Lenovo 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

94

NOTES TO THE FINANCIAL STATEMENTS (Continued)

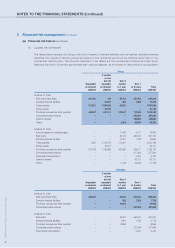

3 Financial risk management

The Group’s activities expose it to a variety of financial risks, such as market risk (including foreign currency risk, price risk,

cash flow interest rate risk and fair value interest rate risk), credit risk, and liquidity risk. The Group’s overall risk management

program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Group’s

financial performance. The Group uses derivative financial instruments to hedge certain risk exposures.

Risk management is carried out by a central treasury department (“Group Treasury”) under approved policies. Group Treasury

identifies, evaluates and hedges financial risks in close co-operation with the Group’s operating units. The Group has the

overall risk management such as foreign exchange risk, credit risk, interest rate risk, price risk, use of derivative financial

instruments and investing excess liquidity.

(a) Financial risk factors

(i) Foreign currency risk

The Group operates internationally and is exposed to foreign exchange risk arising from various currency

exposures, primarily with respect to Australian dollar, Canadian dollar, Euro, Japanese Yen, Pound Sterling and

Renminbi. Foreign currency risk arises from future commercial transactions, recognized assets and liabilities and

net investment in foreign operations.

Management has set up a policy to require group companies to manage their foreign exchange risk against their

functional currency. The Group’s foreign currency forward contracts are either used to hedge a percentage of

anticipated cash flows (mainly export sales and purchase of inventories) which are highly probable, or used as fair

value hedges for the identified assets and liabilities.

For segment reporting purposes, external hedge contracts on assets, liabilities or future transactions are

designated to each subsidiary/region, as appropriate.

(ii) Price risk

The Group is also exposed to commodity price risk on key component prices and raw material costs. However, the

Group does not enter into commodity derivative instruments or futures to hedge any potential price fluctuations of

key components and raw materials.

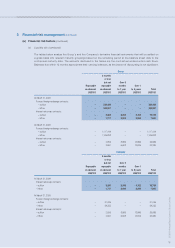

(iii) Cash flow and fair value interest rate risk

During the years ended March 31, 2008 and 2009, the Group’s substantial long-term borrowings are denominated

in United States dollar. Borrowings denominated in other currencies for the years ended March 31, 2008 and 2009

are insignificant. It is the Group’s policy to mitigate interest rate risk through the use of appropriate interest rate

hedging instruments. Generally, the Group manages its cash flow interest rate risk by using floating-to-fixed interest

rate swaps. Such interest rate swaps have the economic effect of converting borrowings from floating rates to

fixed rates. Under the interest rate swaps, the Group agrees with other parties to exchange, at specified intervals

(primarily quarterly), the difference between fixed contract rates and floating-rate interest amounts calculated by

reference to the agreed notional amounts.

The Group operates a global channel financing program. The Group is exposed to fluctuation of interest rates of all

the currencies covered by the global channel financing program.