participate in any of the Company's welfare, retirement or other benefits plans or receive any other perquisites. While Mr. Leonard served as interim CEO, he did not receive his customary cash consideration on account of his service on the Board...

-

Page 32

... vesting of all "in the money" stock options and RSUs at the closing price of a share of PBY Stock on February 3, 2007 ($16.01). The following table shows information regarding the payments and benefits that a named executive officer would have received under his Change of Control Agreement assuming...

-

Page 33

... financial statements of Pep Boys and its subsidiaries for fiscal 2007. Deloitte & Touche LLP served as our independent registered public accounting firm for fiscal 2006. A representative of Deloitte & Touche LLP is expected to be present at the meeting and will have the opportunity to make...

-

Page 34

.... Already our following six Pep Boys directors each received more than 25% against votes at our belated 2006 annual meeting: Mr. Leonard Mr. Bassi Ms. Scaccetti Mr. Sweetwood Ms. Atkins Mr. Hotz The Corporate Library, http://www.thecorporatelibrarv.com/, an independent investment research firm said...

-

Page 35

... and updated it in December 1997 and amended it further in August 2006 to protect and maximize the value of every shareholder's investment in Pep Boys. The Board of Directors maintains a special committee of independent Directors which annually evaluates our Shareholder Rights Plan. To assist in...

-

Page 36

... to present at the 2008 Annual Meeting and to have included in the Board of Directors' proxy materials relating to that meeting must be received no later than December 28, 2007. Such proposals should be sent to: Pep Boys 3111 West Allegheny Avenue Philadelphia, PA 19132 Attention: Secretary Our...

-

Page 37

..., Philadelphia, PA (Address of principal executive office) 23-0962915 (I.R.S. employer identification no.) 19132 (Zip code)

215-430-9000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on...

-

Page 38

...Financial Statement Schedules ...Signatures...79 84 Directors, Executive Officers and Corporate Governance ...Executive Compensation...Security Ownership of Certain Beneficial Owners ...Certain Relationships and Related Transactions and Director Independence ...Principal Accounting Fees and Services...

-

Page 39

PART I ITEM 1 BUSINESS

GENERAL The Pep Boys-Manny, Moe & Jack and subsidiaries (the "Company") is a leading automotive retail and service chain. The Company operates in one industry, the automotive aftermarket. The Company is engaged principally in the retail sale of automotive parts, tires and ...

-

Page 40

..., 2005and 2006, and the number of stores opened and closed by the Company during each of the last four fiscal years: NUMBER OF STORES AT END OF FISCAL YEARS 2002 THROUGH 2006

State Alabama ...Arizona ...Arkansas ...California ...Colorado ...Connecticut ...Delaware ...Florida ...Georgia ...Illinois...

-

Page 41

... type of cars registered in the markets where the store is located. A full complement of inventory at a typical SUPERCENTER includes an average of approximately 22,000 items (approximately 21,000 items at a PEP BOYS EXPRESS store). The Company's product lines include: tires (not stocked at PEP BOYS...

-

Page 42

... and commercial credit accounts. The Company does not experience significant seasonal fluctuation in the generation of its revenues. STORE OPERATIONS AND MANAGEMENT All Pep Boys stores are open seven days a week. Each SUPERCENTER has a Retail Manager and Service Manager (PEP BOYS EXPRESS STORES only...

-

Page 43

... of batteries, tires and used lubricants, and the ownership and operation of real property. EMPLOYEES At February 3, 2007, the Company employed 18,794 persons as follows:

Description Full-time % Part-time % Total %

Retail ...Service Center ...STORE TOTAL ...Warehouses...Offices ...TOTAL EMPLOYEES...

-

Page 44

... from our investor relations department. Please call 215-430-9720 or write Pep Boys, Investor Relations, 3111 West Allegheny Avenue, Philadelphia, PA 19132. EXECUTIVE OFFICERS OF THE COMPANY The following table indicates the names, ages and tenures with the Company and positions (together with the...

-

Page 45

... served as Chief Operating Officer and General Manager of Nelson Bowers Dealerships and held positions with American Suzuki Motor and General Motors corporations. Harold L. Smith, Executive Vice President-Merchandising, Marketing, Supply Chain and Commercial, joined the Company in August 2003 after...

