Lenovo 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

119

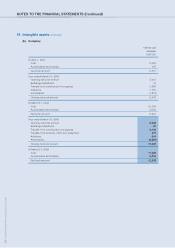

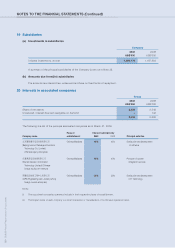

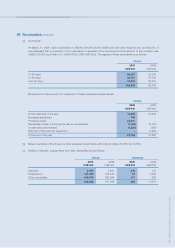

18 Intangible assets (continued)

Impairment tests for goodwill and intangible assets with indefinite useful lives

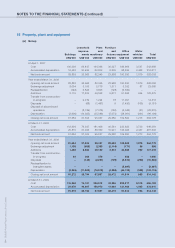

As explained in Note 5, the Group uses geographical segment as its primary segment for reporting segment information. For

the purposes of impairment testing, goodwill and trademarks and trade names with indefinite useful lives are allocated to the

Group’s cash-generating units (CGU). The carrying amounts of goodwill and trademarks and trade names with indefinite useful

lives as at March 31, 2008 and 2009 are presented below:

Asia Pacific

Europe, (excluding

Middle East Greater Greater

Americas and Africa China) China Total

US$ million US$ million US$ million US$ million US$ million

At March 31, 2008 and 2009

Goodwill 364 102 152 679 1,297

Trademarks and trade names 107 30 45 198 380

The Group completed its annual impairment test for goodwill allocated to the Group’s various CGU by comparing their

recoverable amounts to their carrying amounts as at the reporting date. The recoverable amount of a CGU is determined

based on value in use. These assessments use cash flow projections based on financial budgets approved by management

covering a 5-year period with a terminal value related to the future earnings potential of the CGU beyond the next five years.

Future cash flows are discounted at the rate of 11 percent (2008: 11 percent). The estimated growth rates adopted do not

exceed the long-term average growth rates for the businesses in which the CGU operates. These assumptions have been

used for the analysis of each CGU within the geographical segment.

Management determined budgeted gross margins based on past performance and its expectations for the market

development. The weighted average growth rates used are consistent with the forecasts included in industry reports. The

discount rates are pre-tax and reflect specific risks relating to the relevant segments.

The directors are of the view that there was no evidence of impairment of goodwill and trademarks and trade names as at

March 31, 2009 arising from the review (2008: Nil).

A one percentage point increase or decrease in the discount rate would result in a decrease or increase in the recoverable

amount of 11 percent and 13 percent respectively. A one percentage point increase or decrease in forecasted growth rates

would result in an increase or decrease in the recoverable amount of 3 percent respectively. A one percentage point increase

or decrease in forecasted operating margins would result in an increase or decrease in the recoverable amount of 18 percent

respectively.