Lenovo 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

88

NOTES TO THE FINANCIAL STATEMENTS (Continued)

2 Significant accounting policies (continued)

(i) Derivative financial instruments and hedging activities (continued)

(ii) Cash flow hedge

The effective portion of changes in the fair value of derivatives that are designated and qualified as cash flow

hedges are recognized in equity. The gain or loss relating to the ineffective portion is recognized immediately in the

income statement.

Amounts accumulated in equity are recycled in the income statement in the periods when the hedged item affects

profit or loss (for instance when the forecast sale or purchase that is hedged takes place). However, when the

forecast transaction that is hedged results in the recognition of a non-financial asset (for example, inventory) or

a liability, the gains and losses previously deferred in equity are transferred from equity and included in the initial

measurement of the cost of the asset or liability.

When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting,

any cumulative gain or loss existing in equity at that time remains in equity and is recognized when the forecast

transaction is ultimately recognized in the income statement. When a forecast transaction is no longer expected to

occur, the cumulative gain or loss that was reported in equity is immediately transferred to the income statement.

(iii) Derivatives that do not qualify for hedge accounting

Certain derivative instruments do not qualify for hedge accounting. Changes in the fair value of any derivative

instruments that do not qualify for hedge accounting are recognized immediately in the income statement.

(j) Inventories

Inventories are stated at the lower of cost and net realizable value. Cost is determined on a weighted average basis, and

in the case of work-in-progress and finished goods (except for trading products), cost comprises direct materials, direct

labour and an attributable proportion of production overheads. For trading products, cost represents invoiced value on

purchases, less purchase returns and discounts. Net realizable value is determined on the basis of anticipated sales

proceeds less estimated selling expenses.

(k) Trade and other receivables

Trade and other receivables are recognized initially at fair value and subsequently measured at amortized cost using

the effective interest method, less provision for impairment. A provision for impairment of trade and other receivables is

made to the extent that they are considered to be doubtful. The amount of the provision is the difference between the

asset’s carrying amount and the present value of estimated future cash flows, discounted at the original effective interest

rate. The amount of the provision is recognized in the income statement. When trade and other receivables become

uncollectible, they are written off against the allowance account. Subsequent recoveries of amounts previously written

off are credited to the income statement.

(l) Cash and cash equivalents

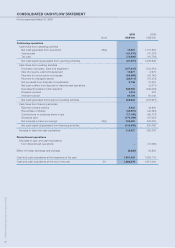

Cash and cash equivalents are carried in the balance sheet at cost. For the purposes of the cash flow statement, cash

and cash equivalents mainly comprise cash on hand, deposits held at call with banks, highly liquid investments which are

subject to an insignificant risk of changes in value, and bank overdrafts. Bank overdrafts are shown within borrowings in

current liabilities on the balance sheet.