Lenovo 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

2008/09 Annual Report Lenovo Group Limited

127

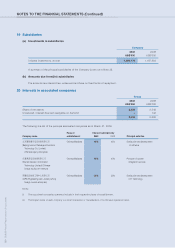

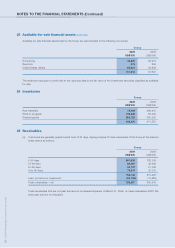

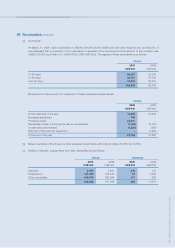

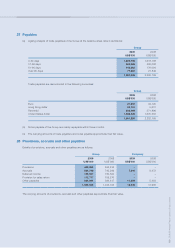

25 Receivables (continued)

(a) (continued)

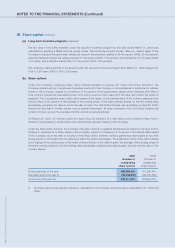

At March 31, 2009, trade receivables of US$160,209,000 (2008: US$86,302,000) were impaired and provided for. It

was assessed that a proportion of the receivables is expected to be recovered and the amount of the provision was

US$29,755,000 as at March 31, 2009 (2008: US$13,885,000). The ageing of these receivables is as follows:

Group

2009 2008

US$’000 US$’000

31-60 days 63,467 32,240

61-90 days 20,727 21,729

Over 90 days 76,015 32,333

160,209 86,302

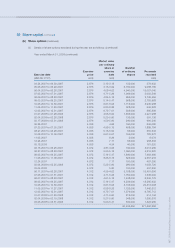

Movements on the provision for impairment of trade receivables are as follows:

Group

2009 2008

US$’000 US$’000

At the beginning of the year 13,885 23,939

Exchange adjustment 168 –

Provisions made 24,631 –

Receivables written off during the year as uncollectible (7,400) (8,167)

Unused amounts reversed (1,529) (597)

Disposal of discontinued operations – (1,290)

At the end of the year 29,755 13,885

(b) Notes receivable of the Group are bank accepted notes mainly with maturity dates of within six months.

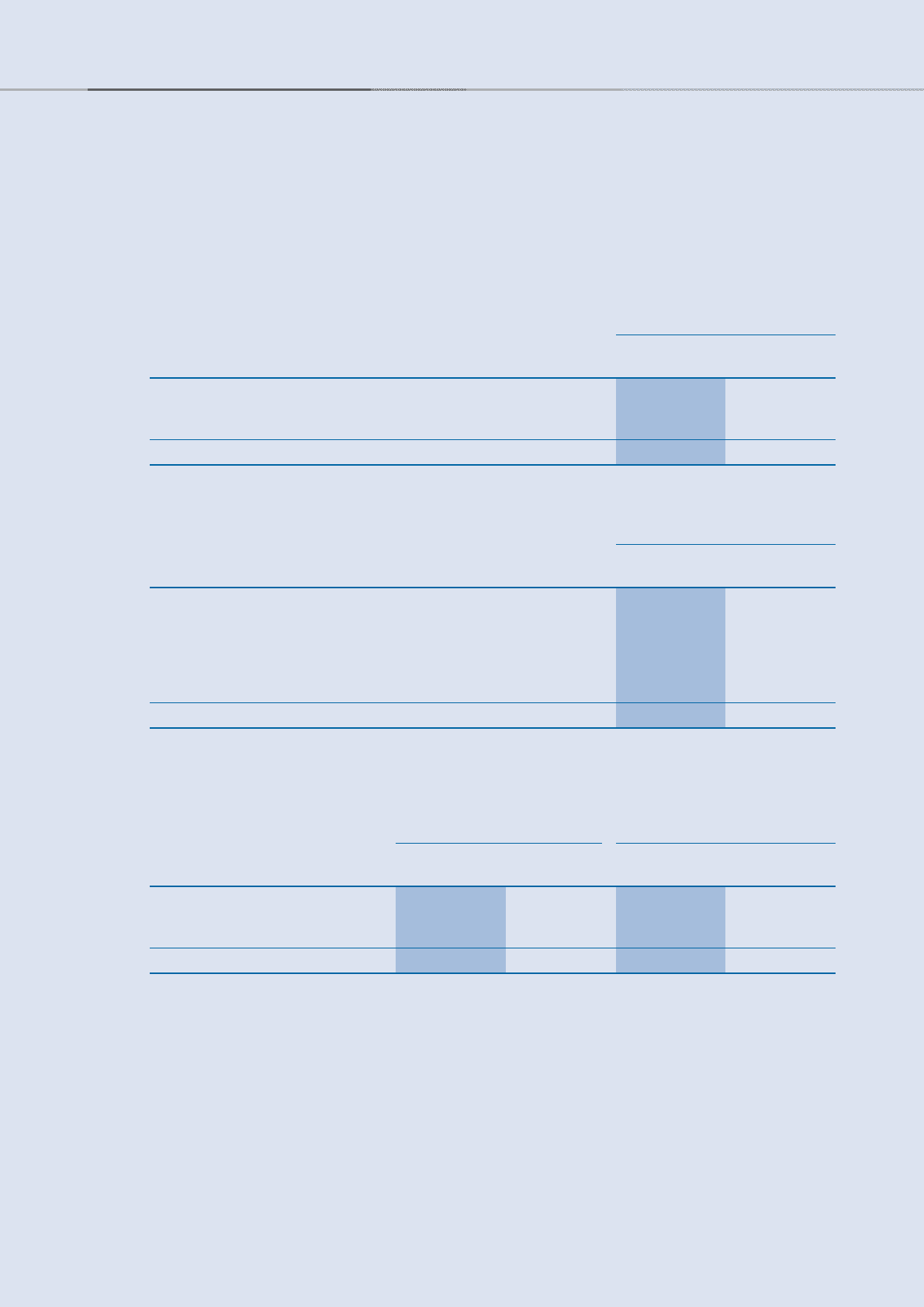

(c) Details of deposits, prepayments and other receivables are as follows:

Group Company

2009 2008 2009 2008

US$’000 US$’000 US$’000 US$’000

Deposits 3,466 2,640 212 153

Prepayments 197,050 182,534 67 5,588

Other receivables 413,310 582,094 317 938

613,826 767,268 596 6,679