Lenovo 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

97

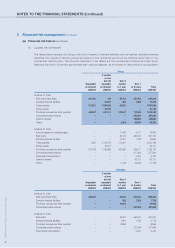

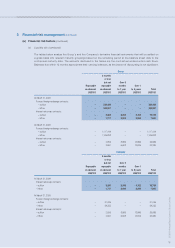

3 Financial risk management (continued)

(a) Financial risk factors (continued)

(v) Liquidity risk (continued)

The tables below analyze the Group’s and the Company’s derivative financial instruments that will be settled on

a gross basis into relevant maturity groupings based on the remaining period at the balance sheet date to the

contractual maturity date. The amounts disclosed in the tables are the contractual undiscounted cash flows.

Balances due within 12 months approximate their carrying balances, as the impact of discounting is not significant.

Group

3 months

or less

but not Over 3

Repayable repayable months Over 1

on demand on demand to 1 year to 5 years Total

US$’000 US$’000 US$’000 US$’000 US$’000

At March 31, 2009

Forward foreign exchange contracts:

– outflow – 534,495 – – 534,495

– inflow – 526,287 – – 526,287

Interest rate swap contracts:

– outflow – 3,300 8,243 4,162 15,705

– inflow – 1,717 3,900 2,244 7,861

At March 31, 2008

Forward foreign exchange contracts:

– outflow – 1,117,419 – – 1,117,419

– inflow – 1,105,808 – – 1,105,808

Interest rate swap contracts:

– outflow – 2,805 8,865 13,966 25,636

– inflow – 2,931 6,608 13,845 23,384

Company

3 months

or less

but not Over 3

Repayable repayable months Over 1

on demand on demand to 1 year to 5 years Total

US$’000 US$’000 US$’000 US$’000 US$’000

At March 31, 2009

Interest rate swap contracts

– outflow – 3,300 8,243 4,162 15,705

– inflow – 1,717 3,900 2,244 7,861

At March 31, 2008

Forward foreign exchange contracts:

– outflow – 31,246 – – 31,246

– inflow – 29,255 – – 29,255

Interest rate swap contracts:

– outflow – 2,805 8,865 13,966 25,636

– inflow – 2,931 6,608 13,845 23,384