Lenovo 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008/09 Annual Report Lenovo Group Limited

110

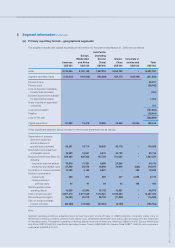

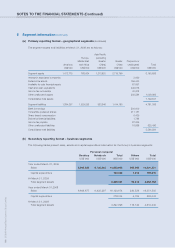

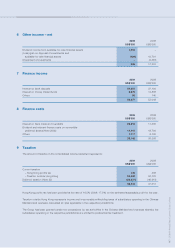

NOTES TO THE FINANCIAL STATEMENTS (Continued)

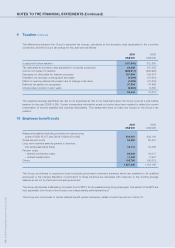

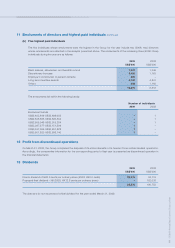

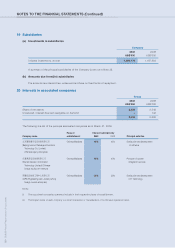

11 Emoluments of directors and highest paid individuals (continued)

(a) Directors’ and senior management’s emoluments (continued)

2008

Retirement

payments and

Long-term employer’s

Discretionary Inducement incentives contribution Other

bonuses fees awards to pension benefits-

Name of Director Fees Salary (note i) (note ii) (note iii) schemes in-kind Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Executive directors

Mr. Yang Yuanqing – 894 1,084 – 2,979 83 18 5,058

Mr. William J. Amelio – 790 1,000 1,500 4,526 – 3,571 11,387

Non-executive directors

Mr. Liu Chuanzhi 40 – – – 94 465 – 599

Mr. Zhu Linan 40 – – – 94 – – 134

Ms. Ma Xuezheng 30 114 403 – 537 1,033 – 2,117

Mr. James G. Coulter 40 – – – 75 – – 115

Mr. William O. Grabe 50 – – – 94 – – 144

Mr. Shan Weijian 40 – – – 94 – – 134

Independent non-executive directors

Professor Woo Chia-Wei 40 – – – 94 – – 134

Mr. Ting Lee Sen 40 – – – 94 – – 134

Mr. John W. Barter III 60 – – – 94 – – 154

Mr. Tian Suning 27 – – – 29 – – 56

Mr. Wong Wai Ming 9 – – – 7 – – 16

416 1,798 2,487 1,500 8,811 1,581 3,589 20,182

Notes:

(i) Discretionary bonuses paid for the two years ended March 31, 2008 and 2009 represent the amounts in connection with the

performance bonuses for the two years ended March 31, 2007 and 2008 respectively.

(ii) Inducement fees paid to Mr. Amelio represent payment made to his former employer pursuant to an agreement entered into

between the Company, Mr. Amelio and his former employer (the “Agreement”). Under the terms of the Agreement, the Company

made a payment in the amount of US$7.5 million to his former employer. This amount reflects benefits realized by Mr. Amelio under

the long-term incentive plans of his former employer that were subject to certain repayment conditions. Inducement fees for the year

ended March 31, 2009 represent the accelerated amortized amount of US$2.98 million (2008: US$1.5 million) upon his resignation

as director of the Company. The inducement fees were previously amortized over a five-year period to December 2010 pursuant to

the Agreement.

(iii) Details of the long-term incentive program of the Company are set out in Note 30(a). The fair value of the employee services

received in exchange for the grant of the long-term incentive awards is recognized as an expense. The total amount to be amortized

over the vesting period is determined by reference to the fair value of the long-term incentive awards at the date of grant. The

amounts disclosed above represent the amortized amounts for the two years ended March 31, 2008 and 2009.

(iv) Mr. William O. Grabe, Professor Woo Chia-Wei, Mr. Ting Lee Sen and Mr. John W. Barter III have elected to defer their receipts of

the cash of director’s fee into fully vested share units under the long-term incentive program (Note 30(a)) in the year ended March

31, 2008. Mr. William O. Grabe, Professor Woo Chia-Wei and Mr. Ting Lee Sen have elected the same deferral from October 1,

2008 to March 31, 2009.

(v) Mr. Justin T. Chang (alternate director to Mr. James G. Coulter), and Mr. Daniel A. Carroll (alternate director to Mr. Shan Weijian)

did not receive any fees or remuneration during the years ended March 31, 2008 and 2009.