Lenovo 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INDEPENDENT AUDITOR’S REPORT

2008/09 Annual Report Lenovo Group Limited

75

Independent Auditor’s Report

To the shareholders of Lenovo Group Limited

(incorporated in Hong Kong with limited liability)

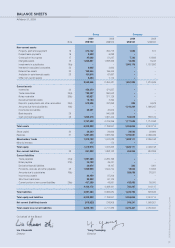

We have audited the consolidated financial statements of Lenovo Group Limited (the “Company”) and its subsidiaries (together, the

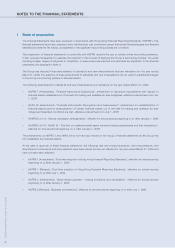

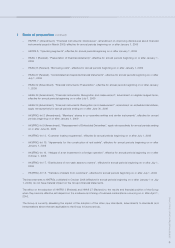

“Group”) set out on pages 76 to 151, which comprise the consolidated and company balance sheets as at March 31, 2009, and

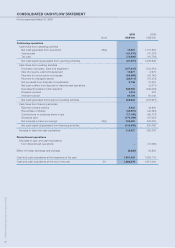

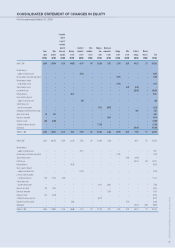

the consolidated income statement, the consolidated statement of changes in equity and the consolidated cash flow statement for

the year then ended, and a summary of significant accounting policies and other explanatory notes.

Directors’ responsibility for the financial statements

The directors of the Company are responsible for the preparation and the true and fair presentation of these consolidated financial

statements in accordance with Hong Kong Financial Reporting Standards issued by the Hong Kong Institute of Certified Public

Accountants, and the Hong Kong Companies Ordinance. This responsibility includes designing, implementing and maintaining

internal control relevant to the preparation and the true and fair presentation of financial statements that are free from material

misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting

estimates that are reasonable in the circumstances.

Auditor’s responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit and to report our opinion

solely to you, as a body, in accordance with section 141 of the Hong Kong Companies Ordinance and for no other purpose. We do

not assume responsibility towards or accept liability to any other person for the contents of this report.

We conducted our audit in accordance with Hong Kong Standards on Auditing issued by the Hong Kong Institute of Certified

Public Accountants. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain

reasonable assurance as to whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements.

The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of

the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control

relevant to the entity’s preparation and true and fair presentation of the financial statements in order to design audit procedures that

are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal

control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting

estimates made by the directors, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements give a true and fair view of the state of affairs of the Company and of the Group

as at March 31, 2009 and of the Group’s loss and cash flows for the year then ended in accordance with Hong Kong Financial

Reporting Standards and have been properly prepared in accordance with the Hong Kong Companies Ordinance.

PricewaterhouseCoopers

Certified Public Accountants

Hong Kong, May 21,2009

PricewaterhouseCoopers

22/F, Prince’s Building

Central, Hong Kong