Lenovo 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

2008/09 Annual Report Lenovo Group Limited

124

NOTES TO THE FINANCIAL STATEMENTS (Continued)

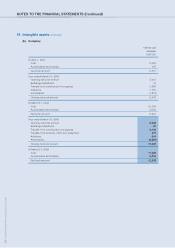

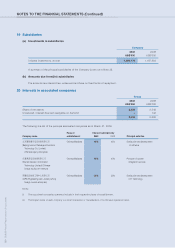

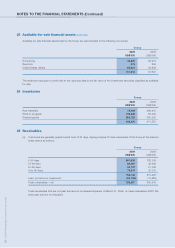

22 Deferred tax assets

Deferred taxation is calculated in full on temporary differences under the liability method using the rates applicable in the

respective jurisdictions.

The movements in the deferred tax assets/(liabilities) are as follows:

Group

2009 2008

US$’000 US$’000

At the beginning of the year 156,440 101,551

Reclassification and exchange adjustments (17,833) 8,309

Credited to consolidated income statement 52,237 51,482

Disposal of discontinued operations – (4,902)

At the end of the year 190,844 156,440

Closing net book amount analyzed into:

Group

2009 2008

US$’000 US$’000

Current 151,939 92,171

Non-current 38,905 64,269

190,844 156,440

Deferred tax assets are recognized for deductible temporary differences and tax losses carried forward to the extent that

realization of the related tax benefit through the future taxable profits is probable. At March 31, 2009, the Group has

unrecognized tax losses of approximately US$187,001,000 (2008: US$62,529,000) that can be carried forward against future

taxable income. Unrecognized tax losses of US$64,889,000 (2008: US$23,806,000) can be carried forward indefinitely. The

remaining balances of unrecognized tax losses will expire as follows:

Group

2009 2008

US$’000 US$’000

Expiring in

– 2011 307 –

– 2014 72,849 7,351

– 2015 19,720 19,720

– 2016 11,652 11,652

– 2017 17,584 –

122,112 38,723