Lenovo 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

2008/09 Annual Report Lenovo Group Limited

126

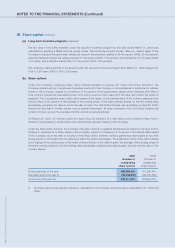

NOTES TO THE FINANCIAL STATEMENTS (Continued)

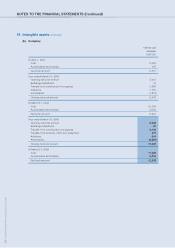

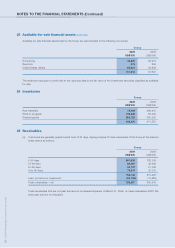

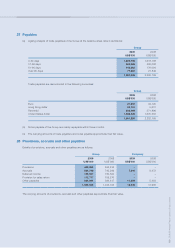

23 Available-for-sale financial assets (continued)

Available-for-sale financial assets held by the Group are denominated in the following currencies:

Group

2009 2008

US$’000 US$’000

Hong Kong 34,220 22,914

Renminbi 875 855

United States dollars 66,821 43,928

101,916 67,697

The maximum exposure to credit risk at the reporting date is the fair value of the investment securities classified as available

for sale.

24 Inventories

Group

2009 2008

US$’000 US$’000

Raw materials 72,402 209,815

Work-in-progress 109,246 56,440

Finished goods 268,722 205,302

450,370 471,557

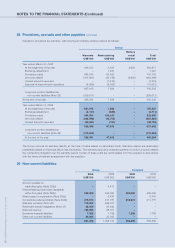

25 Receivables

(a) Customers are generally granted credit term of 30 days. Ageing analysis of trade receivables of the Group at the balance

sheet date is as follows:

Group

2009 2008

US$’000 US$’000

0-30 days 597,933 788,126

31-60 days 63,467 32,240

61-90 days 20,727 21,729

Over 90 days 76,015 32,333

758,142 874,428

Less: provision for impairment (29,755) (13,885)

Trade receivables – net 728,387 860,543

Trade receivables that are not past due are not considered impaired. At March 31, 2009, no trade receivables (2008: Nil)

were past due but not impaired.