Lenovo 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTORS’ REPORT (Continued)

2008/09 Annual Report Lenovo Group Limited

68

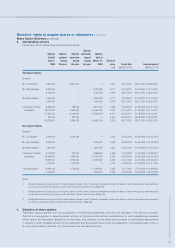

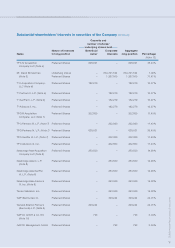

Substantial shareholders’ interests in securities of the Company (continued)

Capacity and

number of shares/

underlying shares held

Nature of interests Beneficial Corporate Aggregate

Name in long position owner interests long position Percentage

(Note 13)

General Atlantic Partners 81, Preferred Shares 39,202 – 39,202 2.21%

L.P. (Note 11)

Gapstar, LLC (Note 12) Preferred Shares 6,343 – 6,343 0.36%

General Atlantic LLC Preferred Shares – 45,545 45,545 2.57%

GAP Coinvestments IV, LLC Preferred Shares 7,222 – 7,222 0.41%

GAP Coinvestments III, LLC Preferred Shares 27,695 – 27,695 1.56%

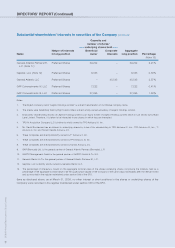

Notes:

1. The English company name “Legend Holdings Limited” is a direct transliteration of its Chinese company name.

2. The shares were beneficially held by Right Lane Limited, a direct wholly-owned subsidiary of Legend Holdings Limited.

3. Employees’ Shareholding Society of Legend Holdings Limited is an equity holder of Legend Holdings Limited which in turn wholly owns Right

Lane Limited. Therefore, it is taken to be interested in any shares in which they are interested.

4. TPG IV Acquisition Company LLC is indirectly wholly owned by TPG Advisors IV, Inc.

5. Mr. David Bonderman has an interest in underlying shares by virtue of his shareholding in TPG Advisors IV, Inc., TPG Advisors III, Inc., T3

Advisors II, Inc. and Tarrant Capital Advisors, Inc.

6. These companies are directly/indirectly owned by T3 Advisors II, Inc.

7. These companies are directly/indirectly owned by TPG Advisors III, Inc.

8. These companies are directly/indirectly owned by Tarrant Advisors, Inc.

9. GAP (Bermuda) Ltd. is the general partner of General Atlantic Partners (Bermuda), L.P.

10. GAPCO Management GmbH is the general partner of GAPCO GmbH & Co. KG.

11. General Atlantic LLC is the general partner of General Atlantic Partners 81, L.P.

12. GapStar, LLC is directly wholly owned by General Atlantic LLC.

13. The percentage of interests is based on the aggregate nominal value of the shares/underlying shares comprising the interests held as a

percentage of the aggregate nominal value of all the issued share capital of the Company of the same class immediately after the relevant event

and as recorded in the register maintained under section 336 of the SFO.

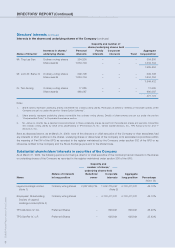

Save as disclosed above, as at March 31, 2009, no other interest or short positions in the shares or underlying shares of the

Company were recorded in the register maintained under section 336 of the SFO.