-

Page 46

... vendors' operations could have a material adverse effect on our business and results of operations. We depend on our senior management team and our other personnel, and we face substantial competition for qualified personnel. Our success depends in part on the efforts of our senior management team...

-

Page 47

..., brake and transmission) repair facilities that provide additional automotive repair and maintenance services. Installed Merchandise/Commercial • mass merchandisers, wholesalers and jobbers (some of which are associated with national parts distributors or associations). Tire Sales • national...

-

Page 48

... square foot corporate headquarters in Philadelphia, Pennsylvania. The Company also owns the following administrative regional offices- approximately 4,000 square feet of space in each of Melrose Park, Illinois and Bayamon, Puerto Rico. In addition, the Company leases approximately 4,000 square feet...

-

Page 49

... table sets forth certain information regarding the owned and leased warehouse space utilized by the Company for its 593 store locations at February 3, 2007:

Warehouse Locations Products Warehoused Square Footage Owned or Leased Stores Serviced States Serviced

San Bernardino, CA . . McDonough, GA...

-

Page 50

... ITEM 5 MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of The Pep Boys-Manny, Moe & Jack is listed on the New York Stock Exchange under the symbol "PBY". There were 6,088 registered shareholders as of April 13, 2007...

-

Page 51

STOCK PRICE PERFORMANCE The following graph compares the cumulative total return on shares of Pep Boys Stock over the past five years with the cumulative total return on shares of companies in (1) the Standard & Poor's SmallCap 600 Index, (2) the S&P 600 Speciality Stores Index and (3) the S&P 600 ...

-

Page 52

... pretax charges of $88,980 related to corporate restructuring and other one-time events of which $29,308 reduced gross profit from merchandise sales, $3,278 reduced gross profit from service revenue and $56,394 was included in selling, general and administrative expenses. Includes pretax charges...

-

Page 53

...data reflects 53 weeks for year ended February 3, 2007 while the prior years reflect 52 weeks. Prior fiscal year amounts reflect reclassifications to separately disclose Net Gain (Loss) from Sales of Assets from Costs of Merchandise Sales and the change in classification of a store from discontinued...

-

Page 54

ITEM 7

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW Introduction Pep Boys is a leader in the automotive aftermarket, with 593 stores and more than 6,000 service bays located throughout 36 states and Puerto Rico. All of our stores feature the ...

-

Page 55

... our advertised opening price points, while offering attractive opportunities for customers to upgrade to tires with better warranties, features, or brands. In addition, we have emphasized training our staff to offer beneficial services related to each tire sale such as wheel balancing, alignments...

-

Page 56

...to our pension plans in fiscal 2006, 2005 and 2004, respectively. Future plan contributions are dependent upon actual plan asset returns and interest rates. We expect contributions to approximate $1,258,000 in fiscal 2007. See Note 9 of Notes to Consolidated Financial Statements in "Item 8 Financial...

-

Page 57

... of $20,000,000. Under this program, the Company's factor makes accelerated and discounted payments to its vendors and the Company, in turn, makes its regularly-scheduled full vendor payments to the factor. As of February 3, 2007 and January 28, 2006, there was an outstanding balance of $13,990,000...

-

Page 58

... with its risk management, import merchandising and vendor financing programs. The Company was contingently liable for $487,000 and $1,015,000 in outstanding import letters of credit and $55,708,000 and $41,218,000 in outstanding standby letters of credit as of February 3, 2007 and January 28, 2006...

-

Page 59

...review of asset class return expectations. The discount rate utilized for the pension plans is based on a model bond portfolio with durations that match the expected payment patterns of the plans. The Company will continue to evaluate its actuarial assumptions and adjust as necessary. In fiscal 2006...

-

Page 60

...or maintaining or repairing vehicles, excluding the sale of any installed parts or materials. (2) Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits and

21

-

Page 61

service center occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes, repairs and maintenance and depreciation and amortization expenses. (3) As a percentage of related sales or revenue, as applicable. (4) As a percentage of (Loss) Earnings from Continuing ...

-

Page 62

... decreases in merchandise margins. The increase in warehousing costs was from increases in rent expense and rental equipment for the new warehouse in San Bernardino, CA. The increase in store occupancy costs was due to increased lease expense associated with the new point-of sale system and building...

