Lenovo 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

59

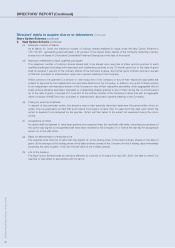

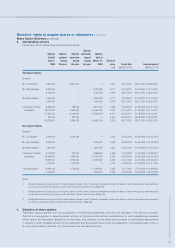

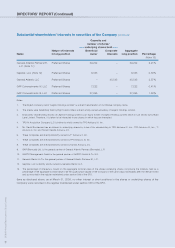

Directors’ rights to acquire shares or debentures (continued)

Share Option Schemes (continued)

3. Outstanding options

Particulars of the outstanding options are as follows:

Options

Options Options Options cancelled/ Options

held at granted exercised lapsed held at

April 1, during during during March 31, Exercise

2008 the year the year the year 2009 price Grant date Exercise period

HK$ (MM.DD.YYYY) (MM.DD.YYYY)

Old Option Scheme

Directors

Mr. Liu Chuanzhi 2,250,000 – 2,250,000 – 0 2.876 08.31.2001 08.31.2001 to 08.30.2011

Mr. Yang Yuanqing 6,000,000 – – – 6,000,000 4.072 04.16.2001 04.16.2001 to 04.15.2011

2,250,000 – – – 2,250,000 2.876 08.31.2001 08.31.2001 to 08.30.2011

Ms. Ma Xuezheng 2,920,000 – – – 2,920,000 4.072 04.16.2001 04.16.2001 to 04.15.2011

1,600,000 – – – 1,600,000 2.876 08.31.2001 08.31.2001 to 08.30.2011

Continuous contract 6,696,000 – 186,000 – 6,510,000 4.038 01.28.2000 01.28.2000 to 01.27.2010

employees 55,012,000 – 2,962,000 – 52,050,000 4.312 01.15.2001 01.15.2001 to 01.14.2011

21,902,000 – 3,006,000 – 18,896,000 4.072 04.16.2001 04.16.2001 to 04.15.2011

832,000 – 832,000 – 0 2.904 08.29.2001 08.29.2001 to 08.28.2011

38,316,000 – 3,664,000 – 34,652,000 2.876 08.31.2001 08.31.2001 to 08.30.2011

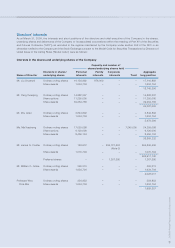

New Option Scheme

Directors

Mr. Liu Chuanzhi 3,000,000 – 3,000,000 – 0 2.245 04.26.2003 04.26.2003 to 04.25.2013

Mr. Yang Yuanqing 3,000,000 – – – 3,000,000 2.245 04.26.2003 04.26.2003 to 04.25.2013

Ms. Ma Xuezheng 1,600,000 – – – 1,600,000 2.245 04.26.2003 04.26.2003 to 04.25.2013

Continuous contract 9,116,000 – 420,000 – 8,696,000 2.435 10.10.2002 10.10.2002 to 10.09.2012

employees 33,456,000 – 1,936,000 – 31,520,000 2.245 04.26.2003 04.26.2003 to 04.25.2013

79,367,051 – 3,876,000 – 75,491,051 2.545 04.27.2004 04.27.2004 to 04.26.2014

1,740,000 – 1,740,000 – 0 2.170 07.08.2004 07.08.2004 to 07.07.2014

Other participants 12,362,000 – 1,076,000 – 11,286,000 2.435 10.10.2002 10.10.2002 to 10.09.2012

1,540,000 – – – 1,540,000 2.245 04.26.2003 04.26.2003 to 04.25.2013

Notes:

1.

Weighted average closing price of the listed or

dinary shar

es

of the Company immediately befor

e the dates on which the option

s wer

e exer

cised

by continuous contract employees under the Old Option Scheme wa

s HK$5.375.

2.

Weighted average closing price of the listed or

dinary shar

es

of the Company immediately befor

e the dates on which the option

s wer

e exer

cised

by continuous contract employees under the New Option Scheme wa

s HK$5.746.

3.

Weighted average closing price of the listed or

dinary shar

es

of the Company immediately befor

e the dates on which the option

s wer

e exer

cised

by other participants under the New Option Scheme was HK$

5.562

.

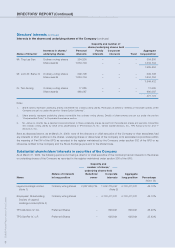

4. Valuation of share options

The share options granted are not recognized in the financial statements until they are exercised. The directors consider

that it is not appropriate to value the share options on the ground that certain crucial factors for such valuation are variables

which cannot be reasonably determined at this stage. Any valuation of the share options based on speculative assumptions

in respect of such variables would not be meaningful and the results thereof may be misleading to the shareholders. Thus, it

is more appropriate to disclose only the market price and exercise price.