Lenovo 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

141

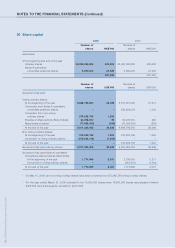

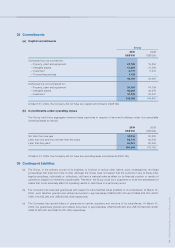

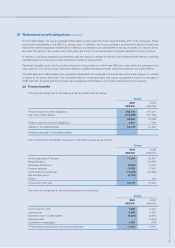

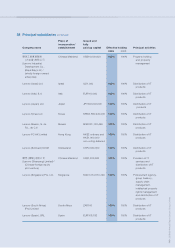

34 Commitments

(a) Capital commitments

Group

2009 2008

US$’000 US$’000

Contracted but not provided for:

– Property, plant and equipment 22,728 15,854

– Intangible assets 10,608 13,584

– Investment 8,719 5,216

– IT consulting services 1,126 –

43,181 34,654

Authorized but not contracted for:

– Property, plant and equipment 34,184 74,184

– Intangible assets 42,660 44,976

– Investment 31,639 25,247

108,483 144,407

At March 31, 2009, the Company did not have any capital commitments (2008: Nil).

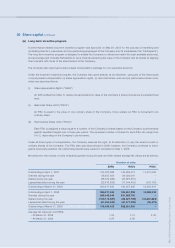

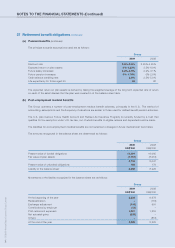

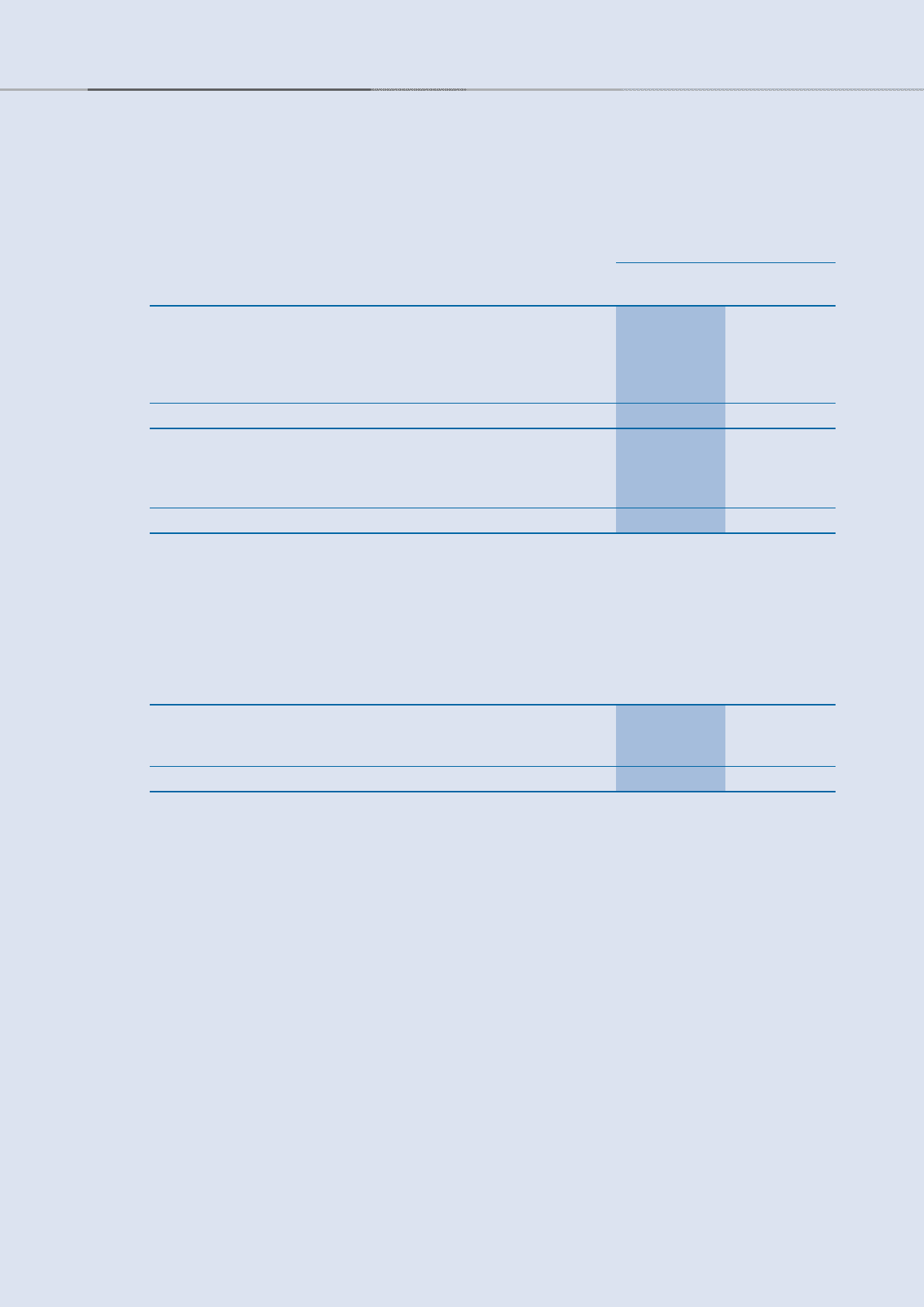

(b) Commitments under operating leases

The Group had future aggregate minimum lease payments in respect of land and buildings under non-cancelable

operating leases as follows:

2009 2008

US$’000 US$’000

Not later than one year 38,946 35,225

Later than one year but not later than five years 93,714 82,539

Later than five years 61,901 60,399

194,561 178,163

At March 31, 2009, the Company did not have any operating lease commitments (2008: Nil).

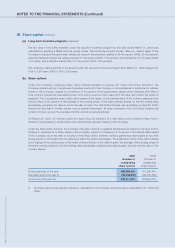

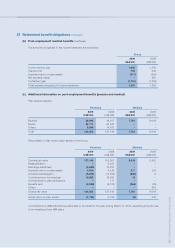

35 Contingent liabilities

(a) The Group, in the ordinary course of its business, is involved in various other claims, suits, investigations, and legal

proceedings that arise from time to time. Although the Group does not expect that the outcome in any of these other

legal proceedings, individually or collectively, will have a material adverse effect on its financial position or results of

operations, litigation is inherently unpredictable. Therefore, the Group could incur judgments or enter into settlements of

claims that could adversely affect its operating results or cash flows in a particular period.

(b) The Company has executed guarantees with respect to bank facilities made available to its subsidiaries. At March 31,

2009, such facilities granted and utilized amounted to approximately US$533,837,000 and US$59,952,000 (2008:

US$1,166,542,000 and US$326,402,000) respectively.

(c) The Company has issued letters of guarantee to certain suppliers and vendors of its subsidiaries. At March 31,

2009, the guarantees granted and utilized amounted to approximately US$100,000,000 and US$176,929,000 (2008:

US$512,500,000 and US$123,281,000) respectively.