-

Page 63

... primarily to decreases in store expenses, general office costs and employee benefits, offset, in part, by an increase in net media expense. The decrease in store expenses was primarily caused by a decrease of approximately $21,132,000 in payroll and related benefit costs (see above explanation of...

-

Page 64

...and related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes, repairs and maintenance and depreciation and amortization expenses. CRITICAL ACCOUNTING POLICIES AND ESTIMATES Management's Discussion and Analysis of Financial...

-

Page 65

.... A 10% difference in these estimates at February 3, 2007 would have affected net earnings by approximately $428,000 for the fiscal year ended February 3, 2007. • The Company has risk participation arrangements with respect to casualty and health care insurance, including the maintaining of stop...

-

Page 66

... pricing model and generally accepted valuation techniques require management to make assumptions and to apply judgment to determine the fair value of our awards. These assumptions and judgments include the expected life of stock options, expected stock price volatility, future employee stock option...

-

Page 67

...address how a company should address the disclosure of such items in interim and annual financial statements, either gross or net pursuant to APB Opinion No. 22, Disclosure of Accounting Policies. The Company is required to adopt this statement in fiscal 2007. The Company presents sales net of sales...

-

Page 68

...funded status of a benefit plan and the additional disclosure requirements are effective for fiscal years ended after December 15, 2006. Accordingly, the Company adopted SFAS No.158 for its fiscal year ended February 3, 2007. The incremental effect from applying SFAS No. 158 on individual line items...

-

Page 69

... the Company at February 3, 2007:

(dollar amounts in thousands) Amount Average Interest Rate

Fair value at February 3, 2007 ...Expected maturities: 2007 ...2008 ...2009 ...2010 ...2011 ...Thereafter...

$189,268 268 - - - - 200,000 $200,268 $ 8.00% - - - - 7.50%

At January 28, 2006, the Company had...

-

Page 70

..., Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, SFAS No. 123 (revised 2004), Share-Based Payment, and Financial Accounting Standards Board Interpretation No. 47, Accounting for Conditional Asset Retirement Obligations, as of February 3, 2007, January 29, 2006, and...

-

Page 71

... The Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except share data)

February 3, 2007 January 28, 2006

ASSETS Current Assets: Cash and cash equivalents ...Accounts receivable, less allowance for uncollectible accounts of $1,505 and $1,188 ...Merchandise inventories...

-

Page 72

... The Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except share data)

Year ended

February 3, 2007

January 28, 2006

January 29, 2005

Merchandise Sales ...Service Revenue ...Total Revenues...Costs of Merchandise Sales ...Costs of Service Revenue ...Total Costs of...

-

Page 73

......Effect of stock options and related tax benefits...Effect of restricted stock unit conversions ...Stock compensation expense ...Repurchase of Common Stock ...Dividend reinvestment plan ...Balance, January 28, 2006 ...Comprehensive Loss: Net loss ...Minimum pension liability adjustment, net of tax...

-

Page 74

...Gain from sales of assets...Loss on impairment of assets...Gain from derivative valuation ...Excess tax benefits from stock based awards ...Increase in cash surrender value of life insurance policies ...Changes in operating assets and liabilities: Decrease (increase) in accounts receivable, prepaid...

-

Page 75

...OF SIGNIFICANT ACCOUNTING POLICIES BUSINESS The Pep Boys-Manny, Moe & Jack and subsidiaries (the "Company") is engaged principally in the retail sale of automotive parts and accessories, automotive maintenance and service and the installation of parts through a chain of stores. The Company currently...

-

Page 76

... discounted payments to its vendors and the Company, in turn, makes its regularly-scheduled full vendor payments to the factor. There were outstanding balances of $13,990 and $11,156 under the program at February 3, 2007 and January 28, 2006, respectively. VENDOR SUPPORT FUNDS The Company receives...

-

Page 77

... store occupancy costs. Costs of service revenue include service center payroll and related employee benefits, service center occupancy costs and cost of providing free or discounted towing services to our customers. Occupancy costs include utilities, rents, real estate and property taxes, repairs...

-

Page 78

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

by SFAS No. 158 "Employers' Accounting for Defined Benefit Pension and Other ...

