Lenovo 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

108

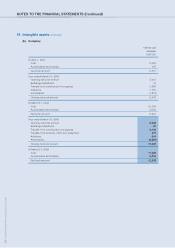

NOTES TO THE FINANCIAL STATEMENTS (Continued)

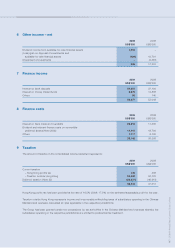

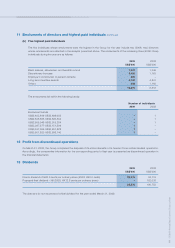

9 Taxation (continued)

The differences between the Group’s expected tax charge, calculated at the domestic rates applicable to the countries

concerned, and the Group’s tax charge for the year were as follows:

2009 2008

US$’000 US$’000

(Loss)/profit before taxation (187,945) 512,850

Tax calculated at domestic rates applicable in countries concerned 24,689 107,552

Income not subject to taxation (248,517) (209,925)

Expenses not deductible for taxation purposes 237,954 130,574

Utilization of previously unrecognized tax losses (1,699) (21,610)

Effect on opening deferred tax assets due to change in tax rates (1,993) (16,202)

Deferred tax assets not recognized 37,304 47,868

(Over)/under provision in prior years (9,294) 9,356

38,444 47,613

The weighted average applicable tax rate is not presented as this is not meaningful given the Group incurred a loss before

taxation for the year (2008: 9.3%). Certain comparative information as set out above have been restated to reflect the current

presentation of income taxability and expense deductibility. The restatement does not have any impact on the Group’s tax

position.

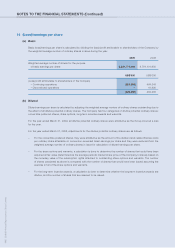

10 Employee benefit costs

2009 2008

US$’000 US$’000

Wages and salaries (including provision for restructuring

costs of US$116,077,000 (2008: US$44,070,000)) 939,421 929,106

Social security costs 98,250 85,201

Long-term incentive awards granted to directors

and employees (Note 30(a)) 54,114 53,328

Pension costs

– defined contribution plans 25,403 19,017

– defined benefit plans 11,302 6,931

Others 108,760 100,613

1,237,250 1,194,196

The Group contributes to respective local municipal government retirement schemes which are available to all qualified

employees in the Chinese Mainland. Contributions to these schemes are calculated with reference to the monthly average

salaries as set out by the local municipal government.

The Group participates a Mandatory Provident Fund (“MPF”) for all qualified Hong Kong employees. The assets of the MPF are

held separately from those of the Group in an independently administered fund.

The Group also contributes to certain defined benefit pension schemes, details of which are set out in Note 37.