Lenovo 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION & ANALYSIS

2008/09 Annual Report Lenovo Group Limited

28

to substantially reduce operational costs, eliminate duplications across organizations, and improve efficiencies by more

closely aligning the Group’s structure and growth strategies, impairment of server license of US$19 million (2008: Nil),

warranty costs not reimbursable by suppliers of US$15 million (2008: Nil), and bad debt provision of US$9 million (2008:

Nil).

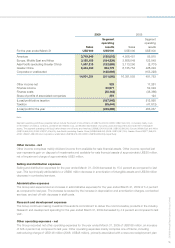

Major expense items

2009 2008

For the year ended March 31 US$’000 US$’000

Depreciation of property, plant and equipment and amortization of

prepaid lease payments 143,269 88,025

Amortization and impairment of intangible assets 83,729 127,313

Employee benefit costs, including 1,237,250 1,194,196

– long-term incentive awards 54,114 53,328

– severance and related costs 116,077 44,070

Termination of onerous contracts 19,996 3,570

Rental expenses under operating leases 45,976 34,703

CAPITAL EXPENDITURE

The Group incurred capital expenditures of US$194 million (2008: US$284 million, excluding discontinued operations)

during the year ended March 31, 2009, mainly for the acquisition of plant and equipment, completion of construction-

in-progress and investments in the Group’s information technology systems.

LIQUIDITY AND FINANCIAL RESOURCES

At March 31, 2009, total assets of the Group amounted to US$6,308 million (2008: US$7,200 million), which were

financed by shareholders’ funds of US$1,311 million (2008: US$1,613 million), minority interests of US$177,000 (2008:

US$174,000), and non-current and current liabilities of US$4,997 million (2008: US$5,587 million). At March 31, 2009,

the current ratio of the Group was 0.92 (2008: 1.05).

The Group has a solid financial position. At March 31, 2009, bank deposits, cash and cash equivalents totaled

US$1,863 million (2008: US$2,191 million), of which 65.7 (2008: 63.9) percent was denominated in United States

dollars, 24.5 (2008: 20.4) percent in Renminbi, 2.8 (2008: 2.2) percent in Euros, 1.9 (2008: 2.9) percent in Japanese

Yen, and 5.1 (2008: 10.6) percent in other currencies.

The Group adopts a conservative policy to invest the surplus cash generated from operations. At March 31, 2009, 81.0

(2008: 72.1) percent of cash are bank deposits, and 19.0 (2008: 27.9) percent of cash are investments in liquid money

market fund of investment grade.

Due to the unprecedented global economic challenges, the Group continued to incur a significant operating loss in the

fourth quarter. The global resource redeployment plan announced in January also realized a significant restructuring

charge. The substantial loss incurred in the fourth quarter triggered a breach of certain financial covenants in connection

with the US$400 million 5-year revolving and term loan facility with syndicated banks. The Group has obtained consent

from the syndicated banks the waiver from strict compliance with those financial covenants and will enter into a revised

loan agreement. At March 31, 2009, this facility was fully utilized and the facility will expire in March 2011.

The Group also has a 5-year fixed rate loan facility with a bank in China expiring in March 2011. At March 31, 2009, the

outstanding loan balance was US$65 million (2008: US$100 million).

To secure more long-term funding for the Group in case the economy continues to stay weak, the Group has obtained

a new US$300 million 3-year term loan facility with a bank in China in March 2009. This facility was utilized to the extent

of US$200 million at March 31, 2009.