-

Page 79

... requisite service period (generally the vesting period of the equity award). Prior to January 29, 2006, the Company accounted for share-based compensation to employees in accordance with Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees" (APB No. 25), and related...

-

Page 80

...for a time period similar to that of the expected term. In estimating the expected term of the options, the Company has utilized the "simplified method" allowable under the Securities and Exchange Commission, or SEC, Staff Accounting Bulletin No. 107, Share-Based Payment. The risk-free rate is based...

-

Page 81

... SFAS No. 131, the Company aggregates all of its stores and reports one operating and reporting segment. Sales by major product categories are as follows:

Year ended Feb. 3, 2007 Jan. 28, 2006 Jan. 29, 2005

Parts and Accessories ...Tires ...Total Merchandise Sales...Service Labor ...Total Revenues...

-

Page 82

...address how a company should address the disclosure of such items in interim and annual financial statements, either gross or net pursuant to APB Opinion No. 22, Disclosure of Accounting Policies. The Company is required to adopt this statement in fiscal 2007. The Company presents sales net of sales...

-

Page 83

... CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

In September 2006, the FASB issued SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans- an...

-

Page 84

... 2007 January 28, 2006

7.50% Senior Subordinated Notes, due December 2014 ...Senior Secured Term Loan, due October 2013...Medium-Term Notes, 6.4% to 6.52%, due July 2007 through September 2007 ...Other notes payable, 8.0% ...Capital lease obligations, payable through October 2009 ...Line of credit...

-

Page 85

... of the agreement through December 2009. The weighted average interest rate on borrowings under the line of credit agreement was 7.67 % and 6.2% at February 3, 2007 and January 28, 2006, respectively. In the third quarter of fiscal 2004, the Company entered into a vendor financing program with an...

-

Page 86

... risk management, import merchandising and vendor financing programs. The Company was contingently liable for $487 and $1,015 in outstanding import letters of credit and $55,708 and $41,218 in outstanding standby letters of credit as of February 3, 2007 and January 28, 2006 respectively. The Company...

-

Page 87

...the leased real estate to substantially reduce or eliminate the Company's payment under the residual guarantee at the end of the lease term. In accordance with FIN 45, the Company has recorded a liability for the fair value of the guarantee related to this operating lease. As of February 3, 2007 and...

-

Page 88

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

The aggregate minimum rental payments for such leases having initial terms of ...

-

Page 89

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

SALE OF COMMON STOCK On March 24, 2004, the Company sold 4,646,464 shares of ...

-

Page 90

... which are unsecured and fully and unconditionally guaranteed by the Company's wholly-owned direct and indirect operating subsidiaries, The Pep Boys Manny, Moe & Jack of California, Pep Boys-Manny, Moe & Jack of Delaware, Inc., Pep Boys-Manny, Moe & Jack of Puerto Rico, Inc. and PBY Corporation.

51

-

Page 91

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

The following are consolidating balance sheets of the Company as of February 3,...

-

Page 92

... ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

CONDENSED CONSOLIDATING BALANCE SHEET

As of January 28, 2006 ASSETS Current Assets: Cash and cash equivalents...Accounts receivable, net ...Merchandise inventories ...Prepaid expenses...

-

Page 93

...3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Subsidiary Guarantors Subsidiary NonGuarantors Consolidation / Elimination

Merchandise Sales ...Service Revenue ...Other Revenue ...Total Revenues...Costs...

-

Page 94

...3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Subsidiary Guarantors Subsidiary NonGuarantors Consolidation / Elimination

Merchandise Sales ...Service Revenue ...Other Revenue ...Total Revenues...Costs...

-

Page 95

... 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Subsidiary Guarantors Subsidiary NonGuarantors Consolidation / Elimination

Year ended January 29, 2005

Pep Boys

Consolidated

Merchandise Sales ...Service...

-

Page 96

...gain) from sale of assets...Loss on impairment of assets ...Gain from derivative valuation ...Excess tax benefits from stock based awards ...Increase in cash surrender value of life insurance policies ...Changes in operating assets and liabilities: Decrease (increase) in accounts receivable, prepaid...

-

Page 97

... income taxes ...Net gain from reduction in asset retirement liability ...Loss (gain) from sale of assets...Loss on impairment of assets ...Increase in cash surrender value of life insurance policies ...Changes in operating assets and liabilities: Decrease (increase) in accounts receivable, prepaid...

-

Page 98

... ...Proceeds from exercise of stock options ...Proceeds from dividend reinvestment plan ...Net Cash (used in) Provided by Financing Activities ...Net (Decrease) Increase in Cash ...Cash and Cash Equivalents at Beginning of Year...Cash and Cash Equivalents at End of Year ...

Pep Boys $ 23,579 387 29...

-

Page 99

...full-time employees hired on or before February 1, 1992. Normal retirement age is 65. Pension benefits are based on salary and years of service. The Company's policy is to fund amounts as are necessary on an actuarial basis to provide assets sufficient to meet the benefits to be paid to plan members...

-

Page 100

...2007 Year ended January 28, 2006 January 29, 2005

Service cost ...Interest cost ...Expected return on plan assets ...Amortization of transitional obligation ...Amortization of prior service cost...Recognized actuarial loss ...Net periodic benefit cost...FAS No. 88 settlement charge ...Total Pension...

-

Page 101

... CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

The following table sets forth the reconciliation of the benefit obligation, fair value of plan assets and funded status of the Company...

-

Page 102

... Company selected the discount rate at December 31, 2006 to reflect a rate commensurate with a model bond portfolio with durations that match the expected payment patterns of the plans. Pension plan assets are stated at fair market value and are composed primarily of money market funds, stock index...

-

Page 103

...Equity securities include Pep Boys common stock in the amounts of $817 (2.2% of total plan assets) and $819 (2.3% of total plan assets) at December 31, 2006 and December 31, 2005, respectively. Benefit payments, including amounts to be paid from Company assets, and reflecting expected future service...

-

Page 104

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

NOTE 10-NET EARNINGS PER SHARE For fiscal years 2006, 2005 and 2004, basic ...

-

Page 105

... previously granted non-qualified stock options and incentive stock options to key employees and members of its Board of Directors. As of February 3, 2007, there were no awards remaining available for grant under the 1990 Plan. The Company has a stock-based compensation plan originally approved by...

-

Page 106

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

The following table summarizes the options under our plans:

Fiscal 2006 ...

-

Page 107

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

The following table summarizes information about RSUs during the last three ...

-

Page 108

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

Had the Company adopted the provisions of FIN 47 prior to January 28, 2006, the...

-

Page 109

... of the deferred tax accounts are as follows:

February 3, 2007 January 28, 2006

Deferred tax assets: Employee compensation ...Store closing reserves ...Legal ...Benefit Accruals...Net operating loss carryforwards ...Tax credit carryforwards...Accrued leases ...Interest rate derivatives ...Other...

-

Page 110

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

As of February 3, 2007 and January 28, 2006, the Company had available tax net ...

-

Page 111

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

Expense. The Company intends to meet the documentation requirements of SFAS No....

-

Page 112

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 3, 2007, January 28, 2006 and January 29, 2005 (dollar amounts in thousands, except share data)

NOTE 17-QUARTERLY FINANCIAL DATA (UNAUDITED)

Net (Loss) Earnings Per Share From...

-

Page 113

...of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (3) provide reasonable assurance regarding prevention or timely...

-

Page 114

... Deloitte & Touche LLP, the Company's independent registered public accounting firm who audited the Company's consolidated financial statements, has issued a report on management's assessment of the Company's internal control over financial reporting as of February 3, 2007 and is included on page 76...

-

Page 115

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of The Pep Boys-Manny, Moe & Jack Philadelphia, Pennsylvania We have audited management's assessment, included in the accompanying Management's Report on Internal Control over Financial Reporting, that The Pep Boys...

-

Page 116

..., Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, SFAS No. 123 (revised 2004), Share-Based Payment, and Financial Accounting Standards Board Interpretation No. 47, Accounting for Conditional Asset Retirement Obligations, as of February 3, 2007, January 29, 2006, and...

-

Page 117

...of Directors Code of Conduct and the charters of our audit, human resources and nominating and governance committees may also be found under the "About Pep Boys-Corporate Governance" section of our website. As required by the New York Stock Exchange (NYSE), promptly following our 2006 Annual Meeting...

-

Page 118

... ended February 3, 2007, January 28, 2006 and January 29, 2005 ...Notes to Consolidated Financial Statements ...31 32 33 34 35 36

2.

The following consolidated financial statement schedule of The Pep Boys-Manny, Moe & Jack is included ...Schedule II Valuation and Qualifying Accounts and Reserves...

-

Page 119

...Reimbursement Plan of the Company

(10.1)*

(10.2)*

Directors' Deferred Compensation Plan, as amended

(10.3)*

Form of Employment Agreement (Change of Control) between the Company and certain officers of the Company. Change of Control Agreement dated as of February 10, 2006 between the Company and...

-

Page 120

...-Competition Agreement between the Company and certain officers of the Company. Employment Agreement dated March 13, 2007 between the Company and Jeffrey C. Rachor. The Pep Boys-Manny, Moe and Jack 1990 Stock Incentive Plan-Amended and Restated as of March 26, 2001. The Pep Boys-Manny, Moe and Jack...

-

Page 121

....20) (10.21)

The Pep Boys Grantor Trust Agreement Amended and Restated Loan and Security Agreement, dated August 1, 2003, by and among the Company, Congress Financial Corporation, as Agent, The CIT Group/Business Credit, Inc. and General Electric Capital Corporation, as Co-Documentation Agents, and...

-

Page 122

... of Earnings to Fixed Charges Subsidiaries of the Company Consent of Independent Registered Public Accounting Firm Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley...

-

Page 123

... duly authorized. THE PEP BOYS-MANNY, MOE & JACK (Registrant) by: Dated: April 18, 2007 /s/ HARRY F. YANOWITZ Harry F. Yanowitz Senior Vice President and Chief Financial Officer

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following...

-

Page 124

SIGNATURE

CAPACITY

DATE

/s/ JANE SCACCETTI Jane Scaccetti /s/ JOHN T. SWEETWOOD John T. Sweetwood /s/ NICK WHITE Nick White /s/ JAMES A. WILLIAMS James A. Williams

Director Director

April 18, 2007 April 18, 2007

Director Director

April 18, 2007 April 18, 2007

85

-

Page 125

... Charged to Costs and Other Expenses Accounts(2)

Column D

Column E Balance at End of Period

Deductions(3)

SALES RETURNS AND ALLOWANCES: Year Ended February 3, 2007 ...Year Ended January 28, 2006 ...Year Ended January 29, 2005 ...(2) Additions charged to merchandise sales. (3) Actual returns and...

-

Page 126

(This page intentionally left blank.)

-

Page 127

Exhibit 12 THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES Exhibit 12-Statement Regarding Computation of Ratios of Earnings to Fixed Charges

February 3, 2007 January 28, January 29, January 31, 2006 2005 2004 (in thousands, except ratios) February 1, 2003

Fiscal year Interest...Interest factor in ...

-

Page 128

... & Jack of Delaware, Inc. 3111 W. Allegheny Avenue Philadelphia, PA 19132 ...Pep Boys-Manny, Moe & Jack of Puerto Rico, Inc. 3111 W. Allegheny Avenue Philadelphia, PA 19132 ...Colchester Insurance Company 7 Burlington Square Burlington, VT 05401 ...PBY Corporation Suite 946 1105 North Market Street...

-

Page 129

..., Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, SFAS No. 123(revised 2004), Share-Based Payment, and Financial Accounting Standards Board Interpretation No. 47, Accounting for Conditional Asset Retirement Obligations, as of February 3, 2007, January 29, 2006, and...

-

Page 130

...record, process, summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: April 18, 2007 /s/ JEFFREY C. RACHOR Jeffrey C. Rachor...

-

Page 131

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: April 18, 2007 /s/ HARRY F. YANOWITZ Harry F. Yanowitz Senior Vice President...

-

Page 132

... with the Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the "Company") for the year ended February 3, 2007, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Jeffrey C. Rachor, Chief Executive Officer of the Company, certify, pursuant...

-

Page 133

...connection with the Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the "Company") for the year ended February 3, 2007, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Harry F. Yanowitz, Senior Vice President and Chief Financial Officer of the...

-

Page 134

(This page intentionally left blank.)

-

Page 135

-

Page 136